3D Motion Capture System Market Size, Share by System (Optical, Non-Optical) Type (Hardware, Software, Service), Application (Media and Entertainment, Biomechanical Research and Medical), Geography - Global Forecast 2025

Updated on : March 23, 2023

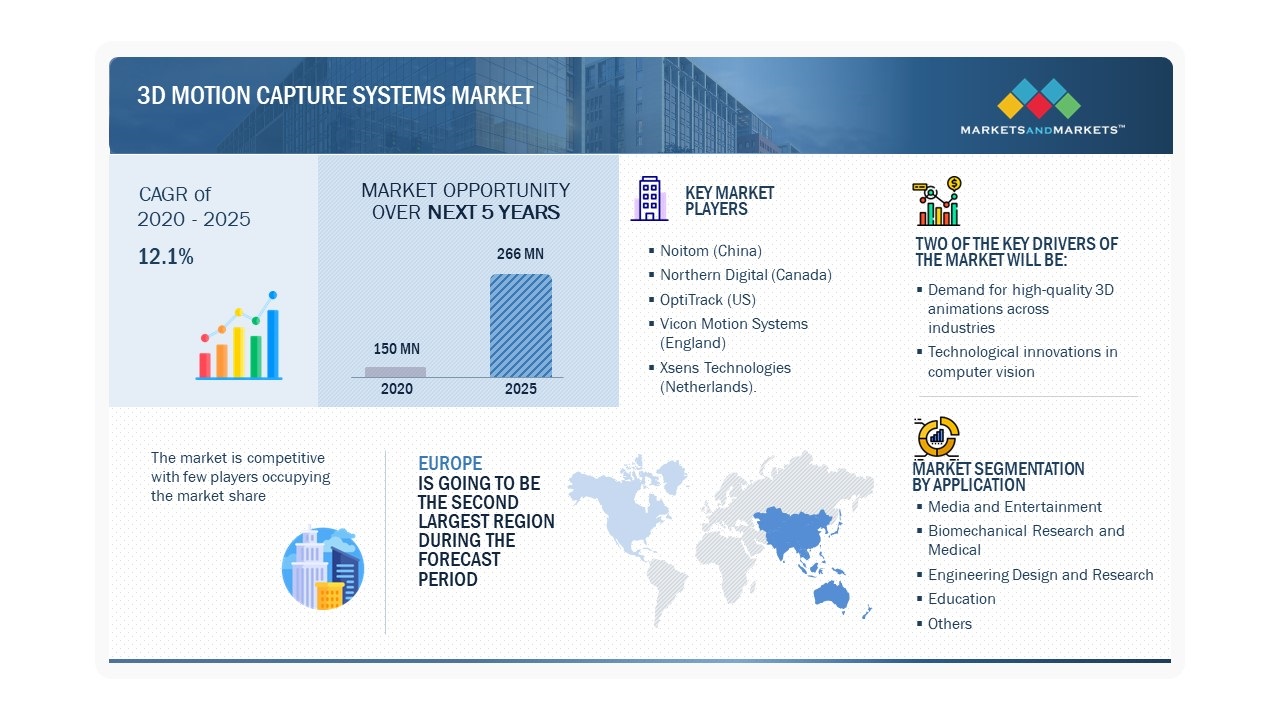

The 3D Motion Capture System Market size is anticipated to witness substantial growth from USD 150 Million in 2020 to USD 266 Million in 2025, recording a CAGR of 12.1% between 2020-2025.

A 3D motion capture system is an advanced technology that captures the movements of individuals or objects and converts them into actionable data. This data is then leveraged to generate a 3D view of the performance. The system finds diverse applications across entertainment, sports, medical, ergonomics, and robotics domains.

3D Motion Capture System Market Forecast to 2025

To know about the assumptions considered for the study, Request for Free Sample Report

3D motion capture system component includes Hardware, software, and services. These products serve various industrial applications such as Media and entertainment, biomedical research and medical, engineering & design and industrial, education, and others.

3D Motion Capture System Market Size Dynamics:

Driver: Popularity of science-fiction movies among young population

Science-fiction movies are a genre emphasizing actual, extrapolative, or speculative science. These films now generally occupy a space wherein their scientific aspects are mere dressing to the philosophically and emotionally impactful features. The motion capture technology has been used by filmmakers for a range of purposes over the past decade and is now gaining popularity in science-fiction movies. The motion capture system is used in films to animate the characters by measuring real movements, which are then modeled with the help of computers. Animation plays an important role in the enhancement and improvement of filmed sequences, from commercials to full-length films. Animations are captured using the 3D motion capture systems. Thus, with the growing popularity of science-fiction movies among the young population, the market for the 3D motion capture system is expected to increase.

Restraint: Requirement of specialized hardware and software for data processing

Motion capture (mocap) requires the system to have specialized hardware and software for data capturing and processing since it uses sensing technology to track and store movement. The motion capture system records motion using a variety of cameras, sensors, and accessories. The camera's purpose is to determine 3D positions. The low-frequency magnetic field produced by the transmitter source is measured by sensors. As a result, hardware that can transfer collected data to the system before the animation software compiles it is needed. The software serves as an interface between various motion capture system components and aids in recording, cleaning up, pre-editing, post-editing, and reusing captured data. It is a necessary component of a 3D motion capture system. For a variety of applications, many businesses provide various hardware and software. Nexus data capture software for clinical gait, biomechanics, and animal sciences; Evoke for VR environments; and Tracker for an engineering solution. Along with the need for specialized hardware and software, their high price is a barrier to market growth. For instance, the cost of 2 132 Vicon cameras and one license of the Vicon Blade mocap software is around USD 12,500.

Opportunity: Growing use of cloud-based platforms for 3D motion capture

Cloud computing is highly used for motion capture systems. Most companies use cloud-based platforms to offer real-time monitoring to their customers. It is used for various applications such as sports organizations, research labs, medical clinics, and entertainment. Moreover, cloud-based platforms allow human performance and rehabilitation practitioners to objectively assess the biomechanics in real-time. The platforms allow a user to connect with the motion capture system; once the desired space is captured in high-quality immersive 3D models, the algorithms process the photography and 3D data, thereby providing a dimensionally accurate geometry of the image. Thus, cloud-based platforms for 3D motion capture systems can be an efficient method for applications such as life sciences, professional sports, and gaming.

Challenge :Requirement for high-end processors

Motion capture is a method for digitizing human, animal, and object motion. The motion capture technology was designed primarily for uses in ergonomics and immersive virtual reality. To achieve the desired output, data capturing, and data processing are done. The processing is carried out using a computer system that can manage the large volume of data. Processing the compiled data takes a long time due to the size of the collated data. The graphics processing units (GPUs) and central processing units (CPUs) might not always meet the needs of motion capture systems.

3D Motion Capture System Market Segment Insights:

Based on Applications, the Media and Entertainment segment to dominate the 3D motion capture system market Share in the year 2020

The media and entertainment application is expected to hold the largest share of the 3D motion capture system market during the forecast period. The growth is attributed to the increasing adoption of 3D motion capture systems for broadcast, live shows, and gaming. Because of the easy and real-time implementation of 3D motion capture systems for creating and animating new creatures and models in games and films, the media and entertainment application has a high share in the overall market.

Regional Insights:

The European region is projected to Grow at the second highest CAGR during the forecast period

In Europe, the 3D motion capture system market is largely supported by countries such as the UK, Germany, and France. The market is being driven by the presence of a significant number of players and the expansion of application areas in the entertainment and life science sectors, including gaming, movies, sports, and medical. Players in Europe, such as Vicon Motion Systems (England), Codamotion (England), and Synertial Labs (England), offer a wide range of products and hold leading position have an influential position in the 3D motion capture system market.

Germany is expected to grow at the highest CAGR in the European 3D motion capture system market. The growing use of motion capture systems for sports, films, and game production in the country is expected to boost the market during the forecast period. For instance, Mimic Productions (Berlin) uses motion capture systems. Trixter, one of the leading VFX studios in the country, uses motion capture systems for film production.

3D Motion Capture System Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players:

Some of the Major players in 3D Motion Capture Systems Market size are Noitom (China), Northern Digital (Canada), OptiTrack (US), Vicon Motion Systems (England), and Xsens Technologies (Netherlands).These players have adopted various growth strategies such as contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches to expand their presence in the 3D Motion Capture Systems Market.

Northern Digital is one of the leading innovators and manufacturers of advanced 3D motion capture systems. It operates through 3 segments, namely Industrial, Life Science, and Simulation. The company’s optical measurement and electromagnetic tracking solutions are used by organizations and institutes in the field of medicine, industry, simulation, and academia. It offers optical measurement systems, electromagnetic tracking systems, and reflective marker spheres. The company’s solutions are used for a broad spectrum of applications, ranging from image-guided surgery, aeronautics, and quality assurance to biomechanics research. Moreover, the company’s medical division has been at the forefront of researching and developing advanced 3D motion capture solutions

OptiTrack is one of the leading motion capture system companies and offers products and services for movement sciences, virtual reality, animation, and robotics. Its VR and filmmaking were used in the making of the movie The Lion King. The company offers software for game engines, content creation, and software development kits (SDKs). The company’s clients include Boeing (US), Caterpillar (US), Disney (US), John Deere (US), and Under Armor (US). The company has adopted product launches as one of its key strategies to increase its existing market share and widen its customer base through product development.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered |

2017–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD million/billion) |

|

Segments covered |

Technology, Component, and Application |

|

Regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Noitom (China), Northern Digital (Canada), OptiTrack (US), Vicon Motion System (England), Xsens Technologies (Netherlands), Motion Analysis (US), Motus Digital (US), Phasespace (US), Qualiysis (Sweden), Simi Reality Motion Systems (Germany) |

In this report, the overall 3D motion capture system market has been segmented based on technology, component, application, and region.

By Technology:

-

Optical Systems

- Active Marker

- Passive Marker

- Markerless

- Underwater

-

Non-Optical Systems

- Inertial Systems

- Mechanical Systems

- Electromagnetic Systems

By Component:

-

Hardware

- Sensors

- Cameras

- Communication Devices

- Accessories

-

Software

- Packaged Software

- Plugin Software

-

Services

- Consulting and Planning

- Installation

- Training, Support, and Maintenance

By Application:

-

Media and Entertainment

- Gaming

- Film Production

- Live Performance/Shows

- Broadcast

-

Biomechanical Research and Medical

- Sports Science

- Neuroscience

- Animal Science

- Clinical Gait Analysis

- MRI and Surgery

-

Engineering % Design and Industrial Applications

- Unmanned Systems and Robotics

- Ergonomics

- Aerodynamics

- Military Training

- Marine and Underwater

- Education

-

Others

- Precision Agriculture

- Sound and Motion Analysis

By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia Pacific (APAC)

- China

- Japan

- India

- Rest of APAC

- Rest of the World (RoW)

- Middle East & Africa

- South America

3D Motion Capture System Market Highlights:

What is new?

- Major developments that can change the business landscape as well as market forecasts.

The 3D motion capture systems industry has witnessed numerous technological advancements in system and capabilities. Substantial investments have been made in the 3D motion capture system’s research & development and upgrades. The 3D motion capture system value chain comprises participants such as research & development, manufacturers and assembly, distributors, end users, and post-sales service providers.

-

Emerging Technology Trends

- 3D depth sensing

- Time-of-flight

- Structured light

- Addition/refinement in segmentation–Increase the depth or width of market segmentation.

-

3D Motion Capture Systems Market, by Technology

- Optical Systems

- Non-optical Systems

-

3D Motion Capture Systems Market, by Component

- Hardware

- Software

- Services

-

3D Motion Capture Systems Market, by Application

- Media and Entertainment

- Biomechanical Research and Medical

- Engineering & Design and Industrial

- Education

- Others

- Inclusion of new players and change in the market share of existing players - 3D Motion Capture Systems Market

Company profiles: Company profiles give a glimpse of the key players in the market with respect to their business overviews, financials, product offerings, recent developments undertaken by them, and MnM view. In the new edition of the report, we have a total of 25 players (15 major, 10 Startups/SME). Moreover, the share of companies operating in the 3D Motion Capture Systems Market and competitive leadership mapping have also been provided in the report.

- Updated financial information and product portfolios of players operating in the 3D Motion Capture Systems Market

Newer and improved representation of financial information: The latest edition of the report provides updated financial information in the 3D Motion Capture Systems Market till 2019/2020 for each listed company in the graphical representation in a single diagram (instead of multiple tables). This would help to easily analyze the present status of profiled companies in terms of their financial strength, profitability, key revenue-generating region/country, business segment focus in terms of the highest revenue-generating segment, and investment in research and development activities.

- Recent market developments of the profiled players

Recent Developments: Updated market developments such as contracts, joint ventures, partnerships & agreements, acquisitions, new product launches, investments, funding, and certification have been mapped for 2017 to 2020.

Recent Developments

- In March 2020, Vicon Motion System signed a contract with DNEG, a visual effects provider. As per the contract, Vicon will provide its flagship Vantage solution that utilizes both its Tracker and Shôgun software. Adding Vicon’s motion capture to the DNEG toolkit will enable the DNEG team to capture the performances of actors and precisely recreate virtual environments within various studios across the world.

- In November 2019, Vicon Motion System signed a contract with Red Bull Diagnostics and Training Centre, for its inertial tracking solution to help reduce the risk of injury and optimize the performance of athletes.

Frequently Asked Questions (FAQ)

What is the current size of the 3D Motion Capture Systems Market?

The 3D Motion Capture Systems Market is projected to grow to USD 150 million in 2020 to USD 266 million by 2025, at a CAGR of 12.1% between 2020-2025.

Who are the winners in the 3D Motion Capture Systems Market?

Noitom (China), Northern Digital (Canada), OptiTrack (US), Vicon Motion Systems (England), and Xsens Technologies (Netherlands).

What are some of the technological advancements in the market?

3D depth-sensing technology measures the time that the IR light takes to travel from the camera to the object and back to the camera. This technology is used to directly measure the depth and amplitude of any object in every pixel. To obtain the 3D views of the object, image sensors are used. The key features of the 3D depth-sensing technology include accurate depth sensing, easy technological flexibility, low-depth map calculation efforts, and low CPU usage coupled with its high functionality and high image quality in the output. The commercial application of this technology was observed in the field of gaming. Moreover, 3D depth-sensing technology has widened its applicability in the field of 3D imaging and detection. The ability of mobile devices to capture pictures in 3D instead of 2D is one of the key factors contributing to the increasing applicability of 3D sensing technology.

Structured light imaging captures the 3D topography of a surface using specific patterns of light. The light strikes the surface, allowing vision systems to calculate the depth and surface information of the object in the scene as used in the structured-light 3D scanners. The 3D scanner is used for measuring the 3D shape of an object using projected light patterns and camera systems.

What are the factors driving the growth of the market?

Demand for high-quality 3D animations across industries, Technological innovations in computer vision, Real-time data with exceptional spatial and temporal accuracy, and Popularity of science-fiction movies among young population are driving the market growth.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 STUDY SCOPE

1.2 MARKET DEFINITION AND SCOPE

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

1.4.2 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 INTRODUCTION

FIGURE 1 3D MOTION CAPTURE SYSTEM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.3 KEY DATA FROM PRIMARY SOURCES

2.1.4 SECONDARY AND PRIMARY RESEARCH

2.1.4.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size using bottom-up analysis

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size using top-down analysis

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 4 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 5 ASSUMPTIONS FOR RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 32)

FIGURE 6 COVID-19 IMPACT ANALYSIS ON 3D MOTION CAPTURE SYSTEM MARKET

3.1 REALISTIC SCENARIO

3.2 PESSIMISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

FIGURE 7 OPTICAL SYSTEMS ACCOUNTED FOR LARGER MARKET SHARE THAN NON-OPTICAL SYSTEMS IN 2019

FIGURE 8 HARDWARE ACCOUNTED FOR LARGEST MARKET SHARE IN 2019

FIGURE 9 MEDIA AND ENTERTAINMENT ACCOUNTED FOR LARGEST MARKET SHARE, BY APPLICATION, IN 2020

FIGURE 10 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 3D MOTION CAPTURE SYSTEM MARKET, 2020–2025 (USD MILLION)

FIGURE 11 DEMAND FOR HIGH-QUALITY 3D ANIMATION ACROSS INDUSTRIES TO FUEL GROWTH OF MARKET FROM 2020 TO 2025

4.2 MARKET, BY COMPONENT

FIGURE 12 HARDWARE TO HOLD LARGEST MARKET SIZE IN 2025

4.3 3D MOTION CAPTURE SYSTEM MARKET, BY APPLICATION

FIGURE 13 MEDIA AND ENTERTAINMENT TO ACCOUNT FOR LARGEST MARKET SIZE IN 2025

4.4 MARKET, BY TECHNOLOGY AND REGION

FIGURE 14 OPTICAL SYSTEMS AND NORTH AMERICA TO BE LARGEST SHAREHOLDERS IN MARKET IN 2020

4.5 3D MOTION CAPTURE SYSTEM MARKET, BY GEOGRAPHY

FIGURE 15 US TO HOLD LARGEST MARKET SHARE IN 2020

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 3D MOTION CAPTURE SYSTEM MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Demand for high-quality 3D animations across industries

5.2.1.2 Technological innovations in computer vision

5.2.1.3 Real-time data with exceptional spatial and temporal accuracy

5.2.1.4 Popularity of science-fiction movies among young population

FIGURE 17 DRIVERS OF MARKET AND THEIR IMPACTS

5.2.2 RESTRAINTS

5.2.2.1 Specific hardware and software required for data processing

5.2.2.2 Decline in demand for 3D motion capture system due to COVID-19

FIGURE 18 RESTRAINTS FOR 3D MOTION CAPTURE SYSTEM MARKET AND THEIR IMPACTS

5.2.3 OPPORTUNITIES

5.2.3.1 Growing adoption of 3D mocap systems in biomechanics, medical, and industrial applications

5.2.3.2 Growing use of cloud-based platforms for 3D motion capture

FIGURE 19 OPPORTUNITIES FOR MARKET AND THEIR IMPACTS

5.2.4 CHALLENGES

5.2.4.1 Need for high-end processors

FIGURE 20 CHALLENGE FOR MARKET AND ITS IMPACT

5.3 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS: MARKET

5.4 IMPACT OF COVID-19 ON 3D MOTION CAPTURE SYSTEM

6 3D MOTION CAPTURE SYSTEM MARKET, BY TECHNOLOGY (Page No. - 47)

6.1 INTRODUCTION

FIGURE 22 MARKET, BY TECHNOLOGY

FIGURE 23 OPTICAL SYSTEM TO HOLD LARGEST MARKET SIZE IN 2025

TABLE 1 MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

6.2 OPTICAL SYSTEMS

6.2.1 MEDIA AND ENTERTAINMENT TO DRIVE MARKET

6.2.1.1 Active marker

6.2.1.2 Passive maker

6.2.1.2.1 3D depth sensing

6.2.1.2.2 Time-of-flight

6.2.1.2.3 Structured light

6.2.1.3 Markerless

6.2.1.4 Underwater

TABLE 2 OPTICAL SYSTEM: 3D MOTION CAPTURE SYSTEM MARKET, BY COMPONENT, 2017–2025 (USD MILLION)

TABLE 3 OPTICAL SYSTEM: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 4 OPTICAL SYSTEM: MARKET, BY REGION, 2017–2025 (USD MILLION)

6.3 NON-OPTICAL SYSTEMS

6.3.1 USE OF NON-OPTICAL SYSTEMS FOR REAL-TIME DATA OUTPUT IN MOTION CAPTURE

6.3.1.1 Mechanical systems

6.3.1.2 Inertial systems

6.3.1.3 Electromagnetic systems

TABLE 5 NON-OPTICAL SYSTEM: MARKET, BY COMPONENT, 2017–2025 (USD MILLION)

TABLE 6 NON-OPTICAL SYSTEM: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 7 NON-OPTICAL SYSTEM: MARKET, BY REGION, 2017–2025 (USD MILLION)

7 3D MOTION CAPTURE SYSTEM MARKET, BY COMPONENT (Page No. - 55)

7.1 INTRODUCTION

FIGURE 24 MARKET, BY COMPONENT

FIGURE 25 HARDWARE TO HOLD LARGEST SIZE OF MARKET IN 2025

TABLE 8 MARKET, BY COMPONENT, 2017–2025 (USD MILLION)

7.2 HARDWARE

7.2.1 INCREASING DEMAND FROM LIFE SCIENCE AND ENGINEERING TO BOOST MARKET FOR HARDWARE

7.2.1.1 Cameras

7.2.1.2 Sensors

7.2.1.3 Communication devices

7.2.1.3.1 Switches and hubs

7.2.1.3.2 Connectors and cables

7.2.1.4 Accessories

7.2.1.4.1 Markers

7.2.1.4.2 Mounting equipment

7.2.1.4.3 Lenses and filters

7.2.1.4.4 Calibration tools

7.2.1.4.5 Force plates

TABLE 9 3D MOTION CAPTURE SYSTEM MARKET, BY HARDWARE, 2017–2025 (USD MILLION)

TABLE 10 MARKET FOR HARDWARE, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 11 MARKET FOR HARDWARE, BY REGION, 2017–2025 (USD MILLION)

7.3 SOFTWARE

7.3.1 OPTICAL SYSTEMS TO HOLD LARGEST SHARE OF SOFTWARE DURING FORECAST PERIOD

7.3.1.1 Packaged software

7.3.1.2 Plugin software

TABLE 12 MARKET, BY SOFTWARE, 2017–2025 (USD MILLION)

TABLE 13 MARKET FOR SOFTWARE, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 14 MARKET FOR SOFTWARE, BY REGION, 2017–2025 (USD MILLION)

7.4 SERVICES

7.4.1 INSTALLATION SEGMENT TO HOLD LARGEST SIZE IN SERVICES DURING FORECAST PERIOD

7.4.1.1 Installation

7.4.1.2 Consulting and planning

7.4.1.3 Training, support, and maintenance

TABLE 15 MARKET, BY SERVICES TYPE, 2017–2025 (USD MILLION)

TABLE 16 MARKET FOR SERVICES, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 17 MARKET FOR SERVICES, BY REGION, 2017–2025 (USD MILLION)

8 3D MOTION CAPTURE SYSTEM MARKET, BY APPLICATION (Page No. - 64)

8.1 INTRODUCTION

FIGURE 26 MARKET, BY APPLICATION

FIGURE 27 MEDIA AND ENTERTAINMENT TO HOLD LARGEST MARKET SIZE IN 2025

TABLE 18 MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

8.2 COVID-19 IMPACT ON APPLICATIONS OF 3D MOTION CAPTURE

8.3 MEDIA AND ENTERTAINMENT

8.3.1 MEDIA AND ENTERTAINMENT TO DOMINATE MARKET DURING FORECAST PERIOD

8.3.1.1 Gaming

8.3.1.2 Film production

8.3.1.3 Live performance/shows

8.3.1.4 Broadcast

TABLE 19 3D MOTION CAPTURE SYSTEM MARKET FOR MEDIA AND ENTERTAINMENT, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 20 MARKET FOR MEDIA AND ENTERTAINMENT, BY REGION, 2017–2025 (USD MILLION)

TABLE 21 NORTH AMERICA:MARKET FOR MEDIA AND ENTERTAINMENT, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 22 EUROPE: MARKET FOR MEDIA AND ENTERTAINMENT, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 23 APAC: MARKET FOR MEDIA AND ENTERTAINMENT, BY REGION, 2017–2025 (USD MILLION)

TABLE 24 ROW: MARKET FOR MEDIA AND ENTERTAINMENT, BY REGION, 2017–2025 (USD MILLION)

8.4 BIOMECHANICAL RESEARCH AND MEDICAL

8.4.1 GAIT ANALYSIS, REHABILITATION, AND SPORTS SCIENCE DRIVING USE OF 3D MOTION CAPTURE SYSTEMS

8.4.1.1 Sports science

8.4.1.2 Neuroscience

8.4.1.3 Animal science

8.4.1.4 Clinical gait analysis

8.4.1.5 MRI and surgery

TABLE 25 3D MOTION CAPTURE SYSTEM MARKET FOR BIOMECHANICAL RESEARCH AND MEDICAL, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 26 MARKET FOR BIOMECHANICAL RESEARCH AND MEDICAL, BY REGION, 2017–2025 (USD MILLION)

TABLE 27 NORTH AMERICA: MARKET FOR BIOMECHANICAL RESEARCH AND MEDICAL, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 28 EUROPE: MARKET FOR BIOMECHANICAL RESEARCH AND MEDICAL, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 29 APAC: MARKET FOR BIOMECHANICAL RESEARCH AND MEDICAL, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 30 ROW: MARKET FOR BIOMECHANICAL RESEARCH AND MEDICAL, BY REGION, 2017–2025 (USD MILLION)

8.5 ENGINEERING & DESIGN AND INDUSTRIAL

8.5.1 3D MOTION CAPTURE SYSTEMS ENABLE EASY AND ACCURATE MOTION ANALYSIS OF UNMANNED SYSTEMS/DRONES AND ROBOTS

8.5.1.1 Unmanned systems and robotics

8.5.1.2 Ergonomics

8.5.1.3 Aerodynamics

8.5.1.4 Military training

8.5.1.5 Marine and underwater

TABLE 31 3D MOTION CAPTURE SYSTEM MARKET FOR ENGINEERING & DESIGN AND INDUSTRIAL, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 32 MARKET FOR ENGINEERING & DESIGN AND INDUSTRIAL, BY REGION, 2017–2025 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET FOR ENGINEERING & DESIGN AND INDUSTRIAL, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 34 EUROPE: MARKET FOR ENGINEERING & DESIGN AND INDUSTRIAL, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 35 APAC: MARKET FOR ENGINEERING & DESIGN AND INDUSTRIAL, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 36 ROW: MARKET FOR ENGINEERING & DESIGN AND INDUSTRIAL, BY REGION, 2017–2025 (USD MILLION)

8.6 EDUCATION

8.6.1 MOTION CAPTURE SYSTEM HELPS STUDENTS GAIN BETTER UNDERSTANDING OF BIOMECHANICS AND ERGONOMICS

TABLE 37 MARKET FOR EDUCATION, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 38 MARKET FOR EDUCATION, BY REGION, 2017–2025 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET FOR EDUCATION, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 40 EUROPE: MARKET FOR EDUCATION, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 41 APAC: MARKET FOR EDUCATION, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 42 ROW: MARKET FOR EDUCATION, BY REGION, 2017–2025 (USD MILLION)

8.7 OTHERS

8.7.1 AGRICULTURE AND SOUND ANALYSIS OFFERS HIGH GROWTH OPPORTUNITIES FOR 3D MOTION CAPTURE SYSTEMS

8.7.1.1 Precision agriculture

8.7.1.2 Sound and motion analysis

TABLE 43 MARKET FOR OTHERS, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 44 MARKET FOR OTHERS, BY REGION, 2017–2025 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET FOR OTHERS, BY COUNTRY, 2017–2025 (USD THOUSANDS)

TABLE 46 EUROPE: MARKET FOR OTHERS, BY COUNTRY, 2017–2025 (USD THOUSANDS)

TABLE 47 APAC: MARKET FOR OTHERS, BY COUNTRY, 2017–2025 (USD THOUSANDS)

TABLE 48 ROW: MARKET FOR OTHERS, BY REGION, 2017–2025 (USD THOUSANDS)

9 3D MOTION CAPTURE SYSTEM MARKET, BY GEOGRAPHY (Page No. - 81)

9.1 INTRODUCTION

FIGURE 28 MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 49 MARKET, BY REGION, 2017–2025 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 29 NORTH AMERICA: MARKET SNAPSHOT

TABLE 50 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 51 US: MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 52 US: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 53 CANADA: MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 54 CANADA: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 55 MEXICO: MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 56 MEXICO: MARKET, BY APPLICATION, 2017–2025 (USD THOUSANDS)

TABLE 57 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET, BY COMPONENT, 2017–2025 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET FOR OPTICAL SYSTEM, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET FOR NON-OPTICAL SYSTEM, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

9.2.1 US

9.2.1.1 Presence of various industries to drive market

9.2.2 CANADA

9.2.2.1 Financial support for media industry to spur demand for 3D motion capture systems

9.2.3 MEXICO

9.2.3.1 Attractive growth opportunities for development of 3D motion capture systems

9.3 EUROPE

FIGURE 30 EUROPE: 3D MOTION CAPTURE SYSTEM MARKET

TABLE 62 EUROPE: MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 63 UK: MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 64 UK: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 65 GERMANY: MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 66 GERMANY: MARKET, BY APPLICATION, 2017–2025 (USD THOUSANDS)

TABLE 67 FRANCE: MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 68 FRANCE: MARKET, BY APPLICATION, 2017–2025 (USD THOUSANDS)

TABLE 69 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 70 REST OF EUROPE: MARKET, BY APPLICATION, 2017–2025 (USD THOUSANDS)

TABLE 71 EUROPE: MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 72 EUROPE: MARKET, BY COMPONENT, 2017–2025 (USD MILLION)

TABLE 73 EUROPE: MARKET FOR OPTICAL SYSTEM, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 74 EUROPE: MARKET FOR NON-OPTICAL SYSTEM, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 75 EUROPE: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

9.3.1 UK

9.3.1.1 Growing investments in biomechanical research and entertainment to drive market growth

9.3.2 GERMANY

9.3.2.1 Increasing demand for medical and sports applications to drive market

9.3.3 FRANCE

9.3.3.1 Growing applications to boost market

9.3.4 REST OF EUROPE

9.3.4.1 Rising use of mocap mapping

9.4 ASIA PACIFIC

FIGURE 31 APAC: 3D MOTION CAPTURE SYSTEM MARKET

TABLE 76 APAC: MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 77 CHINA: MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 78 CHINA: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 79 JAPAN: MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 80 JAPAN: MARKET, BY APPLICATION, 2017–2025 (USD THOUSANDS)

TABLE 81 INDIA: MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 82 INDIA: MARKET, BY APPLICATION, 2017–2025 (USD THOUSANDS)

TABLE 83 REST OF APAC: MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 84 REST OF APAC: MARKET, BY APPLICATION, 2017–2025 (USD THOUSANDS)

TABLE 85 APAC: MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 86 APAC: MARKET, BY COMPONENT, 2017–2025 (USD MILLION)

TABLE 87 APAC: MARKET FOR OPTICAL SYSTEM, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 88 APAC: MARKET FOR NON-OPTICAL SYSTEM, BY APPLICATION, 2017–2025 (USD THOUSANDS)

TABLE 89 APAC: MARKET, BY APPLICATION, 017–2025 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Growing entertainment industry to create demand for 3D motion capture systems

9.4.2 JAPAN

9.4.2.1 Growing animation industry to drive demand for 3D motion capture systems

9.4.3 INDIA

9.4.3.1 Government support for media and entertainment industry to boost demand for 3D motion capture systems

9.4.4 REST OF APAC

9.4.4.1 Growth across various industries to increase demand for 3D motion capture systems

9.5 REST OF THE WORLD

FIGURE 32 ROW: 3D MOTION CAPTURE SYSTEM MARKET

TABLE 90 ROW: MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 91 MIDDLE EAST AND AFRICA: MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 92 MIDDLE EAST AND AFRICA: MARKET, BY APPLICATION, 2017–2025 (USD THOUSANDS)

TABLE 93 SOUTH AMERICA: MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 94 SOUTH AMERICA: MARKET, BY APPLICATION, 2017–2025 (USD THOUSANDS)

TABLE 95 ROW: MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 96 ROW: MARKET, BY COMPONENT, 2017–2025 (USD MILLION)

TABLE 97 ROW: MARKET FOR OPTICAL SYSTEM, BY APPLICATION, 2017–2025 (USD THOUSANDS)

TABLE 98 ROW: MARKET FOR NON-OPTICAL SYSTEM, BY APPLICATION, 2017–2025 (USD THOUSANDS)

TABLE 99 ROW: MARKET, BY APPLICATION, 2017–2025 (USD THOUSANDS)

9.5.1 MIDDLE EAST & AFRICA

9.5.1.1 Growing economies to drive demand for 3D motion capture systems

9.5.2 SOUTH AMERICA

9.5.2.1 Increasing investments to drive demand for 3D motion capture systems

10 COMPETITIVE LANDSCAPE (Page No. - 109)

10.1 OVERVIEW

FIGURE 33 PRODUCT LAUNCHES EMERGED AS KEY GROWTH STRATEGY ADOPTED BY MARKET PLAYERS FROM 2017 TO 2020

10.2 RANKING OF PLAYERS IN 3D MOTION CAPTURE SYSTEM MARKET

FIGURE 34 RANKING OF TOP 5 PLAYERS IN MARKET, 2019

10.3 MICROQUADRANTS OVERVIEW

10.3.1 VISIONARIES

10.3.2 INNOVATORS

10.3.3 DYNAMIC DIFFERENTIATORS

10.3.4 EMERGING COMPANIES

FIGURE 35 3D MOTION CAPTURE SYSTEM MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING

10.4 COMPETITIVE SITUATIONS & TRENDS

FIGURE 36 PRODUCT LAUNCHES ADOPTED MOST OFTEN BY LEADING MARKET PLAYERS FROM 2017 TO 2020

10.4.1 PRODUCT LAUNCHES

TABLE 100 PRODUCT LAUNCHES, 2019–2020

10.4.2 CONTRACTS

TABLE 101 CONTRACTS, 2019–2020

10.4.3 PARTNERSHIPS

TABLE 102 PARTNERSHIPS, 2019–2020

10.4.4 EXPANSIONS

TABLE 103 EXPANSIONS, 2017–2020

11 COMPANY PROFILES (Page No. - 116)

11.1 KEY PLAYERS

11.1.1 NOITOM

11.1.2 NORTHERN DIGITAL(NDI)

11.1.3 OPTITRACK

11.1.4 VICON MOTION SYSTEM

11.1.5 XSENS TECHNOLOGIES

11.1.6 MOTION ANALYSIS

11.1.7 MOTUS DIGITAL

11.1.8 PHASESPACE

11.1.9 QUALIYSIS

11.1.10 SIMI REALITY MOTION SYSTEMS

11.2 OTHER KEY PLAYERS

11.2.1 AR TRACKING

11.2.2 CODAMOTION

11.2.3 DARI MOTION

11.2.4 METRIA INNOVATION

11.2.5 MOTION WORKSHOP

11.2.6 NANSENSE

11.2.7 NORAXON

11.2.8 PHOENIX TECHNOLOGIES

11.2.9 ROKOKO ELECTRONICS

11.2.10 STT SYSTEMS

12 APPENDIX (Page No. - 139)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

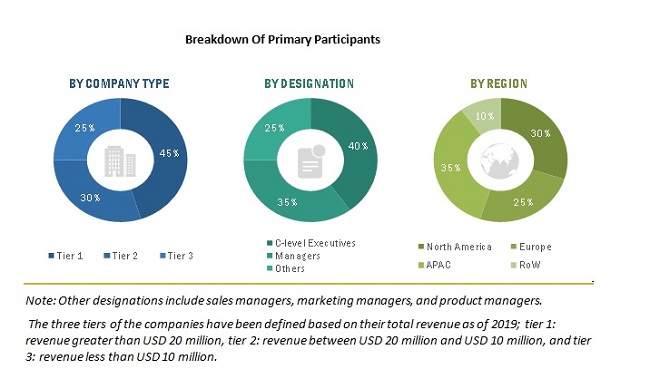

The study involves four major activities for estimating the size of the 3D motion capture system market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the 3D motion capture system market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources such as encyclopedias, directories, databases, the association for computing machinery, animation magazine, and VFX voice have been used to identify and collect information for an extensive technical and commercial study of the 3D motion capture system market.

Primary Research

In the primary research process, primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources, such as experts from related industries and suppliers, have been interviewed to obtain and verify critical information, as well as assess prospects. Key players in the 3D motion capture system market have been identified through secondary research, and their respective market rankings have been determined through primary and secondary research. This research includes the study of annual reports of the top market players and interviews with key opinion leaders, such as chief executive officers (CEOs), directors, and marketing personnel.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the 3D motion capture system market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives:

- To estimate and forecast the size of the 3D motion capture system market, in terms of value, based on technology, component, and application

- To describe and forecast the market size, in terms of value, for four key regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the technologies of the 3D motion capture system

- To provide detailed information regarding the COVID-19 impact on the 3D motion capture system market

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the value chain of the ecosystem of the 3D motion capture system

- To strategically analyze micro markets concerning individual market trends, growth prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market position in terms of their ranking and core competencies, along with detailed competitive landscape for the market leaders

- To analyze key growth strategies such as product launches, acquisitions, and contracts adopted, as well as investments undertaken by the key market players to enhance their position in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report.

Company information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in 3D Motion Capture System Market

We are dealing with tracking systems for animation market, do you cover this into your report? We want to understand competitive scenario for this market.

We want to understand market senario for 3D motion capture in the US.

We are especially interested in Passive optical motion capture, The complete market and also divided by segments like Biomechanic research,and Sports biomechanic research. We would like to know market size in terms of volume, dose your report covers it?