Collagen and Gelatin Market by Source (Bovine, Porcine, Marine), Application (Wound Care, Orthopaedic, Cardiovascular, Dental, Surgical, Nerve Repair), End User (Hospitals, Surgical Centers), Region - Global Forecast to 2028

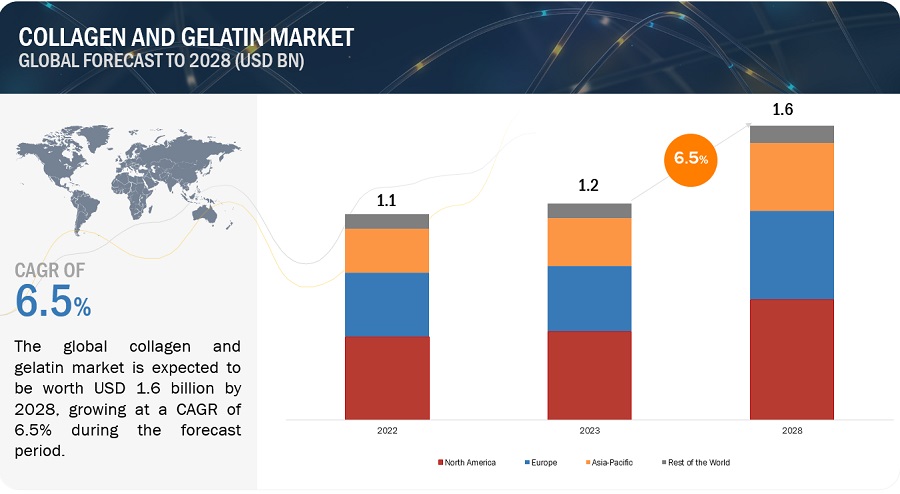

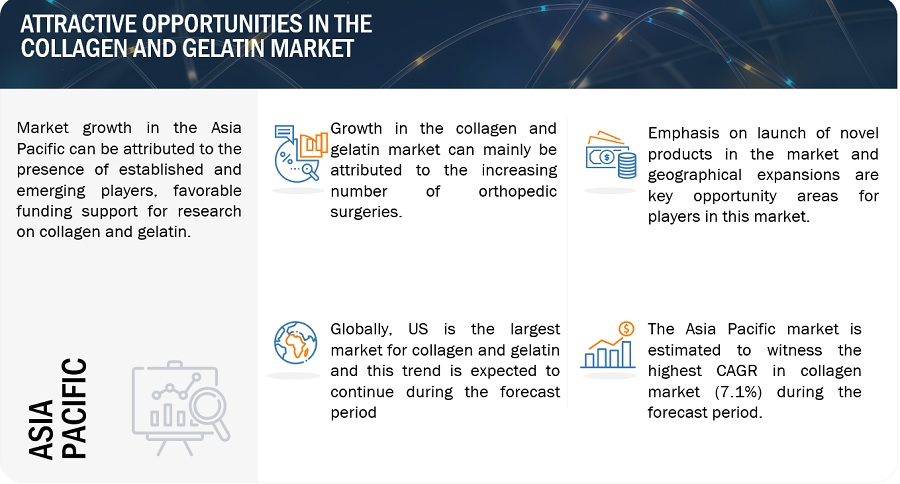

The global collagen and gelatin market in terms of revenue was estimated to be worth $1.2 billion in 2023 and is poised to reach $1.6 billion by 2028, growing at a CAGR of 6.5% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The rising incidence of chronic diseases, increasing demand for collagen and gelatin due to increased demand for wound care products, and strong emphasis on the launch of novel products by key market players are driving the market growth.

Attractive Opportunities in the Collagen and Gelatin Market

To know about the assumptions considered for the study, Request for Free Sample Report

Collagen and Gelatin Market Dynamics

DRIVER: Growing incidence of Chronic wounds, diabetes, and cancer

The prevalence of diabetes makes it a significant target indication due to its association with complex wound complications, including infections, ulcerations (such as leg or foot ulcers), and surgical wounds. Treating these complications incurs high medical expenses. In the US, approximately 25% of individuals with diabetes develop foot ulcers at some point in their lives, and around 15% of the diabetic population experiences diabetic foot ulcers (DFUs). As the prevalence of DFUs continues to rise, there is an increasing demand for regenerative medicine products such as grafts and matrices.

RESTRAINT: Availability of alternative biomaterials

The global market growth may be hindered due to the presence of substitute biomaterials that offer efficient and reliable healing, repair, and regeneration of damaged or diseased tissue and organs. Various biomaterials, including chitosan, alginate, cellulose, hyaluronic acid, polylactic acid (PLA), poly(lactic-co-glycolic acid) (PLGA), are being utilized as alternatives to collagen and gelatin in the field of regenerative medicine. The availability of these substitutes has the potential to impede the progress of the market on a global scale.

OPPORTUNITY: Implementation of the 21st Century Cures Act

In December 2016, The 21st Century Cures Act was signed into law in the US. The Act is intended to help accelerate medical product development and bring innovations and advances to patients who need them faster and more efficiently. Under this Act, a new Regenerative Medicine Advanced Therapy designation is been instituted, along with a fast-track approvals for novel regenerative medicine products. The implementation of the 21st Century Cures Act is likely to potentially result in the approval of new regenerative medicine products in the US and promote research and development in the field of regenerative medicine.

CHALLENGE: Insufficient processing technologies

The process of extracting and processing collagen and gelatin proteins is highly advanced and requires sophisticated technology. Once the edible collagen is extracted from porcine, bovine, or fish skins, it undergoes filtration and ion exchange. The filtration process utilizes microfiltration technology, allowing the fluid to pass through a porous membrane. Heat sterilization is then applied, requiring high-temperature heat treatment, followed by drying the product through spray drying technology. Unfortunately, these technologies are not widely developed in many regions, particularly in developing countries such as India, China, and the Rest of Asia Pacific. Consequently, collagen peptides and gelatin production are limited to certain countries, such as the US, the UK, and Germany. Developing countries with high demand for protein-based ingredients are at a disadvantage due to the lack of advanced technologies for manufacturing and marketing these products.

Collagen and Gelatin Market Ecosystem

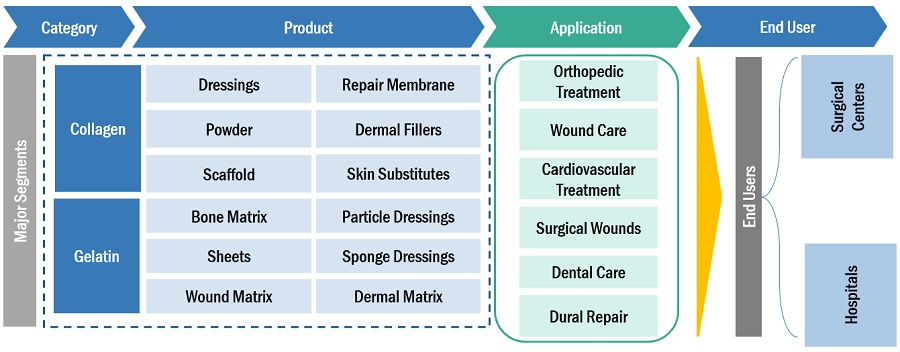

The orthopedic segment dominated the collagen and gelatin industry in 2022.

Based on application, the global collagen and gelatin market is segmented into wound care, dental, orthopedic, surgical, cardiovascular, and other collagen applications. The global gelatin market is segmented into orthopedics, wound care, and other gelatin application. The orthopedic segment accounted for the largest share of the both market. The dominant share is majorly due to the rising adoption of biomaterials in orthopedic surgeries and the launch of novel products in the market.

The hospitals segment of collagen and gelatin industry accounted for the segment-dominated market in 2022.

Based on end users, the collagen and gelatin market is segmented into hospitals and surgical centers. In 2022, the hospitals segment accounted for the largest share of the market. The segment held the dominant share in the market owing to various factors such as an increased number of surgical procedures across the globe and increased adoption of collagen-based products in orthopedic, wound care, dental and other applications.

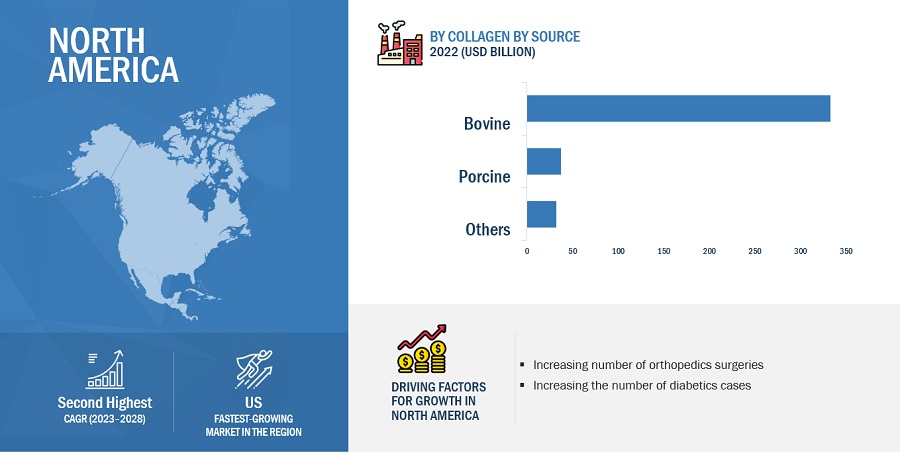

North America held a dominant share in the regional market for the collagen and gelatin industry in 2022.

To know about the assumptions considered for the study, download the pdf brochure

Geographically, the collagen and gelatin market is segmented into North America, Europe, Asia Pacific, Rest of the World. In 2022, North America accounted for the largest share of the gelatin market, followed by Europe & Asia Pacific. The dominance of the region is attributable to various factors, such as the presence of top market players in the region, the presence of top medical facilities leading to the adoption of technologically advanced wound care products, and the increased number of surgeries in the region.

Key players in the Collagen and Gelatin market include Integra LifeSciences (US), DSM (Netherlands), CollPlant Biotechnologies Ltd. (Israel), Nitta Gelatin Inc. (Japan), Collagen Solutions PLC (UK), and others.

Scope of the Collagen and Gelatin Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$1.2 billion |

|

Projected Revenue by 2028 |

$1.6 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 6.5% |

|

Market Driver |

Growing incidence of Chronic wounds, diabetes, and cancer |

|

Market Opportunity |

Implementation of the 21st Century Cures Act |

This report categorizes the collagen and gelatin market to forecast revenue and analyze trends in each of the following submarkets:

By Source

- Bovine

- Porcine

- Other sources

By Application

- Orthopedic

- Wound Care

- Dental

- Surgical

- Cardiovascular Disease

- Others

By Application

- Orthopedic

- Wound Care

- Other Applications

By End User

- Hospitals

- Surgical Centers

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- Japan

- China

- India

- Rest of Asia Pacific (RoAPAC)

-

Rest of World (RoW)

- Latin America

- Middle East and Africa (MEA)

Recent Developments of Collagen and Gelatin Industry

- In January 2023, TELA Bio, Inc. launched NIVIS Fibrillar Collagen Pack. NIVIS Fibrillar Collagen Pack is an absorbent matrix of Type I and Type III bovine collagen proposed to manage moderately to heavily exudating wounds and to control minor bleeding.

- In October 2022, Collagen Matrix acquired Polyganics B.V. expanded its portfolio of bioresorbable solutions and technology platforms for bone and tissue repair.

- In January 2021, Integra LifeSciences acquired ACell. This acquisition enabled the company to provide more comprehensive complex wound management solutions.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global collagen and gelatin market?

The global collagen and gelatin market boasts a total revenue value of $1.6 billion by 2028.

What is the estimated growth rate (CAGR) of the global collagen and gelatin market?

The global collagen and gelatin market has an estimated compound annual growth rate (CAGR) of 6.5% and a revenue size in the region of $1.2 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

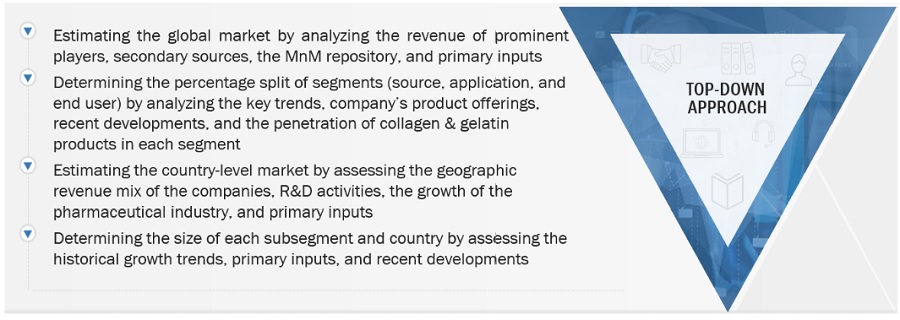

This study involved four major activities in estimating the current size of the collagen and gelatin market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The top-down and other approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the collagen and gelatin market. Some of the key secondary sources referred to for this study include publications from government sources World Health Organization (WHO), the US Food and Drug Administration (FDA), the National Institutes of Health (NIH), the National Center for Biotechnology Information (NCBI), American Heart Association (AHA), The University of Alabama (UAB) Organisation for Economic Co-operation and Development (OECD), American Diabetes Association (ADA), Academy of Physicians in Wound Healing (APWH), American Academy and Board of Regenerative Medicine, Canadian Association for Research in Regenerative Medicine. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives. Secondary sources also include corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global collagen and gelatin market, which was validated through primary research.

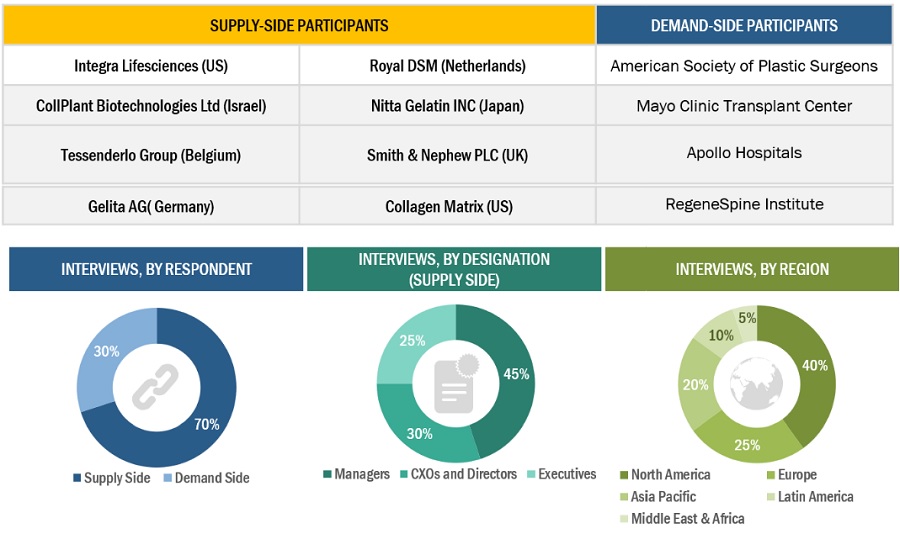

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

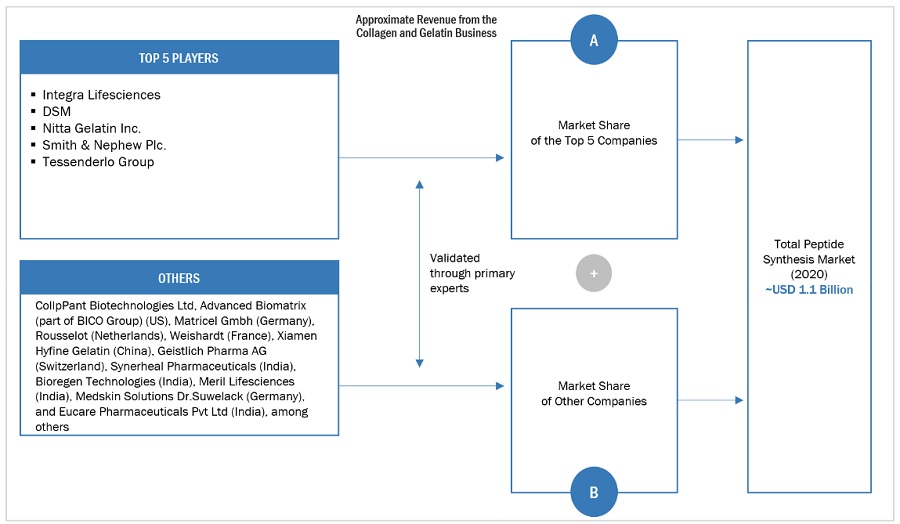

Market Size Estimation

The global size of the collagen and gelatin market was estimated through multiple approaches. A detailed market estimation approach was followed to estimate and validate the value of the market and other dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The major players in the industry and market have been identified through extensive primary and secondary research.

- The revenues generated from the collagen and gelatin business of players operating in the market have been determined through secondary research and primary analysis.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Bottom-up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Top-down Approach-

Data Triangulation

After estimating the overall market size through the market size estimation process, the total market was further separated into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Collagen is an abundant fibrous protein found in connective tissue, and serves as a vital structural component. It is characterized by its high content of proline and glycine amino acids and can be converted into gelatin through hydrolysis. Gelatin, in turn, is a partially hydrolyzed form of collagen. These natural biomaterials, collagen, and gelatin, play significant roles in wound care and orthopedic applications.

Key Stakeholders

- Biomaterial manufacturing companies

- Original equipment manufacturing companies

- Biomaterial suppliers and distributors

- Medical research institutes

- Government bodies

- Corporate entities

- Market research and consulting firms

Report Objectives

- To define, describe, segment, and forecast the global collagen & gelatin market by source, application, end user, and region

- To provide detailed information about the factors influencing the market growth (drivers, restraints, opportunities, Challenges)

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall collagen & gelatin market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the collagen & gelatin market in four main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (ROW)

- To profile the key players in the global collagen & gelatin market and comprehensively analyze their core competencies2 and market shares

- To track and analyze competitive developments, such as product launches, mergers & acquisitions, collaborations, expansions, and partnerships in the collagen & gelatin market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Geographic Analysis

- Further breakdown of the Rest of Europe's collagen and gelatin market, by country

- Further breakdown of the Rest of Asia Pacific collagen and gelatin market, by country

- Further breakdown of the Rest of Latin America and Middle East & Africa collagen and gelatin market, by country

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Company Information

- An additional five company profiles

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Collagen and Gelatin Market