Wi-Fi Market by Offering (Hardware, Solutions, Services), Density (High-density Wi-Fi, Enterprise-class Wi-Fi), Location Type (Indoor, Outdoor), Application, Vertical (Education, Retail & eCommerce) and Region - Global Forecast to 2028

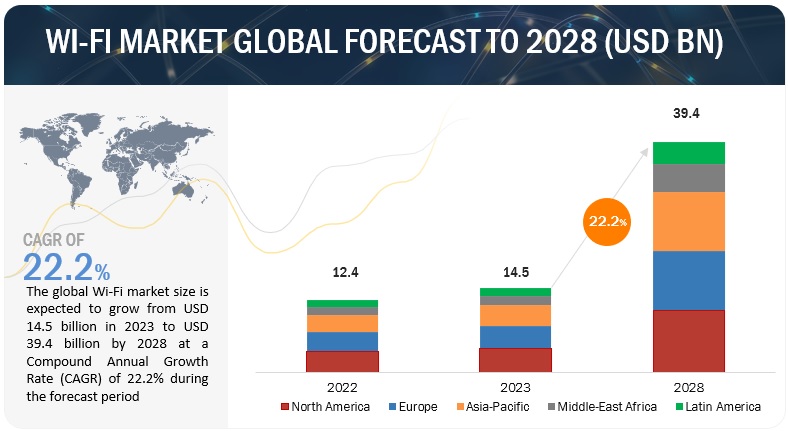

[302 Pages Report] The Wi-Fi market size is expected to grow from USD 14.5 billion in 2023 to USD 39.4 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 22.2% during the forecast period. The growing number of smart homes, IoT devices, and digital initiatives in various sectors like healthcare and education have created a need for robust and scalable Wi-Fi solutions.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Wi-Fi: Market Dynamics

Driver: Rising adoption of digital solutions for quality wireless network connectivity.

The relentless surge in the adoption of digital solutions has catalyzed a paradigm shift in the way we perceive and utilize wireless network connectivity, propelling the Wi-Fi market into unprecedented growth. As the world becomes increasingly interconnected, the demand for seamless and high-quality internet connectivity has never been higher. The rise of smart homes, IoT devices, and the proliferation of mobile devices has necessitated robust Wi-Fi networks. Consequently, companies and individuals alike are investing significantly in advanced Wi-Fi technologies, including Wi-Fi 6 and Wi-Fi 6E, to enhance their connectivity experiences. Digital solutions have not only improved the efficiency and reliability of wireless networks but also opened new avenues for innovation, driving the Wi-Fi market forward. Businesses are integrating Wi-Fi solutions into their operations, realizing the potential for enhanced productivity and customer satisfaction.

Restraint: Difficulty in securing Wi-Fi Networks

Wi-Fi networks are indeed vulnerable to a wide range of security threats due to their wireless nature and the omnipresence of Wi-Fi-enabled devices. Despite significant advancements in security protocols, such as WPA3 (Wi-Fi Protected Access 3), the evolving landscape of cyber threats poses ongoing challenges for ensuring the safety and integrity of Wi-Fi networks and the data transmitted over them. Wi-Fi networks can be targeted for data breaches, especially in corporate environments where confidential information is transmitted. Attackers can exploit vulnerabilities in Wi-Fi security protocols, unauthorized access points, or unpatched devices to gain access to corporate networks.

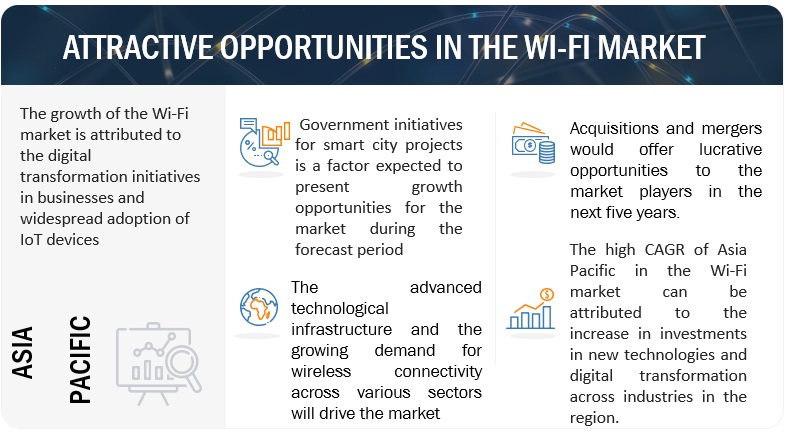

Opportunity: Increasing role of Wi-Fi in smart city revolution

Smart city initiatives aimed at enhancing urban living through innovative technologies and interconnected solutions, are providing significant opportunities in the Wi-Fi market. As cities globally invest in smart infrastructure, Wi-Fi networks are at the forefront of these developments. Wi-Fi is the backbone for various smart city applications, including public Wi-Fi hotspots, intelligent transportation systems, smart street lighting, and environmental monitoring. The demand for high-speed, reliable, and pervasive Wi-Fi connectivity in smart cities is growing exponentially. With increasing urbanization, seamless internet connectivity becomes vital for citizens, businesses, and municipal services. Additionally, Wi-Fi enables real-time data collection and analysis, facilitating smart governance, efficient public services, and enhanced citizen engagement. Companies specializing in Wi-Fi solutions, from hardware manufacturers to service providers, find lucrative opportunities in deploying and managing large-scale, high-performance networks for smart city projects. These initiatives foster digital inclusion and fuel innovation and economic growth, making the Wi-Fi market integral to building smarter, more connected urban environments.

Challenge: Lack of data security and privacy in deploying Wi-Fi solutions

The lack of data security and privacy in deploying Wi-Fi solutions poses a significant challenge in the Wi-Fi market. As the adoption of Wi-Fi technology continues to soar, the vulnerability of networks to cyber threats and data breaches has become a growing concern. Wi-Fi networks, especially in public spaces such as airports, cafes, and hotels, are often targeted by malicious actors seeking to exploit weak security measures and gain unauthorized access to sensitive information. Moreover, inadequate privacy measures in Wi-Fi deployments can result in the unauthorized collection of user data. Businesses, especially those offering free Wi-Fi services, may collect user information without adequate consent, leading to privacy violations. Such practices erode user trust and can have legal implications, especially in regions with stringent data protection regulations like the GDPR in the European Union. Additionally, IoT devices connected to Wi-Fi networks often have lax security measures, making them vulnerable to cyber-attacks. Compromised IoT devices can be used to launch large-scale attacks, such as Distributed Denial of Service (DDoS) attacks, affecting the overall stability and security of Wi-Fi networks.

Market Ecosystem

WLAN Controllers segment is expected to grow at higher CAGR during the forecast period.

WLAN controllers help networks improve the management of work and conduct operations smoothly. They also control the network operational costs. Companies such as Cisco, Aerohive Networks, and Extreme Networks that offer WLAN controllers are making efforts to develop highly scalable and reliable solutions to cater to the requirements of their customers. The WLAN controllers’ segment of the Wi-Fi market is projected to grow at a significant rate, owing to an increase in the number of Wi-Fi deployments, especially in the retail and travel and hospitality verticals.

High density Wi-Fi segment is expected to grow at higher CAGR during the forecast period.

High-density wireless environments are locations that require the support of hundreds or even thousands of wireless clients in a given area. High-density wireless environments include convention centers, auditoriums, hotel meeting rooms, lecture halls, sports stadiums, and concert halls. The need to provide stable and high-speed internet access to a large number of concurrent users, enabling smooth internet, will drive the market.

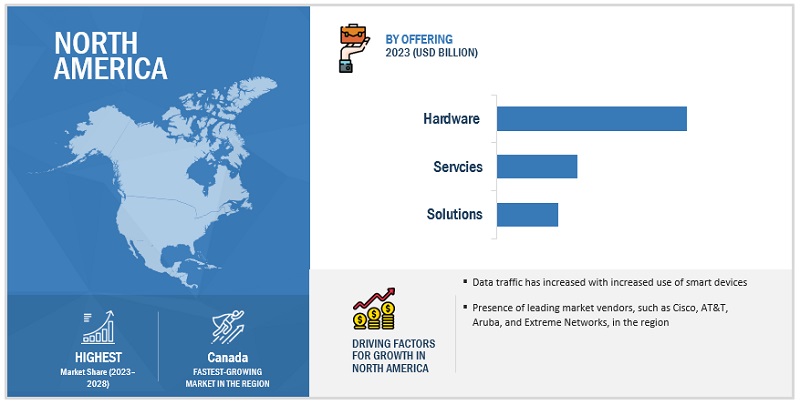

North America to account for the largest market share during the forecast period

North America is expected to account for a major share of the Wi-Fi market, and the trend is expected to continue during the forecast period. The startup culture in North America is growing at a fast pace as compared to the other regions. Additionally, the advent of SMEs and increasing R&D activities by large enterprises have aided the growth of the North American market. The growth in North America is mainly driven by the increasing adoption of integrated enterprise and business solutions for more flexible and agile business processes and operations. The demand for the adoption of wireless hotspots and Wi-Fi solutions and services is expected to increase due to the major regional companies' rise in wireless technology investments.

Key Market Players

The Wi-Fi market vendors have implemented various organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global Wi-Fi Cisco (US), Ericsson (Sweden), Extreme Networks (US), Huawei (China), Juniper Networks (US), Panasonic (Japan), Fortinet ( US), Aruba (US), Alcatel-Lucent Enterprise (France), NETGEAR (US), Broadcom (US), Airtel (India), Orange Business Services (France), Comcast Business (US), Vodafone (UK), Telstra (Australia), Fujitsu (Japan), AT&T (US), Ubiquiti Networks (US), Lever Technology Group (UK), Redway Networks ( England), Superloop (Australia), Cambium Networks (US), Casa Systems (US), Fon (Spain), D-Link (Taiwan), Actiontec Electronics (US), ADB Global (Switzerland). SDMC Technology (China), Edgewater Wireless Systems (Canada).

The study includes an in-depth competitive analysis of these key players in the Wi-Fi market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million/ Billion) |

|

Segments covered |

By offering, density, location type, application, vertical and region |

|

Regions covered |

North America, Europe, Asia Pacific, Latin America, and Middle East and Africa |

|

Companies covered |

Cisco (US), Ericsson (Sweden), Extreme Networks (US), Huawei (China), Juniper Networks (US), Panasonic (Japan), Fortinet ( US), Aruba (US), Alcatel-Lucent Enterprise (France), NETGEAR (US), Broadcom (US), Airtel (India), Orange Business Services (France), Comcast Business (US), Vodafone (UK), Telstra (Australia), Fujitsu (Japan), AT&T (US), Ubiquiti Networks (US), Lever Technology Group (UK), Redway Networks ( England), Superloop (Australia), Cambium Networks (US), Casa Systems (US), Fon (Spain), D-Link (Taiwan), Actiontec Electronics (US), ADB Global (Switzerland). SDMC Technology (China), Edgewater Wireless Systems (Canada) |

This research report categorizes the Wi-Fi market to forecast revenues and analyze trends in each of the following subsegments:

By Offering:

-

Hardware

- Access Points

- WLAN Controllers

- Wireless Hotspot Gateways

- Others*

- Solutions

-

Services

-

Professional Services

- Network Planning, Design, and Implementation

- Training, Support, and Maintenance

- Survey, Analysis, and Consulting

- Managed Services

-

Professional Services

By Location Type

- Indoor

- Outdoor

By Density

- Enterprise-class Wi-Fi

- High-density Wi-Fi

By Application

- Smart Home Devices

- Public Wi-Fi & Dense Environment

- IoT & Industry 4.0

- HD Video Streaming & Video Conferencing

- Online Gaming

- Other Applications

By Vertical

- Education

- Retail and eCommerce

- Government

- Healthcare and Life Sciences

- Transportation and Logistics

- Manufacturing

- Hospitality

- Others*

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe*

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East & Africa

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In September 2023, Huawei introduced the Huawei Router 3B Pro with WiFi-7 capabilities, which can transfer a single file through both 2.4gHz and 5gHz channels to boost speed.

- In August 2023, US cellular and Ericsson collaborated to provide private wireless network solutions for various industry segments. This includes an initial focus on Industry 4.0 manufacturing, logistics, distribution and warehouse use cases, expanding into hospitals, Industrial Internet of Things (IIoT), ports, utilities, and airports.

- In May 2023, Extreme Networks introduced a variety of new solutions. It launched the AP3000 Wi-Fi 6E access point (AP) to meet enterprise-grade performance. Extreme also extended its Universal Switch series by introducing the 7520 and 7720 switches, custom-built for enterprise core and aggregation use cases, and 8820 switches, high-density, deep buffer switch routers designed for large enterprise networks.

- In February 2023, Federated Wireless and Cisco collaborated to gain ultra-high speed, capacity, and scalability of Wi-Fi 6E to enterprises in markets globally. Cisco will integrate the Federated Wireless Automated Frequency Coordination (AFC) solution into Cisco Wireless 6 GHz capable access points.

- In February 2022, Juniper Networks acquired WiteSand, an innovator of cloud-native zero-trust Network Access Control (NAC) solutions. This agreement would bring a skilled engineering team and technology to Juniper, quickening the company’s attempts to deliver a next-generation NAC solution.

Frequently Asked Questions (FAQ):

What is Wi-Fi?

As defined by MnM, the Wi-Fi market deals with the installation of Wi-Fi solutions across indoor and outdoor locations by businesses to enable seamless connectivity for Wi-Fi-enabled devices, such as smartphones, tablets, and laptops. Enterprise Wi-Fi solutions provide secure and robust wireless services to internal as well as external customers. By offering network connectivity through these solutions, enterprises can engage with their visitors or customers to further boost engagement and loyalty. Businesses implementing the Bring Your Own Device (BYOD) trend are shifting toward Wi-Fi solutions and services to ensure that their employees use smartphones and tablets for day-to-day work commitments.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, France in the European region.

Which are the key drivers supporting the growth of the Wi-Fi market?

The growing adoption of IoT devices in industries like healthcare, agriculture, and manufacturing fuels the demand for Wi-Fi connectivity. Also, the rapid increase in smartphones, tablets, laptops, smart home devices, and IoT gadgets drives the need for Wi-Fi connectivity.

Who are the key vendors in the Wi-Fi market?

The key vendors operating in the Wi-Fi market include. Cisco (US), Ericsson (Sweden), Extreme Networks (US), Huawei (China), Juniper Networks (US), Panasonic (Japan), Fortinet ( US), Aruba (US), Alcatel-Lucent Enterprise (France), NETGEAR (US), Broadcom (US), Airtel (India), Orange Business Services (France), Comcast Business (US), Vodafone (UK), Telstra (Australia), Fujitsu (Japan), AT&T (US), Ubiquiti Networks (US), Lever Technology Group (UK), Redway Networks ( England), Superloop (Australia), Cambium Networks (US), Casa Systems (US), Fon (Spain), D-Link (Taiwan), Actiontec Electronics (US), ADB Global (Switzerland). SDMC Technology (China), Edgewater Wireless Systems (Canada)

Which region is expected to hold the highest market share In the Wi-Fi market?

North America is expected to hold the highest market share in the Wi-Fi market. The presence of key players across the region will drive the growth of the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

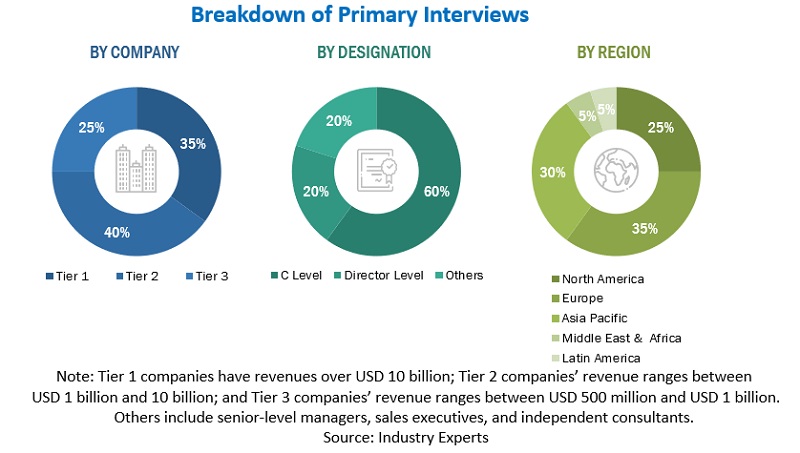

This research study involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information useful for this technical, market-oriented, and commercial study of the Wi-Fi market. Primary sources were mainly industry experts from core and related industries, preferred system developers, service providers, resellers, partners, and organizations related to the various segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants and subject-matter experts, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects. These included key industry participants, subject-matter experts, C-level executives of key companies, and industry consultants.

Secondary Research

In the secondary research process, various secondary sources were referred for identifying and collecting information for the study. The secondary sources included annual reports, press releases, and investor presentations of companies, and white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals and various associations were also referred, such as the National Telecommunications and Information Administration, the US Department of Commerce, the Canadian Radio-television and Telecommunications Commission, the UK Government Digital Service, EU Wi-Fi4EU Initiative, European Wireless Infrastructure Association, Asia Internet Coalition (AIC), Internet and Mobile Association of India (IAMAI), Internet Association Japan, and the Australian Broadcasting Authority (ABA). Secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both the market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Technology Officers (CTOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from Wi-Fi solution and service vendors, system integrators, professional and managed service providers, industry associations, and consultants; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data on revenue collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various technology, application, deployment, and region trends. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use Wi-Fi solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of Wi-Fi solutions, which is expected to affect the overall market growth.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, the top-down and bottom-up approaches were used along with multiple data triangulation methods to estimate and validate the size of the Wi-Fi market and other dependent submarkets. Key market players were identified through secondary research, and their market share in the targeted regions was determined with the help of primary and secondary research. This entire research methodology included the study of annual and financial presentations of the top market players and interviews with experts for key insights (quantitative and qualitative).

The percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary research. All the possible parameters that affect the Wi-Fi market were verified in detail with the help of primary sources and analyzed to obtain quantitative and qualitative data. This data was supplemented with detailed inputs and analysis from MarketsandMarkets and presented in the report.

Wi-Fi market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Wi-Fi market: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the Wi-Fi market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were used, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

As defined by MnM, the Wi-Fi market deals with installing Wi-Fi solutions across indoor and outdoor locations by businesses to enable seamless connectivity for Wi-Fi-enabled devices, such as smartphones, tablets, and laptops. Enterprise Wi-Fi solutions provide internal and external customers with secure and robust wireless services. By offering network connectivity through these solutions, enterprises can engage with their visitors or customers to further boost engagement and loyalty. Businesses implementing the Bring Your Own Device (BYOD) trend are shifting toward Wi-Fi solutions and services to ensure their employees use smartphones and tablets for daily work commitments.

Key Stakeholders

- Wi-Fi solution providers

- Wi-Fi service providers

- Wireless service providers

- Information Technology (IT) solution providers

- Telecom providers

- Cloud service providers

- Network solution providers

- System integrators

- Independent service providers

Report Objectives

- To determine, segment, and forecast the global Wi-Fi market by offering, density, location type, application, vertical, and region in terms of value.

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market

- To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape.

- To strategically analyze the macro and micro markets with respect to individual growth trends, prospects, and contributions to the total market.

- To analyze the industry trends, pricing data, and patents and innovations related to the market.

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the Wi-Fi market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies.

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, agreements, collaborations, business expansions, and research and development (R&D) activities.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Wi-Fi Market