ADAS Market by Offering (Hardware (Camera, Radar, LiDAR, Ultrasonic, ECU), Software (Middleware, Application Software & OS)), System Type, Vehicle Type (PC, LCV, HCV), Level of Autonomy, Vehicle Class, EV type and Region - Global Forecast to 2030

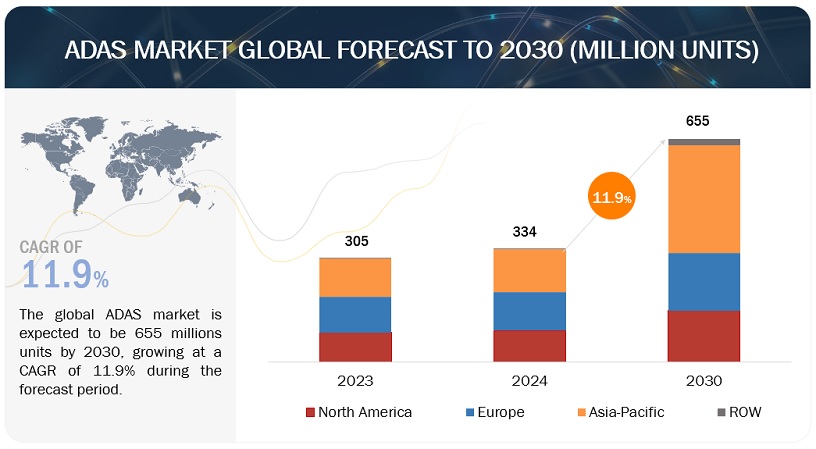

[424 Pages Report] The global Advanced Driver Assistance Systems Market size is expected to grow from 334 million units in 2024 to 655 million units by 2030, at a CAGR of 11.9%. The Advanced Driver Assistance Systems Market is witnessing robust growth driven by increasing demand for electric and autonomous vehicles, which may drive the market for ADAS systems.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

ADAS MARKET:

Driver: Increased focus on Vehicle Safety

With road safety becoming a global concern, governments, regulatory bodies, and consumers are emphasizing implementing advanced safety features in vehicles to mitigate the risk of accidents and enhance overall safety standards. This heightened focus is driven by alarming statistics of road traffic fatalities and injuries, prompting automakers and regulatory bodies to take proactive measures to address this pressing issue. Governments are enacting stringent regulations and safety standards mandating the integration Advanced Driver Assistance Systems technologies into vehicles to improve safety outcomes and reduce the likelihood of accidents. These regulations range from basic requirements for essential safety features like anti-lock braking systems (ABS) and electronic stability control (ESC) to more advanced ADAS functionalities such as collision avoidance systems, lane departure warning systems, and adaptive cruise control. Furthermore, regulatory bodies are implementing crash test ratings and safety assessment programs that incentivize automakers to prioritize safety in vehicle design and manufacturing processes. As a result, automotive manufacturers are increasingly investing in research and development to innovate and integrate ADAS technologies into their vehicle models to comply with regulatory requirements and meet consumer demand for safer vehicles.

Restraint: Lack of adequate infrastructure

The lack of proper infrastructure presents a significant market restraint for the widespread adoption of Advanced Driver Assistance Systems (ADAS). While ADAS technologies offer promising advancements in automotive safety and efficiency, their effectiveness heavily relies on supportive infrastructure, particularly communication networks and road infrastructure. To work effectively, ADAS needs basic infrastructure like well-marked roads, lane markings, and GPS connections. There needs to be good connectivity infrastructure for V2V and V2X communications to work well. On highways, information like lane changes, detecting objects, distances between vehicles, traffic updates, and services like navigation and connectivity are crucial, especially for semi-autonomous and autonomous trucks. However, because highways often have limited network connections, vehicles can't always connect to cloud data. In developing countries like Mexico, Brazil, and India, the IT infrastructure on highways is still growing slowly compared to developed countries. Without adequate infrastructure, certain ADAS features, such as vehicle-to-infrastructure (V2I) communication and real-time traffic data integration, may be limited in functionality or rendered ineffective.

Moreover, the absence of standardized infrastructure across regions can pose integration challenges for automotive manufacturers, hindering the seamless implementation of Advanced Driver Assistance Systems. In rural or less-developed areas where infrastructure investment may be lacking, the utility and reliability of ADAS technologies may be compromised, affecting their appeal to consumers and slowing down market penetration. Addressing this restraint necessitates collaborative efforts between governments, infrastructure providers, and automotive industry stakeholders to prioritize infrastructure development that supports the deployment and scalability of ADAS technologies, thereby unlocking their full potential in enhancing road safety and driving experiences.

Opportunity: Advancements in autonomous vehicle technology

The rise of autonomous vehicles is set to revolutionize commuting, with Advanced Driver Assistance Systems technologies simplifying driving tasks through features like lane monitoring and emergency braking. Autonomous vehicles utilize advanced technologies such as LiDAR, radar, and high-definition cameras to gather data, which is then analyzed by onboard autonomous systems to navigate safely. Algorithms in autonomous vehicles improve accuracy through continuous learning and data sharing among vehicles. The Vehicular Ad hoc Network (VANET) is a recent advancement which enables vehicle-to-vehicle communication for applications like accident notifications and traffic alerts. Companies like Google, Tesla, and Audi are at the forefront of self-driving car technology development. Waymo, for instance, integrates medium and long-range LiDAR and high-resolution cameras for comprehensive visibility, while radar systems track objects effectively in weather conditions like snow and rain. Additionally, a new vehicle network technology, Automotive Ethernet, is expected to significantly improve ADAS functionalities and fuel the development of autonomous vehicles. Automotive ethernet provides ADAS with the high bandwidth and low latency needed for real-time decision-making, which is necessary for features like AEB, LDW, ACC, and more. Recent IEEE standards, such as 802.3cz (Multi-Gigabit Glass Optical Fiber Automotive Ethernet) and 802.3ch (2.5/5/10 Gbps), will further enhance Automotive Ethernet, ensuring reliable data delivery crucial for real-time ADAS. Major OEMs and e-hailing service providers such as General Motors (US), Ford (US), Uber (US), Lyft (US), and Waymo (US) have launched robotaxi trials in the US. DeepRoute.ai (China) introduced the Driver 3.0 HD Map free innovative driving solution in 2023, marking China's first navigation system not dependent on high-definition maps and capable of point-to-point navigation across all regions.

Challenge: Higher cost of ADAS integration

Advanced Driver Assistance Systems consist of different components whose configuration varies based on the features and technology employed. These systems typically include microcontroller units, electronic control units, and various sensors like radar, LIDAR, ultrasonic, image, radio, laser, and infrared sensors. The setup and cost of these components vary depending on the car segment and the type of ADAS installed. Additionally, they incorporate a human-machine interface to assist or alert the driver. Current driver assistance features aim to alert the driver, adjust vehicle speed, and manage engine fuel supply based on external or internal vehicle conditions. These functions require sophisticated technology, which adds complexity and cost to ADAS systems, limiting their availability to premium vehicles. The growing demand for autonomous vehicles and consumer expectations intensifies competition among OEMs, driving innovation in the automotive industry. Regulatory compliance also fuels innovation and the increasing use of software-driven electronic components in vehicles. However, the installation of new ADAS features, driven by consumer demand or regulations, raises overall vehicle costs. While this isn't a concern for premium cars, it's a significant factor for smaller segments. The rising vehicle cost may hinder ADAS market growth, prompting automakers to offer efficient driver assistance features at competitive prices.

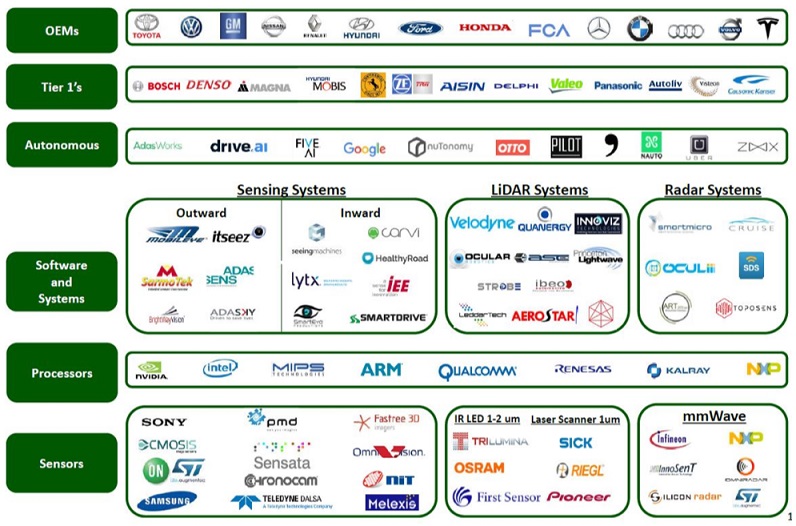

Advanced Driver Assistance Systems Market: Ecosystem

The ecosystem mapping highlights various Advanced Driver Assistance Systems Market involves the design, development, validation, prototyping, and manufacturing support for various ADAS systems and subsystems. In the ADAS market ecosystem, component providers supply crucial elements like semiconductors, sensors, and controllers used in vehicle radar and sensing systems, control modules, and power electronics for ADAS, automated driving, and safety systems. Leading Tier 1 providers such as Robert Bosch, Denso, Continental AG, ZF, Mobileye, and Valeo play pivotal roles in integrating advanced driver assistance systems into vehicle models through partnerships and agreements with component manufacturers and technology providers. Software companies within the ecosystem collaborate with these providers or develop their systems to enhance ADAS functionalities. Additionally, service providers like ride-sharing operators deliver ADAS-enabled services directly to end-users.

Battery Electric Vehicle segment is estimated to exhibit the fastest growth in the global Advanced Driver Assistance Systems Market

BEVs are in increasing demand due to concerns about emission reductions worldwide. Due to the low availability of charging stations and the high cost of EV batteries, BEVs had a low demand. However, the demand for BEVs has increased significantly due to the decreasing cost of EV batteries at a fast and steady rate, increasing EV range, and a growing EV charging network worldwide. The escalating global demand for Battery Electric Vehicles (BEVs) arises from mounting apprehensions regarding emission reduction efforts on a global scale. Previously, BEVs faced limited demand attributable to factors such as the sparse availability of charging infrastructure and the high cost associated with EV batteries. However, the landscape has shifted markedly, with BEVs experiencing a notable surge in demand. This resurgence can be attributed to the rapid and consistent decline in the cost of EV batteries, concurrent with enhancements in EV range capabilities and the proliferation of EV charging infrastructure networks worldwide.

The hardware segment is expected to grow significantly in theAdvanced Driver Assistance Systems Market during the forecast period.

Ongoing enhancements in Advanced Driver Assistance Systems (ADAS) have spurred heightened demand for multi-camera systems within automotive contexts. Prominent Original Equipment Manufacturers (OEMs) now employ a blend of cameras to encompass surround-view functionalities. Images captured by diverse cameras affixed to the vehicle periphery are seamlessly combined to generate a panoramic representation of the surrounding driving milieu. Supplementary elements such as radar sensors are integrated into safety systems to elevate safety ratings and adhere to regulatory standards. In contrast to cameras, radar sensors remain resilient to adverse weather and low-light scenarios. Diverse radar configurations readily discern the velocity, trajectory, and proximity of objects surrounding the vehicle. As cars are upgraded to become safer and sustainable, demand for semiconductors has led to increased investments by major players in developing advanced chipsets. For instance, in August 2023, Horizon Robotics, Aptiv, and Wind River partnered to create hardware and software for ADAS and automated driving.

Similarly, in September 2023, JOYNEXT and Horizon Robotics Deepen their Cooperation and showcased ADAS Domain Controllers at IAA Mobility. Tesla (US) also developed a computer chip to train its automated driving system. The D1 chip uses a 7 nm manufacturing process with a processing power of 362 teraflops. Such strategies fuel opportunities for sensors in the Advanced Driver Assistance Systems Market.

Camera Unit segment is expected to see substantial growth in Advanced Driver Assistance Systems Market during the forecast period.

A camera unit is used in intelligent park assist, pedestrian detection systems, lane departure warning systems, blind-spot monitoring systems, and others. Camera-based systems are commonly deployed in a car's front, side, and rear to provide driving and parking assistance. Front camera systems are most widely mounted behind the rear-view mirror; rear cameras are mounted near the rear license number plate, while side cameras are mounted adjacent to the mirrors on both sides. The primary function of an ADAS front camera (FC) system is to identify and capture images of specified objects, including pedestrians, other vehicles, and similar entities. This system encompasses a lens, sensors responsible for image capture, and an embedded processor chip designed to identify the objects of interest. The heightened awareness of safety among consumers may positively influence the demand for camera units. Side-view, rear-view, and wing-mirror cameras are extensively integrated into automotive systems, with increasing adoption observed in mid-segment and premium vehicles. Features such as blind-spot detection, park assistance, surround-view systems, and visual pillars are implemented in semi-autonomous and autonomous vehicles utilizing camera technology alongside other systems such as radar and LIDAR. Most luxury vehicles are equipped with an array of advanced driver assistance systems, including driver monitoring systems, intelligent park systems, pedestrian detection systems, lane departure warning systems, and blind-spot monitoring systems, all of which incorporate cameras. For instance, ZF Friedrichshafen AG launched Smart Camera 6 for ADAS systems and automated driving. Smart Camera 6 has a 120-degree field of view, more than 4x higher picture resolution (8 megapixels) than the previous model, and more processing power to support sophisticated tasks in January 2023.

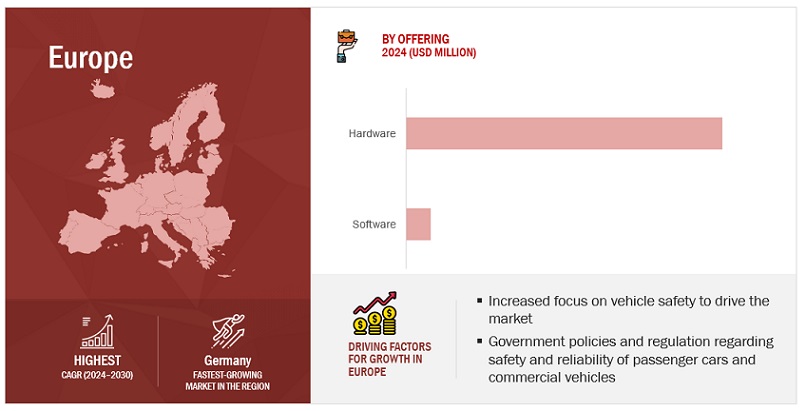

"The European Advanced Driver Assistance Systems Market is projected to grow fastest by 2030."

Europe is estimated to be the fastest Advanced Driver Assistance Systems Market by 2030. Despite the recent global automotive slowdown, the European automotive market has consistently grown over the past six years. This was evident in January 2024, when the European Union's new car market rebounded with a robust 12.1% year-on-year increase in car registrations, totaling 851,690 units, following a slowdown in December 2023. Leading European automotive manufacturers have offered high-performance engines and advanced safety features to maintain competitiveness. Sales of passenger cars by major automakers such as the Volkswagen Group, Mercedes-Benz, Renault, Hyundai, BMW, Toyota, and Stellantis have fueled demand for ADAS-enabled vehicles in the region.

Strict emission regulations and zero-emission objectives in Europe will significantly impact manufacturers of both passenger cars and commercial vehicles. The expansion of the European Advanced Driver Assistance Systems Market is driven by technological progress in driver assistance features like traffic jam assist and blind-spot detection with rear cross-traffic, as well as mandates established since July 2022 for features such as DMS, AEB, and LCW in passenger cars. The increasing transition to electric vehicles (EVs), coupled with rising concerns for road safety and heightened consumer awareness, will further boost the demand for ADAS in the region.

Key Market Players

The global Advanced Driver Assistance Systems Market is dominated by major players such as Robert Bosch (Germany), ZF Friedrichshafen (Germany), Continental AG (Germany), Denso (Japan), Magna International (Canada), Mobileye (Jerusalem), among others.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2019–2030 |

|

Base year considered |

2024 |

|

Forecast period |

2024-2030 |

|

Forecast units |

Value (USD Thousand) |

|

Segments Covered |

Vehicle Class, Level of Autonomy, Vehicle type, Electric Vehicle Type, System Type, By offering and Region |

|

Geographies covered |

Asia Pacific, Europe, North America, and the Rest Of The World |

|

Companies Covered |

Robert Bosch (Germany), ZF Frierdrichshafen (Germany), Continental AG (Germany), Denso (Japan), Magna International (Canada), Mobileye (Jeruselam) |

This research report categorizes the Advanced Driver Assistance Systems Market based on System Type, EV Type, Vehicle Class, Level of Autonomy, offering, Vehicle Type, and Region

ADAS Market, By Vehicle Type:

- Passenger Cars

- Light Commercial Vehicle

- Trucks

- Buses

ADAS Market, By System Type:

- Adaptive Cruise Control

- Adaptive Front Light

- Adaptive Emergency Braking

- Blind spot detection

- Cross-traffic Alert

- Driver Monitoring System

- Intelligent Park Assist

- Forward Collision Warning

- Lane Departure Warning

- Night Vision System

- Pedestrian Detection System

- Road Sign Detection

- Tire Pressure Monitoring System

- Traffic Jam Assist

ADAS Market, By Electric Vehicle Type:

- BEV

- FCEV

- HEV

- PHEV

ADAS Market, By Level Of Autonomy:

- L1

- L2

- L3

- L4

- L5

ADAS Market, By offering:

-

Hardware

- Camera Unit

- Radar Sensor

- Ultrasonic Sensor

- LiDAR

- ECU

- Others (actuators, Infrared sensors, etc.)

-

Software

- Middleware

- Application Software

- Operating System

ADAS Market, By Region

- Asia Pacific

- Europe

- North America

- Rest Of The World

ADAS Market, Vehicle Class

- Asia Pacific

- Europe

- North America

- Rest Of The World

Recent Developments

- In February 2024, ZF Friedrichshafen AG launched ZF Aftermarket OnLaneALERT, a new front camera module for LDW in commercial vehicles.

- In February 2024, Robert Bosch GmbH announced that it is teaming up with Microsoft to develop and research generative AI and how to integrate it within vehicle features such as automated driving.

- In February 2024, Continental AG revealed its new 8MP automotive camera. The satellite camera will help automakers with features like autonomous driving platform, parking assist, 3D surround view, and more.

- In December 2023, Robert Bosch GmbH announced that it would showcase a new vehicle computer called Cockpit & ADAS integration platform. The foundation of this new computer is a single SoC that executes a number of operations from the infotainment and driver assistance domains simultaneously. This features autonomous parking, lane detection, smart, tailored navigation, and voice assistance. Advantages for car makers include reduced space and required cabling, resulting in cheaper costs.

- In December 2023, Telechips, a semiconductor manufacturer from South Korea, announced that Continental AG has supplied its Dolphin System on Chip (SoC) family. The SoC is tailored to the pre-integrated function set of Continental's Smart Cockpit High-Performance Computers (HPCs), providing optimal system performance for cluster, infotainment, and ADAS.

- In October 2023, Denso Corporation announced that it would collaborate with KOITO MANUFACTURING CO., LTD. (Japan) to develop a system to improve the object recognition rate of vehicle image sensors at night. The solution is expected to work with coordinating lamps and image sensors, which will improve driving safety during nighttime.

- In June 2023, Continental AG presented a high-performance computer (HPC) that provides optimal system performance for a pre-integrated set of automobile operations. The Smart Cockpit HPC integrates a variety of domains and services, including cluster, infotainment (display, radio, phone, phone mirroring, and navigation), and Advanced Driver-Assistance Systems (ADAS).

- In May 2023, Robert Bosch GmbH announced that it would collaborate with Plus to develop an assisted driving solution for commercial vehicles.

- In March 2023, Robert Bosch GmbH advanced driver assistance system controller combines radar, video, lidar, ultrasound, and complex algorithms for precise 360° environment modeling, ensuring safe vehicle behavior even at high speeds.

- In January 2023, ZF Friedrichshafen AG launched Smart Camera 6 for ADAS systems and automated driving. Smart Camera 6 has a 120-degree field of view, more than 4x higher picture resolution (8 megapixels) than the previous model, and more processing power to support sophisticated features such as AEB, Automated parking, and more.

Frequently Asked Questions (FAQ):

What is the current size of the global ADAS market?

The global ADAS market size is estimated to be 334.0 Million Units in 2024 and is expected to reach 655.1 Million Units by 2030.

Who are the winners in the global ADAS market?

The global ADAS market dominates ADAS market is dominated by major players such as Robert Bosch (Germany), ZF Friedrichshafen (Germany), Continental AG (Germany), Denso (Japan), Magna International (Canada), and Mobileye (Jerusalem), among others. These companies develop new products, adopt expansion strategies, and undertake collaborations, partnerships, and mergers & acquisitions to gain traction in the ADAS market.

What are the new market trends impacting the growth of the ADAS market?

The new market trend is the integration of artificial intelligence (AI) and machine learning (ML) to make current ADAS features more intuitive and safer.

Which region is expected to be the largest market during the forecast period?

Asia Pacific is anticipated to be the largest ADAS market due to the increasing sales of electric and mid-segment passenger cars with safety and comfort features.

What is the total CAGR expected to be recorded for the ADAS market during 2024-2030?

The CAGR is expected to record a CAGR of 11.9% from 2024-2030 in terms of volume. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

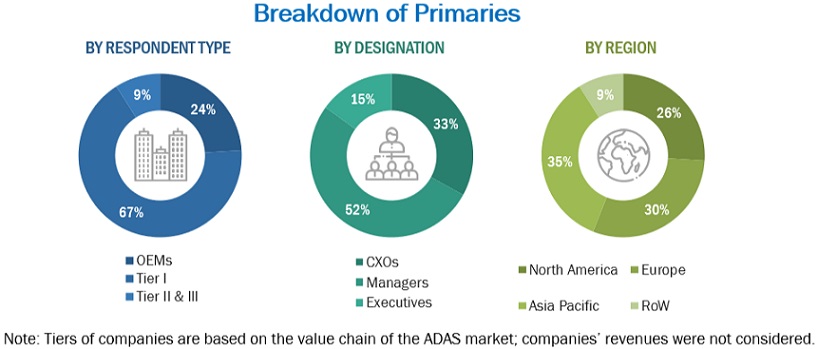

The research study involved extensive secondary sources, such as company annual reports/presentations, industry association publications, magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases, to identify and collect information on the Advanced Driver Assistance Systems Market. Primary sources, such as experts from related industries, automobile OEMs, and suppliers, were interviewed to obtain and verify critical information and assess the growth prospects and market estimations. Key players in the ADAS market have been identified through secondary research. Primary research interviews were conducted with key opinion leaders in the automotive industry, such as CEOs, directors, industry experts, and other executives, to validate revenues.

Secondary Research

Secondary sources for this research study include corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; whitepapers and automotive software-related journals; certified publications; articles by recognized authors; directories; and databases. Secondary data was collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

Extensive primary research was conducted after understanding the Advanced Driver Assistance Systems Market scenario through secondary research. Several primary interviews were conducted with market experts from the demand side (vehicle manufacturers, country-level government associations, and trade associations) and the supply side (ADAS manufacturers, software providers, and system integrators). The regions considered for the research include North America, Europe, Asia Pacific, and the Rest of the World (RoW). Approximately 17% and 83% of primary interviews were conducted from the demand and supply sides. Primary data was collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and marketing, were covered to provide a holistic viewpoint in this report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from the primaries. This and the in-house subject matter experts’ opinions led to the findings described in this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

As mentioned below, a detailed market estimation approach was followed to estimate and validate the volume and value of the Advanced Driver Assistance Systems Market and other submarkets. Key players in the ADAS market were identified through secondary research. Their global market share was determined through primary and secondary research. The research methodology included studying the annual and quarterly financial reports & regulatory filings of significant market players and interviews with industry experts for detailed market insights. All major penetration rates, percentage shares, splits, and breakdowns for the market across end users were determined using secondary sources and verified through primary sources. All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data. The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

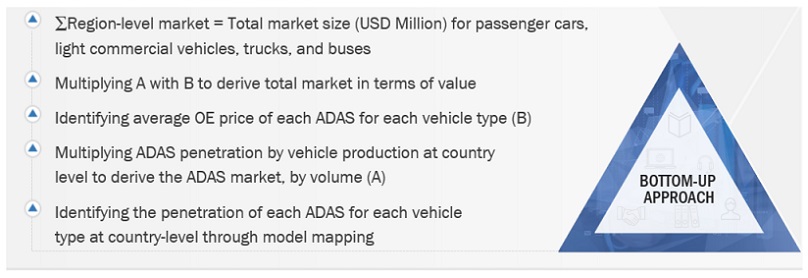

Global Advanced Driver Assistance Systems Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

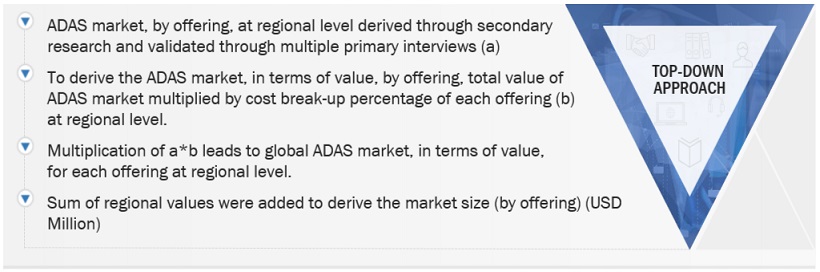

Global Advanced Driver Assistance Systems Market Size: Top-Down Approach

Data Triangulation

The Advanced Driver Assistance Systems Market was split into several segments and subsegments after arriving at the overall market size through the methodology above. Where applicable, the data triangulation procedure was employed to complete the overall market engineering process and arrive at the exact market value for key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand- and supply-side participants.

Market Definition

Advanced Driver Assistance Systems Market: Advanced driver assistance systems (ADAS) monitor a vehicle’s surroundings and driving behavior to pre-emptively detect potential hazards. This technology uses vehicle-based intelligent safety systems to enhance the driving experience and vehicle & pedestrian safety by preventing crashes and mitigating crash severity.

Key Stakeholders

- ADAS Integrators

- ADAS/Occupant Safety Solution Suppliers

- Automobile Original Equipment Manufacturers (OEMs)

- Automotive Camera Manufacturers

- Automotive Component Manufacturers

- Automotive Radar and Ultrasonic Sensor Manufacturers

- Automotive SoC and ECU Manufacturers

- Automotive Software and Platform Providers

- Autonomous Driving Platform Providers

- Country-specific Automotive Associations

- European Automobile Manufacturer Association (ACEA)

- EV and EV Component Manufacturers

- Government & Research Organizations

- LiDAR Manufacturers

- National Highway Traffic Safety Administration (NHTSA)

- Vehicle Safety Regulatory Bodies

Report Objectives

- To segment and forecast the size of the Advanced Driver Assistance Systems Market in terms of volume (Thousand Units) and value (USD million)

- To define, describe, and forecast the size of the Advanced Driver Assistance Systems Market based on system, component, offering, electric vehicle, level of autonomy, vehicle type, vehicle class, sales channel, and Region

- To segment and forecast the market size by electric vehicle [Battery Electric Vehicles (BEVs), Hybrid Electric Vehicles (HEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Fuel Cell Electric Vehicles (FCEVs)]

- To segment and forecast the market size by system [Adaptive Cruise Control (ACC), Adaptive Front Light (AFL), Automatic Emergency Braking (AEB), Blind-spot Detection (BSD), Cross-traffic Alert (CTA), Driver Monitoring System (DMS), Forward Collision Warning (FCW), Intelligent Park Assist (IPA), Lane Departure Warning (LDW), Night Vision System (NVS), Pedestrian Detection System (PDS), Road Sign Recognition (RSR), Tire Pressure Monitoring System (TPMS), and Traffic Jam Assist (TJA)]

- To segment and forecast the market size by offering (Hardware [Camera Units, LiDAR, Radar Sensors, Ultrasonic Sensors, ECU, and Others] and Software [Middleware, Application Software, Operating Systems])

- To segment and forecast the market size by electric vehicle [Battery Electric Vehicles (BEVs), Hybrid Electric Vehicles (HEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Fuel Cell Electric Vehicles (FCEVs)]

- To segment and forecast the market size by level of autonomy (L1, L2, L3, L4, and L5)

- To segment and forecast the market size by vehicle type (Passenger Cars, Light Commercial Vehicles, Trucks, and Buses)

- To forecast the market size by Region [North America, Europe, Asia Pacific, and Rest of the World (RoW)]

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs.

- Advanced Driver Assistance Systems Market, for electric vehicles by the system type level

- Advanced Driver Assistance Systems Market by vehicle type at the country level (for countries not covered in the report)

-

Company Information:

- Profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in ADAS Market

Surround camera systems for blind spot detection -Buses Surround camera systems for blind spot detection on Cars

I am student from UniKL MFI, Malaysia, requesting for the sample report in order to make a research and analysis on the ADAS as required for my Final Year Project.

night vision sensor. Radar sensensors lidar , ultrasonic , pressure sensors markets in india for next five year

Front assist system, Adaptive Cruise Control (ACC,)Lane Departure Warning (LDWS), Drowsiness Monitor, Blind Spot Detection (BSD), By Technology [Ultrasonic, Image, RADAR, LIDAR, Infrared (IR)], vehicle collision avoidance