Managed file transfer is a file transfer solution which automates and secures file transfers. Managed file transfer solutions help enterprises to improve security and offers support to meet compliance requirements.

The driving factor for the growth of the managed file transfer market is the increased need to protect sensitive data among enterprises. Managed file transfer solutions provide a secure, audited method for automatically transferring information within and outside of the enterprise. Moreover, this solution can be deployed to the cloud, on-premise, and hybrid environment. As the file size increases, traditional solutions such as FTP (file transfer protocol) is unable to meet the requirements. Managed file transfer offers users with a modular design, in-built interfaces, business application connectors, and advanced managed folder capabilities. Furthermore, it can be integrated seamlessly with enterprise business processes and IT workflows. Managed file transfer solutions provide data security, file governance, file storage, and file integration, and translation solutions. Additionally, it is capable of offering solutions and services for any business model such as person-person, person-server, sever-server, and business to business.

The global market for managed file transfer is segmented on the basis of deployment, solution, model, enterprise size, industry vertical, and region. Based on deployment, the market has been segmented into cloud, on-premise, and hybrid. In terms of solution, the market is bifurcated into software and professional services. The software solution is further divided into suite/integrated and standalone. The standalone solution is further divided into automated file transfer, file integration, file governance, security & encryption, translation, mobile file sharing and collaboration, file storage, advanced workflows, and others (file synchronization, file acceleration, etc.). Professional services are sub-segmented into installation and integration, and support and maintenance. Based on model, the market has been categorized into person-person, server-person, person-server, and business-business. In terms of enterprise size, the market is fragmented into small & medium enterprises (SMEs) and large enterprises. The large enterprises segment is estimated to account for highest market share in 2018 due to early adoption of managed file transfer. However, the small & medium enterprises (SMEs) segment is projected to expand at the highest CAGR due to the growing need for efficient file transfer solutions. The market is segmented based on industry vertical into BFSI (Banking, Financial Services, and Insurance), IT and telecom, government, healthcare, logistics, education, retail, media and entertainment, manufacturing, energy and utility, and others (travel and hospitality, legal, construction, etc.).

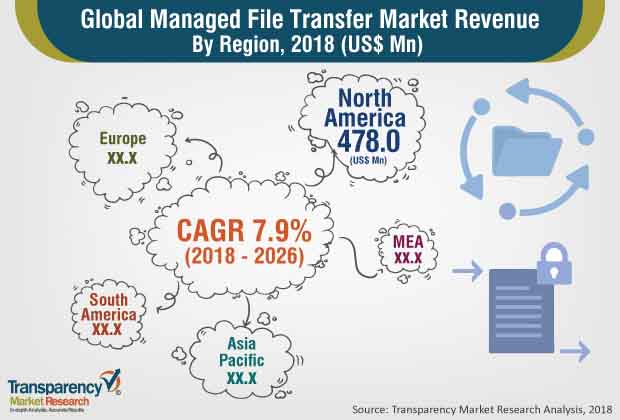

Geographically, the global managed file transfer market is divided into North America, Asia Pacific, Europe, South America, and Middle East & Africa. North America and Europe dominate the global managed file transfer market. This is due to rising concerns about file security. Moreover, government rules and regulations in various industries across these regions further boosts the growth of the market. These include, Payment Card Industry Data Security Standard (PCI-DSS) for the payment industry, and Health Insurance Portability and Accountability Act (HIPAA) for the healthcare industry in the U.S., and Europe. The market in the Asia Pacific region is expected to register the highest growth due to growth in digitalization and industrialization. The markets in Middle East & Africa and South Africa are anticipated to grow at a slow rate due to lack of awareness about managed file transfer solutions.

The global managed file transfer market is highly competitive. Innovations and acquisitions further increase the competitiveness of the market. For instance, in March 2015, Open Text Corporation launched a new version of managed file transfer which has capabilities for fast and secure transfer of files. The latest version of managed file transfer also provides better security and versatility to support the future of managed file transfer in EIM (enterprise information management).

This report on the global managed file transfer market provides market revenue share analysis of various vital participants. Some of the key players profiled in the report include IBM Corporation, Tibco Software Inc., Oracle Corporation, Linoma Software, Ipswitch Inc., Open Text Corporation., GlobalSCAPE Inc., Attunity Ltd., Biscom Inc., Axway Software SA, JScape LLC, Seeburger AG, South River Technologies Inc., and Cleo Communications Inc.

The rise in number of cyberattacks is enforcing enterprises to adopt managed file transfer solutions in order to safely transfer and share different types of information. Managed file transfer solutions are typically used integrated encryption techniques such as Open Pretty Good Privacy (PGP), Secure Sockets Layer (SSL), Secure Shell (SSH) and Advanced Encryption Standard (AES) in order to securely transfer sensitive data by securely encrypting it.

Managed file transfer is an innovation stage that supports different security protocols, for example, TTPS, SFTP, FTPS, and automation capacities, to safely transfer different kinds of data inside and outside an endeavor. Managed file transfer solutions assist endeavors with supporting various regulations and guidelines, for example, Health Insurance Portability, Accountability Act (HIPAA), and EU General Data Protection Regulation (GDPR). These tough government regulations on data security and privacy will fuel the market income. The stage offers advantages, for example, visibility, announcing, logging, security, and tracking contrasted with conventional file transfer solutions.

People-focused managed file transfer is also helping to fuel the case management processes across several different industries such as social service cases and legal actions. It also aids companies to mitigate and control human errors while transferring files across networks. Also, because of the COVID-19 pandemic situation, there has been a growing need for safe data transfer over people-focused models is also rising to make sure protection of data from cyber attackers, hackers and constantly evolving cyber threats.

In China, large enterprises dominated around 60% managed file transfer market share in 2019 owing to growing demand to transfer sensitive data across enterprise branches located at different locations. Managed file transfer solutions enable large enterprises to securely transfer critical data for business processes across different office locations. Growing cybersecurity risks to sensitive business data will boost the market demand. Large enterprises are using different cloud-based file transfer solutions to gain more control over file transfers.

The managed file transfer market has been segmented as below:

Market Segmentation:Global Managed File Transfer Market

|

Deployment |

|

|

Solution |

|

|

Model |

|

|

Enterprise Size |

|

|

Industry Vertical |

|

|

Geography |

|

1. Preface

1.1. Market ScopeandMarket Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modelling

3. Executive Summary: Global Managed File Transfer

4. Market Overview

4.1. Introduction

4.2. Global Market – Macro Economic Factors Overview

4.2.1. World GDP Indicator – For Top 20 Economies

4.2.2. Global ICT Spending (US$ Mn), 2012, 2018, 2026

4.2.3. Key Regional Socio-political-technological Developments and Their Impact Considerations

4.3. Technology/Product Roadmap

4.4. Key Trends Analysis

4.5. Market Factor Analysis

4.5.1. Porter’s Five Forces Analysis

4.5.2. PESTEL Analysis

4.5.3. Market Dynamics (Growth Influencers)

4.5.3.1. Drivers

4.5.3.2. Restraints

4.5.3.3. Opportunities

4.5.3.4. Impact Analysis of Drivers & Restraints

4.6. Global Managed File Transfer Analysis and Forecast, 2016 - 2026

4.6.1. Market Revenue Analysis (US$ Mn)

4.6.1.1. Historic Growth Trends, 2012-2017

4.6.1.2. Forecast Trends, 2018-2026

4.7. Market Opportunity Analysis

4.8. Competitive Scenario and Trends

4.8.1. Mergers & Acquisitions, Expansions

4.9. Market Outlook

5. Global Managed File Transfer Analysis and Forecast, by Deployment

5.1. Overview

5.2. Managed File Transfer Size (US$ Mn) Forecast, by Deployment, 2016 - 2026

5.2.1. Cloud

5.2.2. On-premise

5.2.3. Hybrid

6. Global Managed File Transfer Analysis and Forecast, by Solution

6.1. Overview

6.2. Managed File Transfer Size (US$ Mn) Forecast, by Solution, 2016 - 2026

6.2.1. Software

6.2.1.1. Suite

6.2.1.2. Standalone

6.2.1.2.1. Automated file transfer

6.2.1.2.2. File Integration

6.2.1.2.3. File Governance

6.2.1.2.4. Security & Encryption

6.2.1.2.5. Translation

6.2.1.2.6. Mobile File Sharing and Collaboration

6.2.1.2.7. File Storage

6.2.1.2.8. Advanced Workflows

6.2.1.2.9. Others (File Synchronization, File Acceleration etc.)

6.2.2. Professional Services

6.2.2.1. Installation and Integration

6.2.2.2. Support and Maintenance

7. Global Managed File Transfer Analysis and Forecast, by Model

7.1. Overview

7.2. Managed File Transfer Size (US$ Mn) Forecast, by Model, 2016 - 2026

7.2.1. Person-Person

7.2.2. Server-Person

7.2.3. Person-Server

7.2.4. Business-Business

8. Global Managed File Transfer Analysis and Forecast, by Enterprise Size

8.1. Overview

8.2. Managed File Transfer Size (US$ Mn) Forecast, by Enterprise Size, 2016 - 2026

8.2.1. Small & Medium Enterprises (SMEs)

8.2.2. Large Enterprises

9. Global Managed File Transfer Analysis and Forecast, by Industry Vertical

9.1. Overview

9.2. Managed File Transfer Size (US$ Mn) Forecast, by Industry Vertical, 2016 - 2026

9.2.1. BFSI

9.2.2. IT and Telecom

9.2.3. Government

9.2.4. Healthcare

9.2.5. Logistics

9.2.6. Education

9.2.7. Retail

9.2.8. Media and Entertainment

9.2.9. Manufacturing

9.2.10. Energy and Utility

9.2.11. Others (Travel and Hospitality, Legal, Construction etc.)

10. Global Managed File Transfer Analysis and Forecast, by Region

10.1. Regional Overview

10.2. Managed File Transfer Size (US$ Mn) Forecast, by Region, 2016 - 2026

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Middle East & Africa

10.2.5. South America

11. North America Managed File Transfer Analysis and Forecast

11.1. Overview

11.2. Impact Analysis of Drivers and Restraint

11.3. Managed File Transfer Size (US$ Mn) Forecast, by Deployment, 2016 - 2026

11.3.1. Cloud

11.3.2. On-premise

11.3.3. Hybrid

11.4. Managed File Transfer Size (US$ Mn) Forecast, by Solution, 2016 - 2026

11.4.1. Software

11.4.1.1. Suite

11.4.1.2. Standalone

11.4.1.2.1. Automated file transfer

11.4.1.2.2. File Integration

11.4.1.2.3. File Governance

11.4.1.2.4. Security & Encryption

11.4.1.2.5. Translation

11.4.1.2.6. Mobile File Sharing and Collaboration

11.4.1.2.7. File Storage

11.4.1.2.8. Advanced Workflows

11.4.1.2.9. Others (File Synchronization, File Acceleration etc.)

11.4.2. Professional Services

11.4.2.1. Installation and Integration

11.4.2.2. Support and Maintenance

11.5. Managed File Transfer Size (US$ Mn) Forecast, by Model, 2016 - 2026

11.5.1. Person-Person

11.5.2. Server-Person

11.5.3. Person-Server

11.5.4. Business-Business

11.6. Managed File Transfer Size (US$ Mn) Forecast, by Enterprise Size, 2016 - 2026

11.6.1. Small & Medium Enterprises (SMEs)

11.6.2. Large Enterprises

11.7. Managed File Transfer Size (US$ Mn) Forecast, by Industry Vertical, 2016 - 2026

11.7.1. BFSI

11.7.2. IT and Telecom

11.7.3. Government

11.7.4. Healthcare

11.7.5. Logistics

11.7.6. Education

11.7.7. Retail

11.7.8. Media and Entertainment

11.7.9. Manufacturing

11.7.10. Energy and Utility

11.7.11. Others (Travel and Hospitality, Legal, Construction etc.)

11.8. Managed File Transfer Size (US$ Mn) Forecast, by Country, 2016 - 2026

11.8.1. The U.S.

11.8.2. Canada

11.8.3. Rest of North America

12. Europe Managed File Transfer Analysis and Forecast

12.1. Overview

12.2. Impact Analysis of Drivers and Restraint

12.3. Managed File Transfer Size (US$ Mn) Forecast, by Deployment, 2016 - 2026

12.3.1. Cloud

12.3.2. On-premise

12.3.3. Hybrid

12.4. Managed File Transfer Size (US$ Mn) Forecast, by Solution, 2016 - 2026

12.4.1. Software

12.4.1.1. Suite

12.4.1.2. Standalone

12.4.1.2.1. Automated file transfer

12.4.1.2.2. File Integration

12.4.1.2.3. File Governance

12.4.1.2.4. Security & Encryption

12.4.1.2.5. Translation

12.4.1.2.6. Mobile File Sharing and Collaboration

12.4.1.2.7. File Storage

12.4.1.2.8. Advanced Workflows

12.4.1.2.9. Others (File Synchronization, File Acceleration etc.)

12.4.2. Professional Services

12.4.2.1. Installation and Integration

12.4.2.2. Support and Maintenance

12.5. Managed File Transfer Size (US$ Mn) Forecast, by Model, 2016 - 2026

12.5.1. Person-Person

12.5.2. Server-Person

12.5.3. Person-Server

12.5.4. Business-Business

12.6. Managed File Transfer Size (US$ Mn) Forecast, by Enterprise Size, 2016 - 2026

12.6.1. Small & Medium Enterprises (SMEs)

12.6.2. Large Enterprises

12.7. Managed File Transfer Size (US$ Mn) Forecast, by Industry Vertical, 2016 - 2026

12.7.1. BFSI

12.7.2. IT and Telecom

12.7.3. Government

12.7.4. Healthcare

12.7.5. Logistics

12.7.6. Education

12.7.7. Retail

12.7.8. Media and Entertainment

12.7.9. Manufacturing

12.7.10. Energy and Utility

12.7.11. Others (Travel and Hospitality, Legal, Construction etc.)

12.8. Managed File Transfer Size (US$ Mn) Forecast, by Country, 2016 - 2026

12.8.1. Germany

12.8.2. Italy

12.8.3. France

12.8.4. The U.K.

12.8.5. Rest of Europe

13. Asia Pacific Managed File Transfer Analysis and Forecast

13.1. Overview

13.2. Impact Analysis of Drivers and Restraint

13.3. Managed File Transfer Size (US$ Mn) Forecast, by Deployment, 2016 - 2026

13.3.1. Cloud

13.3.2. On-premise

13.3.3. Hybrid

13.4. Managed File Transfer Size (US$ Mn) Forecast, by Solution, 2016 - 2026

13.4.1. Software

13.4.1.1. Suite

13.4.1.2. Standalone

13.4.1.2.1. Automated file transfer

13.4.1.2.2. File Integration

13.4.1.2.3. File Governance

13.4.1.2.4. Security & Encryption

13.4.1.2.5. Translation

13.4.1.2.6. Mobile File Sharing and Collaboration

13.4.1.2.7. File Storage

13.4.1.2.8. Advanced Workflows

13.4.1.2.9. Others (File Synchronization, File Acceleration etc.)

13.4.2. Professional Services

13.4.2.1. Installation and Integration

13.4.2.2. Support and Maintenance

13.5. Managed File Transfer Size (US$ Mn) Forecast, by Model, 2016 - 2026

13.5.1. Person-Person

13.5.2. Server-Person

13.5.3. Person-Server

13.5.4. Business-Business

13.6. Managed File Transfer Size (US$ Mn) Forecast, by Enterprise Size, 2016 - 2026

13.6.1. Small & Medium Enterprises (SMEs)

13.6.2. Large Enterprises

13.7. Managed File Transfer Size (US$ Mn) Forecast, by Industry Vertical, 2016 - 2026

13.7.1. BFSI

13.7.2. IT and Telecom

13.7.3. Government

13.7.4. Healthcare

13.7.5. Logistics

13.7.6. Education

13.7.7. Retail

13.7.8. Media and Entertainment

13.7.9. Manufacturing

13.7.10. Energy and Utility

13.7.11. Others (Travel and Hospitality, Legal, Construction etc.)

13.8. Managed File Transfer Size (US$ Mn) Forecast, by Country, 2016 - 2026

13.8.1. China

13.8.2. Japan

13.8.3. India

13.8.4. Rest of Asia Pacific

14. Middle East & Africa (MEA) Managed File Transfer Analysis and Forecast

14.1. Overview

14.2. Impact Analysis of Drivers and Restraint

14.3. Managed File Transfer Size (US$ Mn) Forecast, by Deployment, 2016 - 2026

14.3.1. Cloud

14.3.2. On-premise

14.3.3. Hybrid

14.4. Managed File Transfer Size (US$ Mn) Forecast, by Solution, 2016 - 2026

14.4.1. Software

14.4.1.1. Suite

14.4.1.2. Standalone

14.4.1.2.1. Automated file transfer

14.4.1.2.2. File Integration

14.4.1.2.3. File Governance

14.4.1.2.4. Security & Encryption

14.4.1.2.5. Translation

14.4.1.2.6. Mobile File Sharing and Collaboration

14.4.1.2.7. File Storage

14.4.1.2.8. Advanced Workflows

14.4.1.2.9. Others (File Synchronization, File Acceleration etc.)

14.4.2. Professional Services

14.4.2.1. Installation and Integration

14.4.2.2. Support and Maintenance

14.5. Managed File Transfer Size (US$ Mn) Forecast, by Model, 2016 - 2026

14.5.1. Person-Person

14.5.2. Server-Person

14.5.3. Person-Server

14.5.4. Business-Business

14.6. Managed File Transfer Size (US$ Mn) Forecast, by Enterprise Size, 2016 - 2026

14.6.1. Small & Medium Enterprises (SMEs)

14.6.2. Large Enterprises

14.7. Managed File Transfer Size (US$ Mn) Forecast, by Industry Vertical, 2016 - 2026

14.7.1. BFSI

14.7.2. IT and Telecom

14.7.3. Government

14.7.4. Healthcare

14.7.5. Logistics

14.7.6. Education

14.7.7. Retail

14.7.8. Media and Entertainment

14.7.9. Manufacturing

14.7.10. Energy and Utility

14.7.11. Others (Travel and Hospitality, Legal, Construction etc.)

14.8. Managed File Transfer Size (US$ Mn) Forecast, by Country, 2016 - 2026

14.8.1. GCC

14.8.2. South Africa

14.8.3. Turkey

14.8.4. Rest of MEA

15. South America Managed File Transfer Analysis and Forecast

15.1. Overview

15.2. Impact Analysis of Drivers and Restraint

15.3. Managed File Transfer Size (US$ Mn) Forecast, by Deployment, 2016 - 2026

15.3.1. Cloud

15.3.2. On-premise

15.3.3. Hybrid

15.4. Managed File Transfer Size (US$ Mn) Forecast, by Solution, 2016 - 2026

15.4.1. Software

15.4.1.1. Suite

15.4.1.2. Standalone

15.4.1.2.1. Automated file transfer

15.4.1.2.2. File Integration

15.4.1.2.3. File Governance

15.4.1.2.4. Security & Encryption

15.4.1.2.5. Translation

15.4.1.2.6. Mobile File Sharing and Collaboration

15.4.1.2.7. File Storage

15.4.1.2.8. Advanced Workflows

15.4.1.2.9. Others (File Synchronization, File Acceleration etc.)

15.4.2. Professional Services

15.4.2.1. Installation and Integration

15.4.2.2. Support and Maintenance

15.5. Managed File Transfer Size (US$ Mn) Forecast, by Model, 2016 - 2026

15.5.1. Person-Person

15.5.2. Server-Person

15.5.3. Person-Server

15.5.4. Business-Business

15.6. Managed File Transfer Size (US$ Mn) Forecast, by Enterprise Size, 2016 - 2026

15.6.1. Small & Medium Enterprises (SMEs)

15.6.2. Large Enterprises

15.7. Managed File Transfer Size (US$ Mn) Forecast, by Industry Vertical, 2016 - 2026

15.7.1. BFSI

15.7.2. IT and Telecom

15.7.3. Government

15.7.4. Healthcare

15.7.5. Logistics

15.7.6. Education

15.7.7. Retail

15.7.8. Media and Entertainment

15.7.9. Manufacturing

15.7.10. Energy and Utility

15.7.11. Others (Travel and Hospitality, Legal, Construction etc.)

15.8. Managed File Transfer Size (US$ Mn) Forecast, by Country, 2016 - 2026

15.8.1. Brazil

15.8.2. Rest of South America

16. Competition Landscape

16.1. Market Player – Competition Matrix

16.2. Market Revenue Share Analysis (%), by Company (2017)

17. Company Profiles(Details – Business Overview, Sales Area/Geographical Presence, Revenue and Strategy)

17.1. IBM Corporation

17.2. Oracle Corporation

17.3. Open Text Corporation

17.4. Biscom Inc.

17.5. JScape LLC

17.6. Tibco Software Inc.

17.7. Ipswitch Inc.

17.8. Globalscape Inc.

17.9. Attunity Ltd.

17.10. Axway Software SA,

17.11. Seeburger AG

17.12. South River Technologies Inc.

17.13. Cleo Communications Inc.

17.14. Linoma Software

18. Key Takeaways

List of Tables

Table 1: Global Managed File Transfer Market Revenue (US$ Mn) Forecast, by Deployment, 2016 - 2026

Table 2: Global Managed File Transfer Market Revenue (US$ Mn) Forecast, by Solution, 2016 - 2026

Table 3: Global Managed File Transfer Market Revenue (US$ Mn) Forecast, by Model, 2016 - 2026

Table 4: Global Managed File Transfer Market Revenue (US$ Mn) Forecast, by Enterprise Size, 2016 - 2026

Table 5: Global Managed File Transfer Market Revenue (US$ Mn) Forecast, by Industry Vertical, 2016 - 2026

Table 6: Global Managed File Transfer Market Revenue (US$ Mn) Forecast, by Region, 2016 - 2026

Table 7: North America Managed File Transfer Market Revenue (US$ Mn) Forecast, by Deployment, 2016 - 2026

Table 8: North America Managed File Transfer Market Revenue (US$ Mn) Forecast, by Solution, 2016 - 2026

Table 9: North America Managed File Transfer Market Revenue (US$ Mn) Forecast, by Model, 2016 - 2026

Table 10: North America Managed File Transfer Market Revenue (US$ Mn) Forecast, by Enterprise Size, 2016 - 2026

Table 11: North America Managed File Transfer Market Revenue (US$ Mn) Forecast, by Industry Vertical, 2016 - 2026

Table 12: North America Managed File Transfer Market Revenue (US$ Mn) Forecast, by Country, 2016 - 2026

Table 13: Europe Managed File Transfer Market Revenue (US$ Mn) Forecast, by Deployment, 2016 - 2026

Table 14: Europe Managed File Transfer Market Revenue (US$ Mn) Forecast, by Solution, 2016 - 2026

Table 15: Europe Managed File Transfer Market Revenue (US$ Mn) Forecast, by Model, 2016 - 2026

Table 16: Europe Managed File Transfer Market Revenue (US$ Mn) Forecast, by Enterprise Size, 2016 - 2026

Table 17: Europe Managed File Transfer Market Revenue (US$ Mn) Forecast, by Industry Vertical, 2016 - 2026

Table 18: Europe Managed File Transfer Market Revenue (US$ Mn) Forecast, by Country, 2016 - 2026

Table 19: Asia Pacific Managed File Transfer Market Revenue (US$ Mn) Forecast, by Deployment, 2016 - 2026

Table 20: Asia Pacific Managed File Transfer Market Revenue (US$ Mn) Forecast, by Solution, 2016 - 2026

Table 21: Asia Pacific Managed File Transfer Market Revenue (US$ Mn) Forecast, by Model, 2016 - 2026

Table 22: Asia Pacific Managed File Transfer Market Revenue (US$ Mn) Forecast, by Enterprise Size, 2016 - 2026

Table 23: Asia Pacific Managed File Transfer Market Revenue (US$ Mn) Forecast, by Industry Vertical, 2016 - 2026

Table 24: Asia Pacific Managed File Transfer Market Revenue (US$ Mn) Forecast, by Country, 2016 - 2026

Table 25: Middle East & Africa Managed File Transfer Market Revenue (US$ Mn) Forecast, by Deployment, 2016 - 2026

Table 26: Middle East & Africa Managed File Transfer Market Revenue (US$ Mn) Forecast, by Solution, 2016 - 2026

Table 27: Middle East & Africa Managed File Transfer Market Revenue (US$ Mn) Forecast, by Model, 2016 - 2026

Table 28: Middle East & Africa Managed File Transfer Market Revenue (US$ Mn) Forecast, by Enterprise Size, 2016 - 2026

Table 29: Middle East & Africa Managed File Transfer Market Revenue (US$ Mn) Forecast, by Industry Vertical, 2016 - 2026

Table 30: Middle East & Africa Managed File Transfer Market Revenue (US$ Mn) Forecast, by Country, 2016 - 2026

Table 31: South America Managed File Transfer Market Revenue (US$ Mn) Forecast, by Deployment, 2016 - 2026

Table 32: South America Managed File Transfer Market Revenue (US$ Mn) Forecast, by Solution, 2016 - 2026

Table 33: South America Managed File Transfer Market Revenue (US$ Mn) Forecast, by Model, 2016 - 2026

Table 34: South America Managed File Transfer Market Revenue (US$ Mn) Forecast, by Enterprise Size, 2016 - 2026

Table 35: South America Managed File Transfer Market Revenue (US$ Mn) Forecast, by Industry Vertical, 2016 - 2026

Table 36: South America Managed File Transfer Market Revenue (US$ Mn) Forecast, by Country, 2016 - 2026

List of Figures

Figure 1: Global Managed File Transfer Market Size (US$ Mn) Forecast, 2016–2026

Figure 2: Gross Domestic Product (GDP) per Capita; Analysis (1/2) (US$ Mn), by Major Countries, 2012 - 2017

Figure 3: Gross Domestic Product (GDP) Analysis (2/2) (US$ Mn), by Major Countries, 2012 - 2017

Figure 4: Gross Domestic Product (GDP) Analysis (2/2) (US$ Mn), by Major Countries, 2012 - 2017

Figure 5: Managed File Transfer Market Size (US$ Mn) Forecast, 2012 – 2017

Figure 6: Global Managed File Transfer Market Y-o-Y Growth (Value %), 2012 – 2017

Figure 7: Managed File Transfer Market Size (US$ Mn) Forecast, 2018 - 2016

Figure 8: Global Managed File Transfer Market Y-o-Y Growth (Value %), 2018 - 2016

Figure 9: Global Managed File Transfer Market Opportunity Growth Analysis (US$ Mn), 2016 – 2026

Figure 10: Global Managed File Transfer Market Outlook (Value %), by Deployment

Figure 11: Global Managed File Transfer Market Solution (Value %), by Solution

Figure 12: Global Managed File Transfer Market Outlook (Value %), by Model

Figure 13: Global Managed File Transfer Market Solution (Value %), by Enterprise Size

Figure 14: Global Managed File Transfer Market Outlook (Value %), by Industry Vertical

Figure 15: Global Managed File Transfer Market Solution (Value %), by Region

Figure 16: Global Managed File Transfer Market Revenue Share, by Deployment (2018)

Figure 17: Global Managed File Transfer Market Revenue Share, by Deployment (2026)

Figure 18: Global Managed File Transfer Market Revenue Share, by Solution(2018)

Figure 19: Global Managed File Transfer Market Revenue Share, by Solution(2026)

Figure 20: Global Managed File Transfer Market Revenue Share, by Model (2018)

Figure 21: Global Managed File Transfer Market Revenue Share, by Model (2026)

Figure 22: Global Managed File Transfer Market Revenue Share, by Enterprise Size (2018)

Figure 23: Global Managed File Transfer Market Revenue Share, by Enterprise Size (2026)

Figure 24: Global Managed File Transfer Market Revenue Share, by Industry Vertical (2018)

Figure 25: Global Managed File Transfer Market Revenue Share, by Industry Vertical (2026)

Figure 26: Global Managed File Transfer Market Revenue Share, by Region (2018)

Figure 27: Global Managed File Transfer Market Revenue Share, by Region (2026)

Figure 28: North America Managed File Transfer Market Revenue Share, by Deployment (2018)

Figure 29: North America Managed File Transfer Market Revenue Share, by Deployment (2026)

Figure 30: North America Managed File Transfer Market Revenue Share, by Solution (2018)

Figure 31: North America Managed File Transfer Market Revenue Share, by Solution (2026)

Figure 32: North America Managed File Transfer Market Revenue Share, by Model (2018)

Figure 33: North America Managed File Transfer Market Revenue Share, by Model (2026)

Figure 34: North America Managed File Transfer Market Revenue Share, by Enterprise Size (2018)

Figure 35: North America Managed File Transfer Market Revenue Share, by Enterprise Size (2026)

Figure 36: North America Managed File Transfer Market Revenue Share, by Industry Vertical (2018)

Figure 37: North America Managed File Transfer Market Revenue Share, by Industry Vertical (2026)

Figure 38: North America Managed File Transfer Market Revenue Share, by Country (2018)

Figure 39: North America Managed File Transfer Market Revenue Share, by Country (2026)

Figure 40: Europe Managed File Transfer Market Revenue Share, by Deployment (2018)

Figure 41: Europe Managed File Transfer Market Revenue Share, by Deployment (2026)

Figure 42: Europe Managed File Transfer Market Revenue Share, by Solution (2018)

Figure 43: Europe Managed File Transfer Market Revenue Share, by Solution (2026)

Figure 44: Europe Managed File Transfer Market Revenue Share, by Model (2018)

Figure 45: Europe Managed File Transfer Market Revenue Share, by Model (2026)

Figure 46: Europe Managed File Transfer Market Revenue Share, by Enterprise Size (2018)

Figure 47: Europe Managed File Transfer Market Revenue Share, by Enterprise Size (2026)

Figure 48: Europe Managed File Transfer Market Revenue Share, by Industry Vertical (2018)

Figure 49: Europe Managed File Transfer Market Revenue Share, by Industry Vertical (2026)

Figure 50: Europe Managed File Transfer Market Revenue Share, by Country (2018)

Figure 51: Europe Managed File Transfer Market Revenue Share, by Country (2026)

Figure 52: Asia Pacific Managed File Transfer Market Revenue Share, by Deployment (2018)

Figure 53: Asia Pacific Managed File Transfer Market Revenue Share, by Deployment (2026)

Figure 54: Asia Pacific Managed File Transfer Market Revenue Share, by Solution (2018)

Figure 55: Asia Pacific Managed File Transfer Market Revenue Share, by Solution (2026)

Figure 56: Asia Pacific Managed File Transfer Market Revenue Share, by Model (2018)

Figure 57: Asia Pacific Managed File Transfer Market Revenue Share, by Model (2026)

Figure 58: Asia Pacific Managed File Transfer Market Revenue Share, by Enterprise Size (2018)

Figure 59: Asia Pacific Managed File Transfer Market Revenue Share, by Enterprise Size (2026)

Figure 60: Asia Pacific Managed File Transfer Market Revenue Share, by Industry Vertical (2018)

Figure 61: Asia Pacific Managed File Transfer Market Revenue Share, by Industry Vertical (2026)

Figure 62: Asia Pacific Managed File Transfer Market Revenue Share, by Country (2018)

Figure 63: Asia Pacific Managed File Transfer Market Revenue Share, by Country (2026)

Figure 64: Middle East & Africa Managed File Transfer Market Revenue Share, by Deployment (2018)

Figure 65: Middle East & Africa Managed File Transfer Market Revenue Share, by Deployment (2026)

Figure 66: Middle East & Africa Managed File Transfer Market Revenue Share, by Solution (2018)

Figure 67: Middle East & Africa Managed File Transfer Market Revenue Share, by Solution (2026)

Figure 68: Middle East & Africa Managed File Transfer Market Revenue Share, by Model (2018)

Figure 69: Middle East & Africa Managed File Transfer Market Revenue Share, by Model (2026)

Figure 70: Middle East & Africa Managed File Transfer Market Revenue Share, by Enterprise Size (2018)

Figure 71: Middle East & Africa Managed File Transfer Market Revenue Share, by Enterprise Size (2026)

Figure 72: Middle East & Africa Managed File Transfer Market Revenue Share, by Industry Vertical (2018)

Figure 73: Middle East & Africa Managed File Transfer Market Revenue Share, by Industry Vertical (2026)

Figure 74: Middle East & Africa Managed File Transfer Market Revenue Share, by Country (2018)

Figure 75: Middle East & Africa Managed File Transfer Market Revenue Share, by Country (2026)

Figure 76: South America Managed File Transfer Market Revenue Share, by Deployment (2018)

Figure 77: South America Managed File Transfer Market Revenue Share, by Deployment (2026)

Figure 78: South America Managed File Transfer Market Revenue Share, by Solution (2018)

Figure 79: South America Managed File Transfer Market Revenue Share, by Solution (2026)

Figure 80: South America Managed File Transfer Market Revenue Share, by Model (2018)

Figure 81: South America Managed File Transfer Market Revenue Share, by Model (2026)

Figure 82: South America Managed File Transfer Market Revenue Share, by Enterprise Size (2018)

Figure 83: South America Managed File Transfer Market Revenue Share, by Enterprise Size (2026)

Figure 84: South America Managed File Transfer Market Revenue Share, by Industry Vertical (2018)

Figure 85: South America Managed File Transfer Market Revenue Share, by Industry Vertical (2026)

Figure 86: South America Managed File Transfer Market Revenue Share, by Country (2018)

Figure 87: South America Managed File Transfer Market Revenue Share, by Country (2026)

Figure 88: Market Share Analysis by Key Players (2017)