Acousto-optic Devices Market by Device (Modulators, Deflectors, Tunable Filters, Frequency Shifters, Q-Switches), Application (Material Processing, Laser Processing, Micro Processing), Vertical, and Geography - Global Forecast to 2022

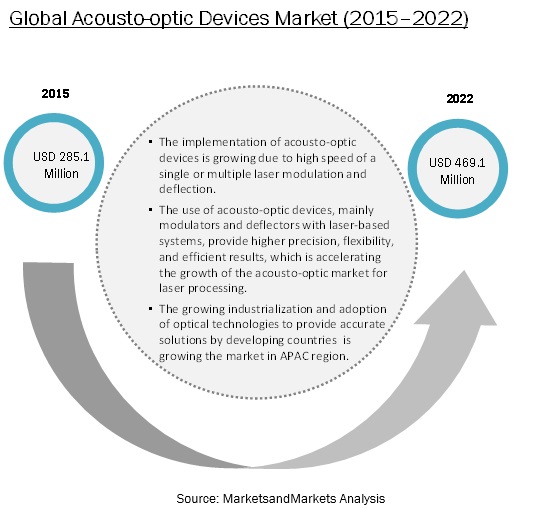

[148 Pages Report] The overall acousto-optic devices market was valued at USD 285.1 million in 2015 and is expected to reach USD 469.1 million by 2022, at a CAGR of 7.24% during the forecast period. The base year considered for the study is 2015, and the forecast has been provided for the period from 2016 to 2022.

Increased implementation of advanced acousto-optic materials drives the global acousto-optic devices market

A variety of different acousto-optic materials are used depending on the laser parameters such as laser wavelength (optical transmission range), divergence, and power density. For the visible and near infrared regions, the modulators are commonly made from gallium phosphide, tellurium dioxide, indium phosphide, or fused quartz. Lithium niobate, indium phosphide, and gallium phosphide are mainly used for high-frequency (GHz) signal processing devices. Recently, the use of advanced AO materials has made it easy to fabricate multichannel AO devices with a wide range of bandwidth, and these devices play an important role in the application of optical matrix processing. These AO materials also increase the capabilities of AO system designs for designing real-time ambiguity function generation for radar signals. AO interaction becomes easy with the use of appropriate AO materials and AO devices in Q-switching and locking for pulsed laser systems. Also, AO tunable filters are used in optical signal processing. So, the use of advance materials in AO devices will help these devices to modulate and control high wavelength laser beams for various applications and increase its demand for large laser applications.

Market Dynamics

Drivers

- Increased implementation of advanced AO materials

- Growing laser applications in scientific sector

Restraints

- High Initial cost and increasing requirement-specific R&D expenses

Opportunities

- Emerging applications of AO devices in various fields

- Growing use of fiber lasers leading the demand for AO devices

Challenges

- Limitation associated with use of AO devices in space-based applications

The following are the major objectives of the study.

- To define, describe, and forecast the global acousto-optic devices market, in terms of value, segmented on the basis of device type, application, vertical, and geography

- To describe the materials used in AO devices

- To forecast the market size for various segments with regard to four main regions, namely, North America, Europe, Asia-Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To use the Porters five forces model to gauge the entry barriers to this market, along with the analysis of the value chain

- To strategically analyze the micromarkets1 with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments in the global acousto-optic (AO) devices market

- To strategically profile key players, comprehensively analyze their market ranking and core competencies2, and detail the competitive landscape of the market

- To analyze competitive developments such as joint ventures, mergers and acquisitions, new product developments, and research and development in the global acousto-optic devices market

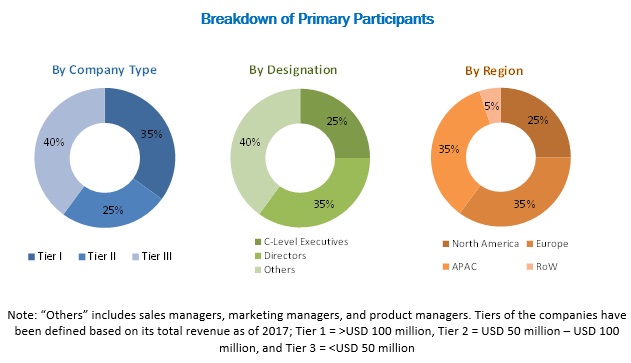

During this research study, major players operating in the acousto-optic devices market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Factiva, as well as through the discussions with the primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem:

The key players in the ecosystem of the acousto-optic devices market profiled in this report are Gooch & Housego PLC (UK), Isomet Corporation (US), Brimrose Corporation of America (US), Harris Corporation (US), AMS Technologies AG (Germany), Coherent, Inc. (US), AA Opto Electronic (France), A·P·E Angewandte Physik & Elektronik GmbH (Germany), IntraAction Corp. (US), and Lightcomm Technology Co., Ltd. (China).

Target Audience:

- Device manufacturers and suppliers

- Laser system manufacturers and providers

- Original equipment manufacturers (OEMs)

- Optical instruments manufacturers

- Software providers

- Research organizations

- Technology standards organizations, forums, alliances, and associations

- Technology investors

- Governments, financial institutions, and investment communities

- End users

Critical Questions

- What are new devices being explored by the acousto-optic materials?

- Which are the key players in the market and how intense is the competition?

Report Scope:

By Device

- Acousto-optic Modulator

- Acousto-optic Deflector

- Acousto-optic Frequency Shifter

- Acousto-optic Tunable Filter

- Acousto-optic Q-switch

- Mode Locker

- Pulse Picker/Cavity Dumper

- RF Driver

By Application

- Material Processing

- Laser Processing

- Micro Processing

- Others (Optical Communication and Signal Processing)

By Vertical

- Aerospace and Defense

- Life Science and Scientific Research

- Medical

- Industrial

- Telecom

- Semiconductor and Electronics

- Oil and Gas

By Geography

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Rest of Europe (Greece, Spain, Italy, Russia, Finland, Denmark, and Sweden)

- APAC

- China

- Japan

- India

- South Korea

- Rest of APAC (Australia, New Zealand, Singapore, Hong Kong, Indonesia, and Taiwan)

- RoW

- Middle East and Africa

- Latin America

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to a companys specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The overall acousto-optic devices market is expected to grow from USD 308.4 million in 2016 to USD 469.1 million by 2022, at a CAGR of 7.24% between 2016 and 2022. Increased implementation of advanced AO materials and growing laser applications in scientific sector are the key factors driving the growth of this market.

Acousto-optic (AO) devices are mainly used with laser systems internally or externally for the electronic control of the intensity and position of the laser beam. In an AO effect, when an incident laser beam passes through a grating due to the interaction of acoustic waves and light in acousto-optical medium, the laser beam behaves as a reflective index wave and diverted its optical path. Then appropriate AO devices are used to provide high efficiency for laser applications by controlling this laser beam for appropriate optical path. There is a growing use of AO devices for the deflection, modulation, signal processing, and frequency shifting of light beams in various verticals. This report analyzes the acousto-optic devices market segmented on the basis of device type, application, vertical, and geography.

On the basis of device type, acousto-optic devices market has been segmented into modulators, deflectors, tunable filters, frequency shifters, Q-switches, mode lockers, pulse pickers/ cavity dumpers, and RF drivers. The market for modulators is expected to grow at a high rate during the forecast period. Acousto-optic modulators are increasingly deployed to provide a reliable, economical means for amplitude modulation of laser light. One important application of AO modulators is to serve as an external modulator in the laser communication systems. This is expected to boost the market for modulators in the future.

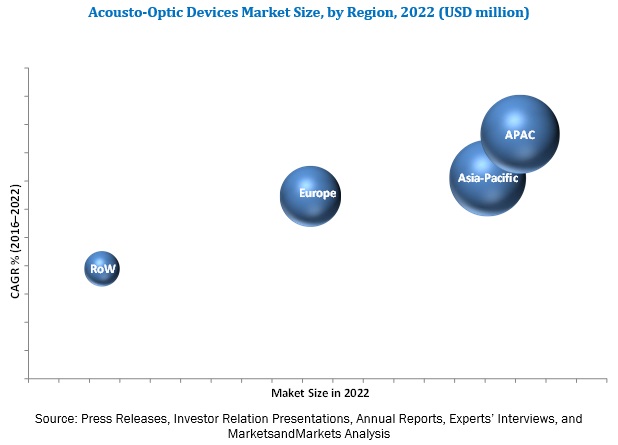

The acousto-optic devices market in APAC is expected to grow at the highest CAGR during the forecast period. A huge population base, increasing investments toward the development of optics technologies, large number of research and development (R&D) activities, and increasing focus of laser applications for the industrial and telecom verticals are driving the acousto-optic devices market in the APAC region.

One of the key restraining factors in the acousto-optic devices market is the slow implementation of acousto-optic device because of the high Initial cost and increasing requirement-specific R&D expenses in this market. The use of AO devices varies for a wide range of wavelengths to measure or process laser beams for different processes, systems, and applications. These devices require different AO materials according to the requirements for different levels of light intensity. A high initial investment is required to design or manufacture these components, which is one of the major restraining factors for the AO devices market. The cost of research and development process is also high. Furthermore, the use of these devices in industries such as semiconductor and electronics, oil and gas, and other industries reduces the various related application costs; it requires significant investments for its implementation.

The key players in the ecosystem of the acousto-optic devices market profiled in this report are Gooch & Housego PLC (UK), Isomet Corporation (US), Brimrose Corporation of America (US), Harris Corporation (US), AMS Technologies AG (Germany), Coherent, Inc. (US), AA Opto Electronic (France), A·P·E Angewandte Physik & Elektronik GmbH (Germany), IntraAction Corp. (US), and Lightcomm Technology Co., Ltd. (China). These players have adopted a major strategy of acquisitions and product launches to grow in acousto-optic devices market.

Growth of acousto-optic devices market driven by industrial vertical

Aerospace and Defense

In range-finding applications, the use of an appropriate optical source is very important. In armed forces, such devices are crucial for various applications. The use of acousto-optic devices is likely to facilitate the development of defensive systems and bring down their operational costs. Satellite surveillance could be improved through the introduction of RF-based optical networks in the satellite. These factors have resulted in the need for advanced systems that could provide cost-effective yet powerful devices for aerospace and defense applications. Communication is an integral part of defense operations. The use of acousto-optic devices with laser technology has brought significant enhancements in communication, owing to which, acousto-optic devices could be successfully used in defense communication systems.

Life Science and Scientific Research

In the scientific research vertical, lasers are widely used for many purposes such as in the detection of gravitational waves, Raman spectroscopy, atmospheric remote sensing, seismology, and atmospheric physics. Apart from these applications, space communication has also registered considerable developments in the recent years under the research category. Laser technology is expected to gain importance for transmitting large quantity of data between satellites which in turn would increase the demand of acousto-optic devices in the life science and scientific research vertical.

Medical

Acousto-optic devices have various uses in the medical vertical such as medical screening, surgery, vision correction, endoscopy, remote medicine, angioplasty, tumor therapy, and skin and dental dermatology. The medical devices and equipment for above mentioned treatments are expensive. Hence, the cost of treatments using these equipment/devices is high. With the developments of telecare and laser treatments in medical application, the use of optics technologies may lead to a reduction in the cost of medical equipment and devices through the implementation of laser source for treatments. Moreover, the research on acousto-optic devices in the mid-infrared region would revolutionize the field of biomedicine.

Industrial

Industrial vertical is one of the largest application areas for acousto-optic devices. Acousto-optic modulators, deflectors, frequency shifters, tunable filters, and other devices have a number of important uses in the industrial processes. The industrial vertical would have the highest market share of 23.45% by 2022. The major applications such as laser scanning, printing, material processing among others would lead to the increase in the demand of acousto-optic devices in the industrial vertical.

Telecom

Lasers play an important role for long distance communication in telecom sector. Laser beams can be formed in a range of wavelengths from ultraviolet to the infrared regions of the electromagnetic spectrum using acousto-optic devices. The acousto-optic devices are being used in the telecommunication vertical for transmission of data through laser or light beams. Laser communication provides high data transfer rates with lower power consumption and is also a highly secure medium of data transmission. Apart from data transmission in the telecom vertical, acousto-optic devices are also used for tasks such as signal strength optimization, precise network design, and proper tower placement.

Semiconductor and Electronics

In the semiconductor and electronics vertical, acousto-optic devices are being used for Q-switching and mode locking of laser beam for a wide range of applications including cutting, marking, deflashing, decapping, annealing, and inspection among others. Laser technology has proved to be beneficial for cutting applications in the semiconductor and electronics vertical, especially for cutting application in manufacturing of miniaturized semiconductor components such as miniaturized memory cards (μSD). Half-cut technology which is a combination of a mechanical saw, and laser is one of the technologies being used for this purpose as it offers less surface roughness and higher performance than other conventional methods. These factors would increase the demand of acousto-optics devices to perform laser operations on materials.

Oil and Gas

The oil and gas is one of the world's largest verticals. Due to a high demand for petroleum products, oil and gas companies are generating huge revenues and have high operating costs. However, the market for acousto-optic devices for oil and gas vertical is very small and has a less growth rate between 2016 and 2022. In the oil and gas vertical, acousto-optic components are used for sensing applications such as pressure and temperature.

Critical questions would be as follows:

- Where will all market-related developments take the acousto-optic devices industry in the mid to long term?

- What are the emerging industries for acousto-optic devices?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 30)

4.1 Acousto-Optic Devices Market, 20162022 (USD Million)

4.2 Market, By Application

4.3 Market, By Device

4.4 Market in APAC Expected to Witness Rapid Growth Between 2016 and 2022

4.5 Acousto-Optic Devices: Market Share of 3 Major Verticals in 2015

4.6 Market: Life Science and Scientific Research and Industrial Verticals (2015)

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Materials Used in Acousto-Optic Devices

5.2.2 Market, By Device Type

5.2.3 Market, By Application

5.2.4 Devices Market, By Vertical

5.2.5 Market, By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increased Implementation of Advanced Acousto-Optic Materials

5.3.1.2 Growing Laser Applications in Scientific Sector

5.3.2 Restraints

5.3.2.1 High Initial Cost and Increasing Requirement-Specific R&D Expenses

5.3.3 Opportunities

5.3.3.1 Emerging Applications for Acousto-Optic Devices in Various Fields

5.3.3.2 Growing Use of Fiber Lasers to Increase the Demand for Acousto-Optic Devices

5.3.4 Challenges

5.3.4.1 Issues Related to Space-Based Applications With Acousto-Optic Devices

6 Industry Analysis (Page No. - 41)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Industry Trends

6.4 Porters Five Forces Model

6.4.1 Intensity of Competitive Rivalry

6.4.2 Threat of Substitutes

6.4.3 Bargaining Power of Buyers

6.4.4 Bargaining Power of Suppliers

6.4.5 Threat of New Entrants

7 Materials Used in Acousto-Optic Devices (Page No. - 49)

7.1 Introduction

7.2 Germanium (GE)

7.3 Doped Glass

7.4 Chalcogenide (Ge33As12Se55)

7.5 Arsenic Trisulfide (As2S3)

7.6 Lead Molybdate (PbMoO4)

7.7 Tellurium Dioxide (TeO2)

7.8 SiO2 (Fused Silica)

8 Acousto-Optic Devices Market, By Device Type (Page No. - 51)

8.1 Introduction

8.2 Modulators

8.2.1 Fiber-Coupled Modulators

8.2.2 Multi-Channel Modulators

8.3 Deflectors

8.4 Frequency Shifters

8.5 Tunable Filters

8.6 Q-Switches

8.7 Mode Lockers

8.8 Pulse Pickers/Cavity Dumpers

8.9 RF Drivers

9 Acousto-Optic Devices Market, By Application (Page No. - 67)

9.1 Introduction

9.2 Material Processing

9.3 Laser Processing

9.4 Micro Processing

9.5 Others

10 Acousto-Optic Devices Market, By Vertical (Page No. - 73)

10.1 Introduction

10.2 Aerospace and Defense

10.3 Life Science and Scientific Research

10.4 Medical

10.5 Industrial

10.6 Telecom

10.7 Semiconductor and Electronics

10.8 Oil and Gas

11 Geographical Analysis (Page No. - 88)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 U.K.

11.3.2 Germany

11.3.3 France

11.3.4 Rest of Europe

11.4 Asia-Pacific

11.4.1 China

11.4.2 Japan

11.4.3 India

11.4.4 South Korea

11.4.5 Rest of APAC

11.5 Rest of the World

11.5.1 Middle East & Africa

11.5.2 Latin America

12 Competitive Landscape (Page No. - 114)

12.1 Overview

12.2 Market Ranking Analysis: Acousto-Optic Devices Market

12.3 Competitive Scenario

12.4 New Product Launches

12.5 Acquisitions and Agreements

12.6 Collaborations and Contracts

12.7 Expansions

13 Company Profiles (Page No. - 120)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

13.1 Introduction

13.2 Gooch & Housego PLC

13.3 Brimrose Corporation of America

13.4 Isomet Corporation

13.5 Harris Corporation

13.6 AMS Technologies AG

13.7 Coherent, Inc.

13.8 AA Opto Electronic

13.9 Intraaction Corp.

13.10 A·P·E Angewandte Physik & Elektronik GmbH

13.11 Lightcomm Technology Co., Ltd.

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 140)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (68 Tables)

Table 1 Key Industry Trends in the Acousto-Optic Devices Market

Table 2 Porters Five Forces Analysis: Bragaining Power of Buyers Having the Lowest Impact on the Overall Market

Table 3 Acousto-Optic Devices Market, By Device Type, 20132022 (USD Million)

Table 4 Acousto-Optic Modulator Market, By Type, 20132022 (USD Million)

Table 5 Acousto-Optic Modulator Market, By Application, 20132022 (USD Million)

Table 6 Acousto-Optic Modulator Market, By Vertical, 20132022 (USD Million)

Table 7 Acousto-Optic Deflector Market, By Application, 20132022 (USD Million)

Table 8 Acousto-Optic Deflector Market, By Vertical, 20132022 (USD Million)

Table 9 Acousto-Optic Frequency Shifter Market, By Application, 20132022 (USD Million)

Table 10 Acousto-Optic Frequency Shifter Market, By Vertical, 20132022 (USD Million)

Table 11 Acousto-Optic Tunable Filters Market, By Application, 20132022 (USD Million)

Table 12 Acousto-Optic Tunable Filter Market, By Vertical, 20132022 (USD Million)

Table 13 Acousto-Optic Q-Switches Market, By Application, 20132022 (USD Million)

Table 14 Acousto-Optic Q-Switches Market, By Vertical, 20132022 (USD Million)

Table 15 Acousto-Optic Mode Lockers Market, By Application, 20132022 (USD Thousand)

Table 16 Acousto-Optic Mode Lockers Market, By Vertical, 20132022 (USD Thousand)

Table 17 Acousto-Optic Pulse Pickers/Cavity Dumpers Market, By Application, 20132022 (USD Thousand)

Table 18 Acousto-Optic Pulse Pickers/Cavity Dumpers Market By Vertical, 20132022 (USD Thousand)

Table 19 Acousto-Optic RF Drivers Market, By Application, 20132022 (USD Thousand)

Table 20 Acousto-Optic RF Drivers Market, By Vertical, 20132022 (USD Thousand)

Table 21 Market, By Application, 20132022 (USD Million)

Table 22 Market for Material Processing Application, By Device Type, 20132022 (USD Million)

Table 23 Market for Laser Processing Application Size, By Device Type, 20132022 (USD Million)

Table 24 Market for Micro Processing Application, By Device Type, 20132022 (USD Million)

Table 25 Market for Other Applications, By Device Type, 20132022 (USD Million)

Table 26 Market, By Vertical, 20132022 (USD Million)

Table 27 Market for Aerospace & Defense Vertical, By Device Type, 20132022 (USD Thousand)

Table 28 Market for Aerospace & Defense Vertical, By Region, 20132022 (USD Million)

Table 29 Market for Life Science & Scientific Research Vertical, By Device Type, 20132022 (USD Thousand)

Table 30 Market for Life Science & Scientific Research Vertical, By Region, 20132022 (USD Million)

Table 31 Market for Medical Vertical, By Device Type, 20132022 (USD Thousand)

Table 32 Market for Medical Vertical, By Region, 20132022 (USD Million)

Table 33 Market for Industrial Vertical, By Device Type, 20132022 (USD Million)

Table 34 Market for Industrial Vertical, By Region, 20132022 (USD Million)

Table 35 Market for Telecom Vertical, By Device Type, 20132022 (USD Thousand)

Table 36 Market for Telecom Vertical, By Region, 20132022 (USD Thousand)

Table 37 Market for Semiconductor and Electronics Vertical, By Device Type, 20132022 (USD Million)

Table 38 Market for Semiconductor and Electronics Vertical, By Region, 20132022 (USD Million)

Table 39 Market for Oil & Gas Vertical, By Device, 20132022 (USD Thousand)

Table 40 Market for Oil & Gas Vertical, By Region, 20132022 (USD Million)

Table 41 Market, By Region, 20132022 (USD Million)

Table 42 Devices Market in North America, By Vertical, 20132022 (USD Million)

Table 43 Market in North America, By Country, 20132022 (USD Million)

Table 44 Market in U.S., By Vertical, 20132022 (USD Million)

Table 45 Market in Canada, By Vertical, 20132022 (USD Thousand)

Table 46 Market in Mexico, By Vertical, 20132022 (USD Thousand)

Table 47 Market in Europe, By Vertical, 20132022 (USD Million)

Table 48 Market in Europe, By Country, 20132022 (USD Million)

Table 49 Market in U.K., By Vertical, 20132022 (USD Million)

Table 50 Market in Germany, By Vertical, 20132022 (USD Thousand)

Table 51 Market in France, By Vertical, 20132022 (USD Thousand)

Table 52 Market in Rest of Europe, By Vertical, 20132022 (USD Thousand)

Table 53 Market in APAC, By Vertical, 20132022 (USD Million)

Table 54 Market in APAC, By Country, 20132022 (USD Million)

Table 55 Market in China, By Vertical, 20132022 (USD Million)

Table 56 Market in Japan, By Vertical, 20132022 (USD Thousand)

Table 57 Market in India, By Vertical, 20132022 (USD Thousand)

Table 58 Market in South Korea, By Vertical, 20132022 (USD Thousand)

Table 59 Market in Rest of APAC, By Vertical, 20132022 (USD Thousand)

Table 60 Market in RoW, By Vertical, 20132022 (USD Thousand)

Table 61 Market in RoW, By Region, 20132022 (USD Million)

Table 62 Market in Middle East & Africa, By Vertical, 20132022 (USD Thousand)

Table 63 Market in Latin America, By Vertical, 20132022 (USD Thousand)

Table 64 Market Ranking of the Top 5 Players in the Acousto-Optic Devices Market

Table 65 New Product Launches, 20142016

Table 66 Acquisitions and Agreements, 20132016

Table 67 Collaborations and Contracts, 20142016

Table 68 Expansions

List of Figures (55 Figures)

Figure 1 Markets Covered

Figure 2 Acousto-Optic Devices Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Assumptions of the Research Study

Figure 6 Acousto-Optic Devices Market, 20132022 (USD Million)

Figure 7 Acousto-Optic Devices Market Share, By Application (2015 vs 2022)

Figure 8 Acousto-Optic Modulators to Hold the Largest Market Size By 2022

Figure 9 Industrial Vertical Expected to Witness the Highest CAGR Between 2016 and 2022

Figure 10 North America Held the Largest Market Share in 2015

Figure 11 Attractive Opportunities for the Acousto-Optic Devices Market

Figure 12 Market for Laser Processing Application to Grow at the Highest CAGR Between 2016 and 2022

Figure 13 Modulators Device Segment Expected to Hold the Largest Market Share During the Forecast Period

Figure 14 China Expected to Emerge as the Fastest-Growing Market for Market During Forecast Period

Figure 15 Life Science and Scientific Research Vertical Held the Largest Share of the Market in APAC in 2015

Figure 16 Life Science and Scientific Research and Industrial Verticals to Hold A Large Share of the Acousto-Optic Devices Market

Figure 17 Market Segmentation, By Geography

Figure 18 Increasing Demand of Acousto-Optic Devices for Laser Applications Would Drive the Growth of the Market

Figure 19 Value Chain Analysis (2015): Maximum Value Added Between Research & Development and Component Manufacturing Phases

Figure 20 Porters Five Forces Analysis (2015)

Figure 21 Acousto-Optic Devices Market: Porters Five Forces Analysis

Figure 22 Impact Analysis of Intensity of Competitive Rivalry

Figure 23 Impact Analysis of Threat of Substitutes

Figure 24 Impact Analysis of Bargaining Power of Buyers

Figure 25 Impact Analysis of Bargaining Power of Suppliers

Figure 26 Impact Analysis of the Threat of New Entrants

Figure 27 Modulators Segment Expected to Hold Largest Market Size in the Market During the Forecast Period

Figure 28 Laser Processing Application Expected to Hold Largest Size of the Acousto-Optic Deflector Market During the Forecast Period

Figure 29 Laser Processing Application Expected to Hold the Largest Size of the Acousto-Optic Tunable Filter Market By 2022

Figure 30 Laser Processing Application Expected to Hold the Largest Size of the Market By 2022

Figure 31 Modulators Expected to Hold the Largest Market Size of the Micro Processing Application By 2022

Figure 32 Market for Industrial Vertical Excepted to Grow at the Highest Rate Between 2016 and 2022

Figure 33 Market for Life Science and Scientific Research Vertical in APAC Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 34 Europe Likely to Hold the Largest Market for Medical Vertical By 2022

Figure 35 APAC Held the Largest Market for the Industrial Vertical in 2015

Figure 36 APAC Expected to Hold the Largest Market for the Telecom Vertical Between 2016 and 2022

Figure 37 APAC Likely to Hold the Largest Market for Oil and Gas Vertical By 2022

Figure 38 Geographic Snapshot: APAC to Witness the Highest Rate Between 2016 and 2022

Figure 39 Market in China Estimated to Grow at the Highest Rate Between 2016 and 2022

Figure 40 Overview of Market in North America, 2015

Figure 41 Overview of Market in Europe, 2015

Figure 42 Overview of Market in APAC, 2015

Figure 43 Companies Adopted New Product Launches as the Key Growth Strategy Between 2013 and 2016

Figure 44 Market Evaluation Framework: New Product Launches and Acquisitions Fueled the Growth Between 2014 and 2016

Figure 45 Battle for Market Share: New Product Launches Was the Key Strategy Adopted

Figure 46 Geographic Revenue Mix of Leading Players

Figure 47 Gooch & Housego PLC: Company Snapshot

Figure 48 Gooch & Housego PLC: SWOT Analysis

Figure 49 Brimrose Corporation of America: SWOT Analysis

Figure 50 Isomet Corporation: Company Snapshot

Figure 51 Isomet Corporation: SWOT Analysis

Figure 52 Harris Corporation: Company Snapshot

Figure 53 Harris Corporation: SWOT Analysis

Figure 54 AMS Technologies AG: SWOT Analysis

Figure 55 Coherent, Inc.: Company Snapshot

Growth opportunities and latent adjacency in Acousto-optic Devices Market

I need to see a sample of this report before I can get an approval to buy it. I need to check if it is an updated one and not the old version, or a redacted report for instance.

I would like to understand the market potential and dynamics for acousto-optic devices market. Also would like to know about the trends and opportunities in the Acousto-optic Devices Market.

I am assessing market analysis data on behalf of a potential customer. However, their perceived market share in this market is considerably different than the revenue figures provided by you. I'd like a sample of the report (ideally with market size headlines for each subsection) to compare my client's revenue data to your data. This way I will be able to gauge how close the report is & whether I can convince them to subscribe.

Acousto-optics devices market - corporate license. I am a former subscriber and have made multiple purchases from your company. What is the best price you can offer on this report?