Nematicide Market by Type (Chemical, Biologicals), Nematode Type (Root-Knot, Cyst, Lesion), Mode of Application (Drenching, Soil Dressing, Seed Treatment, Fumigation), Formulation, Crop Type, and Region - Global Forecast to 2027

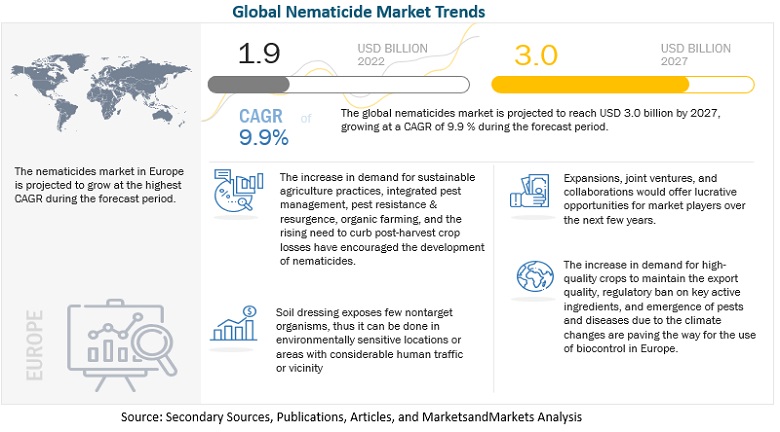

[342 Pages Report] The nematicide market is projected to reach USD 3.0 billion by 2027, recording a CAGR of 9.9% during the forecast period. The global industry is estimated to be valued at USD 1.9 billion in 2022. Nematodes are non-segmented, bilaterally symmetric worm-like invertebrates that lack respiratory and circulatory systems but have a body cavity and a fully functional digestive system. It is difficult to create chemical countermeasures against worms that infests plants. It is challenging to administer a chemical to a nematode's immediate surroundings since most Phyto-parasitic nematodes spend their whole lives isolated to the soil or inside plant roots.

The nematicides market is witnessing high growth because of increasing demand in the developing countries, easy availability of crop protection products, growing area under high-value cash crops such as fruits & vegetables, as well as rise demand for food products on account of increasing population.

Several chemicals and mechanical & biological measures were explored to control the growing nematode population, globally. Various chemical formulations are registered under the US Environmental Protection Agency (US EPA) for application in the commercial and agriculture sectors. Due to the increasing concerns associated with chemical methods over the years, the advent of biological nematicide products has presented numerous benefits such as, biologicals typically do not linger in the environment. Since they rapidly degrade, possible harmful exposure risk to humans and the environment is reduced. Biological products are often exempted from Maximum Residue Limits (MRLs) – helping to improve the global marketability of crops treated with biologicals, owing to which, biologicals are preferred over their chemical counterparts in North American and European regions.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: Economic damage such as crop production losses which leads to monetary losses, caused by Phyto parasitic nematodes continues to maintain the interest of private and public research institutes

According to CropLife India, food crops are damaged by more than 10,000 species of insects, 30,000 species of weeds, 100,000 diseases (caused by fungi, viruses, bacteria, and other microorganisms), and 1,000 species of nematodes, globally. The losses caused need to be contained to meet the food requirements to keep crop production from stagnating.

According to the FAO, approximately 20%–40% of crop yield is lost every year due to pest infestation. Crop pests include fungi, bacteria, viruses, insects, nematodes, viroid, and oomycetes. The diversity of crop pests continues to expand, and new strains are continually evolving. The effect of global warming would increase pest infestation further, as most of them thrive in warmer climates. Losses of major crops due to fungi, nematodes, and other such microorganisms are also on the rise. The study suggests that these figures would increase due to an increase in global temperatures, increased cropping intensity, and reduced crop rotations; this will lead to an increased demand for crop protection products such as nematicides.

Restraints: The economic cost of research and registration of new chemicals is an enormous hurdle for a new chemical nematicide to overcome

One of the major restraining factors for the market growth is the high costs associated with the research and development process to find new chemical compounds which are environmentally friendly. Farmers and growers of agricultural products can combat the growing danger posed by pests by investing in innovation. Herein, the current agricultural market is facing strict societal demands for pesticide solutions that are both environmentally and human health-safe.

Pesticides are continuously improving thanks to scientific innovation. Existing agrochemicals are more effective and less toxic than their decades-old predecessors; less can be used and they persist far less in the environment with minimal bioaccumulation in living organisms. New nematicides are less toxic because problematic active ingredients are screened out early in the development process. Regarding improved efficacy, active ingredient application rates per hectare have decreased 95 percent for newer products compared to older ones. This decrease from kilograms per hectare in the 1960s to grams per hectare today is due to advancements in plant science and technology. Nematicides, among all the pesticides are some of the most tested and regulated products in the world. The testing and regulatory compliances increases the cost of R&D process.

Opportunities: Providing customized solutions targeted toward specific pests

With the growing environmental and pollution concerns and health hazards from many conventional agrochemicals, the demand for natural biologicals is rising steadily across regions. Customers are witnessing a high demand for new biological products such as bionematicides to use against nematodes on standing crops, which cause crop damages, thereby reducing the overall farm yield and quality. One such innovative method is seed treatment, which is gaining traction due to its less or non-toxic nature, reduced cost of cultivation, and favourable effect on the yield and quality of crops. Moreover, seed treatment is targeted toward the desired pests and improve efficiency in nutrient uptake.

The use of biologicals and related alternative management products is increasing. R&D teams of major global players are also engaged in discovering target-specific innovative products by using biological insecticides, which promote organic agriculture. For instance, Crop IQ Technology announced the release of NEMA-DEAD in 2018, the world's first organic nematicide combining chemicals and natural nematicides in a single formula. NEMA-DEAD is therapeutic like chemical nematicides and preventive like biological nematicides, with no residuals. It does not produce stress on treated plants and contains bio stimulants that help wounded bio-stimulants biotic challenges.

Similarly, Zelto, a biological nematicide developed by Marrone Bio Innovations, is based on a non-living bacterium that provide grass protection by employing a revolutionary method of action for safely reducing insect pests that destroy turfs, such as chinch bugs, weevils, and caterpillars. Also, some biological insecticides, such as bacteria, fungi, and other microorganisms, are used in research experiments to invent new biological products

Challenges: Lack of awareness and low utilization of biologicals

As the market is highly fragmented at the regional level, awareness regarding various brands is low. Despite considerable efforts by agronomists, agricultural universities, companies, and governments across the globe in recent years, most of the farmers are unaware of biological products and their benefits in increasing cost-yield sustainability. On the other hand, in countries such as India and China that are the most populous economies and where agriculture is the major source of income for more than half of the countries’ population, food demand remains higher, and farmers are not willing to take risks by production capacity and also small retailers, and shopkeepers are unwilling to stock and sell biologicals in the country, as they feel their quality is unreliable.

Root-Knot segment accounted for the largest share in the global nematicide market by nematode type in 2021

The nematicide market has been segmented by nematode type into root-knot nematodes, cyst nematodes, lesion nematodes and others (Stubby root and stem nematodes). In 2021, the root-knot segment dominated the global nematicide market with a share of 41.6 %, followed by cyst nematodes with a share of 29.5 % and lesion nematodes with a share of 17.4 %. Root-knot nematodes are major nematode types and are impacting yield losses in high-value cash crops, such as onion, winter wheat, onion, tomato, and hot pepper. Cyst nematodes are most prevalent in Europe and are found across the globe. They mostly occur in potatoes, sugarbeet, and beetroot.

Cyst and root-knot nematodes are the two most widespread, economically important plant-parasitic nematodes that cause serious losses on all crops.

Organic acid-based plant extract biocontrol is one of the major trends

Various key players and start-ups are focusing on developing bionematicides through alternate sources which were previously unexplored. A variety of organic acids, including amino, acetic, butyric, formic, and propionic acids have been shown to be toxic to certain species of plant parasitic nematodes. These are either the result of microbial decomposition of various compounds in the soil or metabolites produced by microorganisms. Several acids, including heptalic acid and hydroxamic acid, have been used successfully against nematodes.

According to the FAO 2012, FDI in agriculture in developing countries was only 1% of the total world FDI inflows but has increased in recent years, particularly in Asia and Oceania, Latin America and the Caribbean, and Southeast Europe and the Commonwealth of Independent States. It also suggests that to meet the food demand of 9.1 billion people by 2050, an average annual net investment of USD 83 billion (in 2009) in primary agriculture and necessary downstream activities (for instance, storage and processing facilities), that is, USD 20 billion for crop production, USD 13 billion for livestock production, and USD 59 billion for downstream activities is required in developing countries.

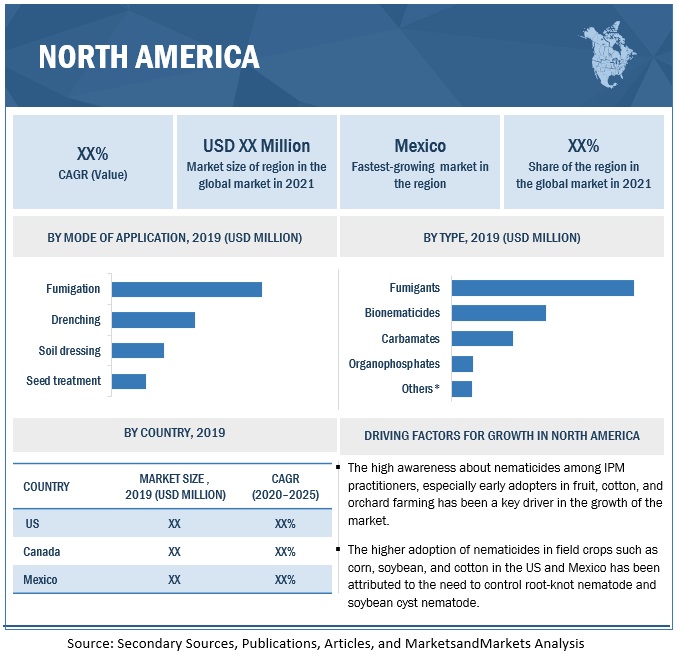

North America Market Scenario Image

To know about the assumptions considered for the study, download the pdf brochure

North America dominated the nematicide market, with a value of USD 0.54 billion in 2021; it is projected to reach USD 0.91 billion by 2027, at a CAGR of 9.4 % during the forecast period.

The US is one of the largest soybean producers and its by-products and contributes to a significant share in the oilseeds market. While a major portion of the demand for oilseeds is from the food and feed industries, the regulatory framework for the biofuel sector of Mexico has been changing. The scope for oilseeds in the biofuel sector is also changing. Canada has been experiencing a high demand for grains, stemming from the livestock industry. The countries are not self-sufficient entirely and depend on imports from the South American countries such as Brazil and Argentina.

The market for bionematicides has been growing in the North American countries such as the US and Mexico; companies have been focusing on the introduction of microorganisms that can be used as bionematicides. For instance, Syngenta (Switzerland) introduced TYMIRIUM technology platform brand in 2020. It is a revolutionary nematicide and fungicide technology that is being developed for both seed and soil applications. TYMIRIUM technology, which is based on the active component cyclobutrifluram, provides long-term protection against a wide range of nematode pests and illnesses across all major crops and geographies.

According to the US District Court report, 2021 for the Columbia Bayer (Germany) has a monopoly in nematicide seed treatment for corn and for soybean.

Key Market Players

The key players in this market include Corteva agriscience (USA), American Vanguard corporation (US), FMC corporation (US).

Target Audience:

- Nematicides suppliers

- Nematicides manufacturers

- Intermediate suppliers, such as traders and distributors of Nematicides

- Manufacturers of food & beverages, Farmers, growers

- Government and research organizations

- Associations, regulatory bodies, and other industry-related bodies:

- Food and Agriculture Organization (FAO)

- World Health Organization (WHO)

- Food Industry Association of Austria (FIAA)

- United States Department of Agriculture (USDA)

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Forecast 2027 |

USD 3.0 BN |

|

Market Size at 2022 |

USD 1.9 BN |

|

Estimated CAGR |

9.9 % |

|

Currency and Unit |

USD |

|

Research Duration Considered |

2022-2027 |

|

Historical Base Year |

2021 |

|

Segmentation |

|

|

Growing Market Geographies |

|

|

Dominant Geography |

North America |

|

Leading Manufacturers In Nematicides Market |

|

This research report categorizes the nematicides market, based on type, formulation, crop type, mode of application, nematode type, and region

By Type

-

Chemical

- Fumigants

- Organophosphates

- Carbamates

- Other types (acetoprole, benclothiaz, DBCP, and chitosan)

-

Biological

- Microbials

- Biochemical

- Macrobials

By Formulation

- Granular

- Liquid

- Other Formulations

By Nematode Type

- Root-Knot Nematodes

- Cyst Nematodes

- Lesion Nematodes

- Other Nematode Types (stubby-root nematodes and stem nematodes)

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest Of the World (Row)

By Mode of Application:

- Drenching

- Soil Dressing

- Seed Treatment

- Fumigation

- Other Mode of Application (dripping and sprinklers)

Key Features of the Nematicide Market

- Product Types: The nematicide market can be segmented into different product types such as organophosphates, carbamates, neonicotinoids, and bio-nematicides.

- Application: The market can be segmented based on the application such as cereals, oilseeds, fruits, vegetables, and others.

- Geography: The market can be segmented based on the geography such as North America, Europe, Asia-Pacific, South America, and Middle East & Africa.

- Mode of Application: The market can be segmented based on the mode of application such as foliar, soil, and seed treatment.

- Formulation: The market can be segmented based on the formulation such as liquid and granular.

- Crop Type: The market can be segmented based on the crop type such as corn, soybean, cotton, and others.

- Supply Chain Analysis: The market can be segmented based on the supply chain analysis such as upstream raw materials, downstream major consumers, and others.

- Market Dynamics: The market is driven by factors such as increasing demand for food security, growing population, and increasing awareness about the benefits of nematicides. The market is also hindered by factors such as stringent regulations, high cost of research and development, and environmental concerns.

Recent Developments

- In January 2021, ADAMA Ltd. and Jiangsu Huifeng Bio Agriculture Co., Ltd announced the completion of the first phase of their previously announced transactions. ADAMA has recently purchased a 51 percent ownership in Shanghai Dibai Plant Protection Co., Ltd., a Huifeng subsidiary focused on the marketing and distribution of major formulated crop protection products in China, in this first phase. This deal will strengthen ADAMA's commercial position and offering in this important and rapidly expanding crop protection industry.

- In May 2020, Syngenta introduced the TYMIRIUM technology platform brand. It is a nematicide and fungicide technology that is being developed for both seed and soil applications. TYMIRIUM technology, which is based on the active component cyclobutrifluram, provides long-term protection against a wide range of nematode pests and illnesses across all major crops and geographies. Syngenta holds the innovator position in the market by the consistent launch of revolutionary technologies like Tymirium. The versatility of Tymirium will further help in strengthening the company’s broad product portfolio.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the global nematicide market?

North America dominated the nematicides market, with a value of USD 0.54 billion in 2021; it is projected to reach USD 0.91 billion by 2027, at a CAGR of 9.4 % during the forecast period. Major players present in the North American nematicides market are Corteva agriscience (USA) and FMC corporation (US).

What is the current size of the global nematicide market?

The global nematicide market is estimated to be valued at USD 1.9 billion in 2022. It is projected to reach USD 3.0 billion by 2027, recording a CAGR of 9.9 % during the forecast period.

Which are the key players in the market, and how intense is the competition?

Key players in this market include BASF SE, Isagro S.P.A, Corteva Agriscience, Syngenta AG, Bayer AG, UPL, American Vanguard Corporation, Nufarm, FMC Corporation, CHR Hansen, ADAMA Agricultural Solutions, Marrone Bio innovations. Since nematicide market is a fast-growing market, the existing players are fixated upon improving their market shares, while startups are being established rapidly. The nematicide market can be classified as a fragmented market as it has a large number of organized players, accounting for a major part of the market share, present at the global level, and unorganized players present at the local level in several countries. .

What is a nematicide?

A nematicide is a chemical substance or biological agent that is used to control or kill nematodes (microscopic worms) that can cause damage to plants and crops.

What are the major factors driving the growth of the nematicide market?

The growth of the nematicide market is driven by factors such as:

- The increasing demand for food due to population growth and urbanization

- The need to protect crops from nematode damage in order to maintain yield and quality

- The development of new and improved nematicides that are more effective and environmentally friendly

What are the major challenges facing the nematicide market?

Some of the major challenges facing the nematicide market include:

- The increasing concerns about the environmental and health risks associated with chemical nematicides

- The development of resistance in nematodes to certain nematicides

- The high cost of nematicides, which can make them unaffordable for small-scale farmers.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 NEMATICIDES MARKET SEGMENTATION

1.3.1 REGIONAL SEGMENTATION

FIGURE 2 NEMATICIDES MARKET: REGIONAL SEGMENTATION

1.3.2 INCLUSIONS & EXCLUSIONS

1.4 YEARS CONSIDERED

1.5 UNITS CONSIDERED

1.5.1 CURRENCY CONSIDERED

1.5.2 VOLUME UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 45)

2.1 RESEARCH DATA

FIGURE 3 NEMATICIDES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 5 NEMATICIDES MARKET SIZE ESTIMATION (DEMAND SIDE)

FIGURE 6 NEMATICIDES MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 7 NEMATICIDES MARKET SIZE ESTIMATION, BY TYPE (SUPPLY SIDE)

FIGURE 8 NEMATICIDES MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.4 ASSUMPTIONS

TABLE 2 ASSUMPTIONS

2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

TABLE 3 RESEARCH LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 56)

TABLE 4 NEMATICIDES MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 10 NEMATICIDES MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 11 NEMATICIDES MARKET, BY CROP TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 12 NEMATICIDES MARKET, BY MODE OF APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 13 NEMATICIDES MARKET, BY NEMATODE TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 14 NEMATICIDES MARKET, BY FORMULATION, 2022 VS. 2027 (USD MILLION)

FIGURE 15 NEMATICIDES MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 62)

4.1 NEMATICIDES MARKET: BRIEF OVERVIEW

FIGURE 16 GRADUAL PHASE-OUT OF CONVENTIONAL CROP PROTECTION CHEMICALS

4.2 NEMATICIDES MARKET, BY REGION

FIGURE 17 EUROPE: SUSTAINABLE SOURCES FOR CONTROLLING SOILBORNE NEMATODES TO DRIVE NEMATICIDE USAGE

4.3 NEMATICIDES MARKET, BY TYPE

FIGURE 18 HIGH ADOPTION OF SUSTAINABLE AGRICULTURAL TECHNIQUES TO DRIVE BIOLOGICALS SEGMENT

4.4 NEMATICIDES MARKET, BY CROP TYPE

FIGURE 19 INCREASE IN USE OF CARBOFURAN IN FRUITS & VEGETABLES AGAINST NEMATODE INFESTATION

4.5 NEMATICIDES MARKET, BY NEMATODE TYPE

FIGURE 20 HIGH RATE OF ROOT-KNOT NEMATODE INFESTATION IN PLANTS

4.6 NEMATICIDES MARKET, BY MODE OF APPLICATION

FIGURE 21 EASE OF APPLICATION TO DRIVE SOIL DRESSING SEGMENT

4.7 NORTH AMERICA: NEMATICIDES MARKET, BY KEY TYPE & COUNTRY

FIGURE 22 CHEMICALS SEGMENT TO ACCOUNT FOR SIGNIFICANT SHARE IN NORTH AMERICA

4.8 NEMATICIDES MARKET GROWTH, BY KEY COUNTRY

FIGURE 23 ITALY, US, SPAIN, AND UK TO GROW AT SIGNIFICANT RATES

5 MARKET OVERVIEW (Page No. - 66)

5.1 INTRODUCTION

5.2 MACROINDICATORS

5.2.1 ADOPTION OF PESTICIDES FOR DEFENSE AGAINST PEST ATTACKS

FIGURE 24 PESTICIDE CONSUMPTION, BY REGION, 2017–2020 (TONNES)

5.2.2 FOREIGN DIRECT INVESTMENTS

5.3 GLOBAL CROP LOSSES DUE TO NEMATODES

FIGURE 25 WORLDWIDE AVERAGE MONETARY LOSS OF MAJOR CROPS DUE TO NEMATODES (USD BILLION)

TABLE 5 AVERAGE ANNUAL MONETARY LOSS CAUSED BY PLANT PARASITIC NEMATODES TO ECONOMICALLY IMPORTANT CROPS

FIGURE 26 FREQUENCY OF TYPES OF NEMATODE INFESTATION IN CROPS

5.4 MARKET DYNAMICS

FIGURE 27 NEMATICIDES MARKET DYNAMICS

5.4.1 DRIVERS

5.4.1.1 Strong demand for high-value crops

FIGURE 28 AREA HARVESTED UNDER FRUITS & VEGETABLES, 2017–2020 (MILLION HECTARES)

5.4.1.2 Demand for low-cost crop protection solutions

5.4.1.3 Increasing damage to crop production due to nematode infestations

5.4.2 RESTRAINTS

5.4.2.1 Technological limitations in use of biological products

5.4.2.2 Varying government regulations

5.4.3 OPPORTUNITIES

5.4.3.1 Use of plant-based nematicides in organic agriculture and horticulture

5.4.3.2 Nematodes developing resistance to crop protection chemicals

5.4.4 CHALLENGES

5.4.4.1 Evolution of biotechnology and increasing acceptance of GM crops as alternatives to crop protection chemicals

TABLE 6 MAJOR GM CROP-GROWING COUNTRIES, 2010–2019 (MILLION HECTARES)

5.4.4.2 Lack of awareness and low utilization of biologicals

6 INDUSTRY TRENDS (Page No. - 78)

6.1 OVERVIEW

6.2 TARIFF AND REGULATORY LANDSCAPE

6.2.1 NORTH AMERICA

6.2.1.1 US

6.2.1.2 Canada

6.2.2 EUROPEAN UNION

6.2.2.1 UK

6.2.2.2 France

6.2.2.3 Russia

6.2.2.4 Australia

6.2.3 ASIA PACIFIC

6.2.3.1 India

6.2.3.2 China

6.2.4 SOUTH AMERICA

6.2.4.1 Brazil

6.2.5 MIDDLE EAST

6.2.5.1 Egypt

6.2.5.2 UAE

6.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.4 TRENDS/DISRUPTIONS IMPACTING BUYERS IN NEMATICIDES MARKET

FIGURE 30 GLOBAL CHEMICAL NEMATICIDE VS. BIONEMATICIDE USE, 2017–2021

6.5 AVERAGE SELLING PRICES

FIGURE 31 AVERAGE PRICE TRENDS FOR NEMATICIDES, BY REGION, 2017–2021 (USD/KG)

FIGURE 32 AVERAGE PRICE TRENDS FOR NEMATICIDES, BY TYPE, 2017–2021 (USD/KG)

6.6 VALUE CHAIN ANALYSIS

FIGURE 33 MANUFACTURING OF NEMATICIDES CONTRIBUTES MAJOR VALUE TO OVERALL PRICE OF NEMATICIDE

6.6.1 RESEARCH AND PRODUCT DEVELOPMENT

6.6.2 MATERIAL SOURCING AND ACQUISITION

6.6.3 NEMATICIDE MANUFACTURING

6.6.4 DISTRIBUTION

6.6.5 SALES MANAGEMENT

6.6.6 POST-SALES SERVICES

6.7 MARKET ECOSYSTEM

TABLE 11 NEMATICIDES MARKET ECOSYSTEM

6.8 TECHNOLOGY ANALYSIS

6.8.1 ORGANIC ACID-BASED PLANT EXTRACT BIOCONTROL

6.8.2 REDUCED-RISK NEMATICIDES

6.8.3 SYNGENTA TYMIRIUM

6.8.4 KRUGER SEEDS NEMASTRIKE

6.9 PATENT ANALYSIS

FIGURE 35 NUMBER OF PATENTS APPROVED FOR NEMATICIDES IN GLOBAL MARKET, 2011–2021

FIGURE 36 JURISDICTIONS WITH MOST PATENT APPROVALS FOR NEMATICIDES, 2011–2021

TABLE 12 RECENT PATENTS GRANTED FOR NEMATICIDES

6.10 TRADE ANALYSIS

TABLE 13 IMPORT VALUE OF INSECTICIDES, FUNGICIDES, HERBICIDES, NEMATICIDES, AND PLANT GROWTH REGULATORS FOR KEY COUNTRIES, 2021 (USD THOUSAND)

TABLE 14 EXPORT VALUE OF INSECTICIDES, FUNGICIDES, HERBICIDES, NEMATICIDES, AND PLANT GROWTH REGULATORS FOR KEY COUNTRIES, 2021 (USD THOUSAND)

6.11 KEY CONFERENCES & EVENTS

TABLE 15 NEMATICIDES MARKET: CONFERENCES & EVENTS, 2022–2023

6.12 CASE STUDY ANALYSIS

6.12.1 USE CASE 1: SYNGENTA AG SEEDCARE LAUNCHES VICTRATO

6.12.2 USE CASE 2: BASF’S IRGACYCLE STABILIZES RECYCLED PLASTICS USED TO PROTECT PINEAPPLES FROM SUNBURN IN MALAYSIA

6.13 KEY STAKEHOLDERS & BUYING CRITERIA

6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP FOUR MODES OF APPLICATION

TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP FOUR MODES OF APPLICATION

FIGURE 38 KEY BUYING CRITERIA OF TOP FOUR MODES OF APPLICATION FOR NEMATICIDES

TABLE 17 KEY BUYING CRITERIA FOR TOP FOUR MODES OF APPLICATION FOR NEMATICIDES

6.14 PORTER’S FIVE FORCES ANALYSIS

TABLE 18 PORTER’S FIVE FORCES ANALYSIS

6.14.1 THREAT OF NEW ENTRANTS

6.14.2 THREAT OF SUBSTITUTES

6.14.3 BARGAINING POWER OF SUPPLIERS

6.14.4 BARGAINING POWER OF BUYERS

6.14.5 INTENSITY OF COMPETITIVE RIVALRY

7 NEMATICIDES MARKET, BY TYPE (Page No. - 105)

7.1 INTRODUCTION

FIGURE 39 NEMATICIDES MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 19 NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 20 NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.2 CHEMICALS

7.2.1 LONGER RESIDUAL ACTIVITY AND QUICK MODE OF ACTION AGAINST NEMATODES TO DRIVE SEGMENT

7.2.2 FUMIGANTS

7.2.2.1 Broad spectrum functionality of fumigants against nematodes to positively drive market

TABLE 21 FUMIGANTS APPLIED TO AGRONOMIC CROPS

TABLE 22 FUMIGANTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 23 FUMIGANTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 24 FUMIGANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 25 FUMIGANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.2.2.1.1 Methyl bromide

7.2.2.1.1.1 Ability to penetrate quickly into sorptive materials at normal atmospheric pressure to drive segment

7.2.2.1.2 Metam sodium

7.2.2.1.2.1 Increase in farmers’ education and adoption of metam sodium in agriculture sector to booster market

7.2.2.1.3 1-3-Dichloropropene

7.2.2.1.3.1 Properties such as minimum soil contamination air dispersion to drive segment

7.2.2.1.4 Other fumigants

7.2.3 CARBAMATES

7.2.3.1 Low toxicity to non-target organisms and selective action against nematodes to accelerate segment growth

TABLE 26 CROPS RECEIVING CARBAMATE APPLICATIONS

TABLE 27 CARBAMATES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 28 CARBAMATES MARKET, BY REGION, 2022–2027 (USD MILLION)

7.2.4 ORGANOPHOSPHATES

7.2.4.1 Fast absorption rate of organophosphates to drive market

TABLE 29 ORGANOPHOSPHATES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 30 ORGANOPHOSPHATES MARKET, BY REGION, 2022–2027 (USD MILLION)

7.2.5 OTHER CHEMICALS

TABLE 31 OTHER CHEMICAL NEMATICIDES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 32 OTHER CHEMICAL NEMATICIDES MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 BIOLOGICALS

7.3.1 STRINGENT REGULATORY POLICIES ON CONVENTIONAL AGROCHEMICALS TO PROPEL SEGMENT GROWTH

TABLE 33 BIOLOGICALS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 34 BIOLOGICALS MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.3.2 MICROBIALS

7.3.2.1 High adoption of sustainable agricultural techniques to fuel growth

TABLE 35 MICROBIALS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 36 MICROBIALS MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3.3 BIOCHEMICALS

7.3.3.1 Residue-free nematode management by biochemicals to propel growth

TABLE 37 BIOCHEMICALS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 38 BIOCHEMICALS MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3.4 MACROBIALS

7.3.4.1 Natural and unique mode of action and convenient application to spur usage

TABLE 39 MACROBIALS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 40 MACROBIALS MARKET, BY REGION, 2022–2027 (USD MILLION)

8 NEMATICIDES MARKET, BY FORMULATION (Page No. - 120)

8.1 INTRODUCTION

FIGURE 40 NEMATICIDES MARKET, BY FORMULATION, 2022 VS. 2027 (USD MILLION)

TABLE 41 NEMATICIDES MARKET, BY FORMULATION, 2017–2021 (USD MILLION)

TABLE 42 NEMATICIDES MARKET, BY FORMULATION, 2022–2027 (USD MILLION)

8.2 GRANULAR

8.2.1 GOOD STORAGE VIABILITY TO DRIVE SEGMENT GROWTH

TABLE 43 GRANULAR NEMATICIDES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 44 GRANULAR NEMATICIDES MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 LIQUID

8.3.1 GREATER DEGREE OF DISPERSION PROPERTY OFFERED BY LIQUID NEMATICIDES TO DRIVE DEMAND

TABLE 45 LIQUID NEMATICIDES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 46 LIQUID NEMATICIDES MARKET, BY REGION, 2022–2027 (USD MILLION)

9 NEMATICIDES MARKET, BY NEMATODE TYPE (Page No. - 125)

9.1 INTRODUCTION

FIGURE 41 NEMATICIDES MARKET, BY NEMATODE TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 47 MOST COMMON NEMATODE SPECIES

TABLE 48 NEMATICIDES MARKET, BY NEMATODE TYPE, 2017–2021 (USD MILLION)

TABLE 49 NEMATICIDES MARKET, BY NEMATODE TYPE, 2022–2027 (USD MILLION)

9.2 ROOT-KNOT NEMATODES

9.2.1 CONTROL OF ECONOMIC DAMAGE WORTH USD 100 BILLION CAUSED BY ROOT-KNOT NEMATODES TO DRIVE DEMAND

TABLE 50 ROOT-KNOT NEMATODES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 51 ROOT-KNOT NEMATODES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 52 ROOT-KNOT NEMATODES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 53 ROOT-KNOT NEMATODES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 54 ECONOMIC LOSSES IN VEGETABLE CROPS DUE TO ROOT-KNOT NEMATODES

9.3 CYST NEMATODES

9.3.1 LARGE-SCALE ECONOMIC LOSSES AND LOWER YIELD QUALITY DUE TO CYST NEMATODE INFESTATION TO INCREASE DEMAND

TABLE 55 CYST NEMATODES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 56 CYST NEMATODES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 57 CYST NEMATODES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 58 CYST NEMATODES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

9.4 LESION NEMATODES

9.4.1 WIDE HOST RANGE AND PRESENCE IN TEMPERATE AND TROPICAL ENVIRONMENTS TO DRIVE MARKET

TABLE 59 LESION NEMATODES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 60 LESION NEMATODES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 61 LESION NEMATODES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 62 LESION NEMATODES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

9.5 OTHER NEMATODE TYPES

TABLE 63 OTHER NEMATODE TYPES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 64 OTHER NEMATODE TYPES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 65 OTHER NEMATODE TYPES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 66 OTHER NEMATODE TYPES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

10 NEMATICIDES MARKET, BY MODE OF APPLICATION (Page No. - 137)

10.1 INTRODUCTION

FIGURE 42 NEMATICIDES MARKET, BY MODE OF APPLICATION, 2022 VS. 2027 (USD MILLION)

TABLE 67 NEMATICIDES MARKET, BY MODE OF APPLICATION, 2017–2021 (USD MILLION)

TABLE 68 NEMATICIDES MARKET, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

10.2 FUMIGATION

10.2.1 LOWER COSTS INVOLVED IN FUMIGATION FOR NEMATODE CONTROL TO PROPEL GROWTH

TABLE 69 FUMIGATION MODE MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 70 FUMIGATION MODE MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 DRENCHING

10.3.1 PRECISE APPLICATION AND DEEP PENETRATION OF NEMATICIDES ON TARGET NEMATODES TO DRIVE DEMAND

TABLE 71 DRENCHING MODE MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 72 DRENCHING MODE MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 SOIL DRESSING

10.4.1 EFFECTIVE MANAGEMENT OF EARLY SEASON NEMATODE TO DRIVE DEMAND

TABLE 73 SOIL DRESSING MODE MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 74 SOIL DRESSING MODE MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 SEED TREATMENT

10.5.1 SAFER APPLICATION AND EARLY SEASON PROTECTION AGAINST NEMATODE TO AUGMENT DEMAND

TABLE 75 SEED TREATMENT MODE MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 76 SEED TREATMENT MODE MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 OTHER MODES OF APPLICATION

TABLE 77 OTHER MODES OF APPLICATION MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 78 OTHER MODES OF APPLICATION MARKET, BY REGION, 2022–2027 (USD MILLION)

11 NEMATICIDES MARKET, BY CROP TYPE (Page No. - 147)

11.1 INTRODUCTION

FIGURE 43 NEMATICIDES MARKET, BY CROP TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 79 NEMATICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 80 NEMATICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

11.2 CEREALS & GRAINS

11.2.1 RISE IN CONSUMPTION OF CEREALS & GRAINS TO DRIVE MARKET

TABLE 81 CEREAL & GRAIN CROPS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 82 CEREAL & GRAIN CROPS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 83 CEREAL & GRAIN CROPS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 84 CEREAL & GRAIN CROPS MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.2.2 CORN

11.2.2.1 Commercial value and vulnerability of corn crop to needle nematodes to drive nematicide demand

TABLE 85 NEMATODE TYPES AFFECTING CORN

11.2.3 WHEAT

11.2.3.1 Severe damage to wheat crop in Asia & Europe due to root-knot and cyst nematodes to drive market

11.2.4 RICE

11.2.4.1 Major global rice export demand and severe yield loss caused due to Meloidogyne graminicola nematodes to drive demand

11.2.5 OTHER CEREALS & GRAINS

11.3 OILSEEDS & PULSES

11.3.1 INCREASE IN CONSUMPTION OF PROTEIN- AND HEALTHY FAT-RICH MEALS TO DRIVE SEGMENT

TABLE 86 OILSEED & PULSE CROPS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 87 OILSEED & PULSE CROPS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 88 OILSEED & PULSE CROPS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 89 OILSEED & PULSE CROPS MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.3.2 SOYBEAN

11.3.2.1 Increase in vegan population and severe crop loss due to infestation from soybean cyst nematodes to drive market

11.3.3 SUNFLOWER

11.3.3.1 Preference for sunflower oil due to its associated heart-related health benefits to drive demand

11.3.4 OTHER OILSEEDS & PULSES

11.4 FRUITS & VEGETABLES

11.4.1 RISE IN EXPORTS OF FRESH, FROZEN, AND PROCESSED FRUITS & VEGETABLES FROM SOUTH ASIA TO DRIVE DEMAND

TABLE 90 FRUIT & VEGETABLE CROPS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 91 FRUIT & VEGETABLE CROPS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 92 FRUIT & VEGETABLE CROPS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 93 FRUIT & VEGETABLE CROPS MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.4.2 POME FRUITS

11.4.2.1 Economic losses caused due to nematode-related complex diseases to drive market

11.4.3 CITRUS FRUITS

11.4.3.1 Severe yield loss caused due to citrus nematodes in citrus fruits to drive nematicides market

11.4.4 LEAFY VEGETABLES

11.4.4.1 Susceptibility of leafy vegetables to needle nematodes and lesion nematodes to drive market

11.4.5 BERRIES

11.4.5.1 Rise in demand for berries in food & beverage, pharmaceutical, and cosmetics industries in US to positively drive market

11.4.6 ROOTS & TUBERS VEGETABLES

11.4.6.1 Severe economic losses due to tuber blemishes caused by nematodes to drive market

11.4.7 OTHER FRUITS & VEGETABLES

11.5 OTHER CROP TYPES

TABLE 94 OTHER CROP TYPES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 95 OTHER CROP TYPES MARKET, BY REGION, 2022–2027 (USD MILLION)

12 NEMATICIDES MARKET, BY REGION (Page No. - 161)

12.1 INTRODUCTION

FIGURE 44 SPAIN TO BE FASTEST-GROWING COUNTRY DURING FORECAST PERIOD

FIGURE 45 EUROPE PROJECTED TO RECORD HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 96 NEMATICIDES MARKET, BY REGION, 2017–2021 (USD MILLION)

12.2 NORTH AMERICA

TABLE 98 NORTH AMERICA: NEMATICIDES MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 99 NORTH AMERICA: NEMATICIDES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 100 NORTH AMERICA: NEMATICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 101 NORTH AMERICA: NEMATICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 102 NORTH AMERICA: NEMATICIDES MARKET, BY NEMATODE TYPE, 2017–2021 (USD MILLION)

TABLE 103 NORTH AMERICA: NEMATICIDES MARKET, BY NEMATODE TYPE, 2022–2027 (USD MILLION)

TABLE 104 NORTH AMERICA: NEMATICIDES MARKET, BY FORMULATION, 2017–2021 (USD MILLION)

TABLE 105 NORTH AMERICA: NEMATICIDES MARKET, BY FORMULATION, 2022–2027 (USD MILLION)

TABLE 106 NORTH AMERICA: NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 107 NORTH AMERICA: NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 108 NORTH AMERICA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 109 NORTH AMERICA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 110 NORTH AMERICA: BIOLOGICAL NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 111 NORTH AMERICA: BIOLOGICAL NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 112 NORTH AMERICA: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2017–2021 (USD MILLION)

TABLE 113 NORTH AMERICA: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

12.2.1 US

12.2.1.1 Research undertaken to introduce nematode-resistant vegetables and field crops

TABLE 114 US: NEMATODE SPECIES AND THEIR PREVALENCE

TABLE 115 US: NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 116 US: NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 117 US: NEMATICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 118 US: NEMATICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

12.2.2 CANADA

12.2.2.1 Losses in high-value cash crops to drive adoption of nematicides

TABLE 119 CANADA: CROPS INFESTED BY NEMATODES

TABLE 120 CANADA: NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 121 CANADA: NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 122 CANADA: NEMATICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 123 CANADA: NEMATICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

12.2.3 MEXICO

12.2.3.1 Increase in root-knot and root-lesion nematode infestation in wheat to fuel market

TABLE 124 MEXICO: NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 125 MEXICO: NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 126 MEXICO: NEMATICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 127 MEXICO: NEMATICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

12.3 EUROPE

FIGURE 47 EUROPE: NEMATICIDES MARKET SNAPSHOT

TABLE 128 EUROPE: NEMATICIDES MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 129 EUROPE: NEMATICIDES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 130 EUROPE: NEMATICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 131 EUROPE: NEMATICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 132 EUROPE: NEMATICIDES MARKET, BY NEMATODE TYPE, 2017–2021 (USD MILLION)

TABLE 133 EUROPE: NEMATICIDES MARKET, BY NEMATODE TYPE, 2022–2027 (USD MILLION)

TABLE 134 EUROPE: NEMATICIDES MARKET, BY FORMULATION, 2017–2021 (USD MILLION)

TABLE 135 EUROPE: NEMATICIDES MARKET, BY FORMULATION, 2022–2027 (USD MILLION)

TABLE 136 EUROPE: NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 137 EUROPE: NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 138 EUROPE: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 139 EUROPE: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 140 EUROPE: BIOLOGICAL NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 141 EUROPE: BIOLOGICAL NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 142 EUROPE: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2017–2021 (USD MILLION)

TABLE 143 EUROPE: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

12.3.1 GERMANY

12.3.1.1 Major players investing in agricultural solutions to cater to nematode attacks in field crops

TABLE 144 GERMANY: NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 145 GERMANY: NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 146 GERMANY: NEMATICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 147 GERMANY: NEMATICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

12.3.2 UK

12.3.2.1 High demand for nematicides since farmers still use traditional farming methods

TABLE 148 UK: NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 149 UK: NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 150 UK: NEMATICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 151 UK: NEMATICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

12.3.3 FRANCE

12.3.3.1 Extensive government funds in R&D to devise various sustainable methods for nematode control

TABLE 152 FRANCE: NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 153 FRANCE: NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 154 FRANCE: NEMATICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 155 FRANCE: NEMATICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

12.3.4 SPAIN

12.3.4.1 Increase in government initiatives to encourage use of biological nematicides

TABLE 156 SPAIN: NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 157 SPAIN: NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 158 SPAIN: NEMATICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 159 SPAIN: NEMATICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

12.3.5 ITALY

12.3.5.1 Changes across entire supply chain with goal of sustainable farming to drive market

TABLE 160 ITALY: NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 161 ITALY: NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 162 ITALY: NEMATICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 163 ITALY: NEMATICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

12.3.6 NETHERLANDS

12.3.6.1 Stringent regulatory scenario on pesticide usage to fuel market for biological nematicides

TABLE 164 NETHERLANDS: NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 165 NETHERLANDS: NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 166 NETHERLANDS: NEMATICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 167 NETHERLANDS: NEMATICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

12.3.7 REST OF EUROPE

TABLE 168 REST OF EUROPE: NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 169 REST OF EUROPE: NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 170 REST OF EUROPE: NEMATICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 171 REST OF EUROPE: NEMATICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

12.4 ASIA PACIFIC

TABLE 172 ASIA PACIFIC: NEMATICIDES MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 173 ASIA PACIFIC: NEMATICIDES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 174 ASIA PACIFIC: NEMATICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 175 ASIA PACIFIC: NEMATICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 176 ASIA PACIFIC: NEMATICIDES MARKET, BY NEMATODE TYPE, 2017–2021 (USD MILLION)

TABLE 177 ASIA PACIFIC: NEMATICIDES MARKET, BY NEMATODE TYPE, 2022–2027 (USD MILLION)

TABLE 178 ASIA PACIFIC: NEMATICIDES MARKET, BY FORMULATION, 2017–2021 (USD MILLION)

TABLE 179 ASIA PACIFIC: NEMATICIDES MARKET, BY FORMULATION, 2022–2027 (USD MILLION)

TABLE 180 ASIA PACIFIC: NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 181 ASIA PACIFIC: NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 182 ASIA PACIFIC: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 183 ASIA PACIFIC: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 184 ASIA PACIFIC: BIOLOGICAL NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 185 ASIA PACIFIC: BIOLOGICAL NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 186 ASIA PACIFIC: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2017–2021 (USD MILLION)

TABLE 187 ASIA PACIFIC: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

12.4.1 CHINA

12.4.1.1 Rise in infestation by root-knot nematodes in crops to propel market

TABLE 188 CHINA: NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 189 CHINA: NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 190 CHINA: NEMATICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 191 CHINA: NEMATICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

12.4.2 JAPAN

12.4.2.1 Various products catering to long-term viability of crops to drive growth

TABLE 192 JAPAN: MAJOR CROPS INFESTED BY NEMATODES

TABLE 193 JAPAN: NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 194 JAPAN: NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 195 JAPAN: NEMATICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 196 JAPAN: NEMATICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

12.4.3 INDIA

12.4.3.1 Protected environment in polyhouses to create favorable environment for root-knot nematodes

TABLE 197 INDIA: NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 198 INDIA: NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 199 INDIA: NEMATICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 200 INDIA: NEMATICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

12.4.4 AUSTRALIA

12.4.4.1 Increase in canola losses due to nematode attacks to support adoption of nematicides

TABLE 201 AUSTRALIA: NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 202 AUSTRALIA: NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 203 AUSTRALIA: NEMATICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 204 AUSTRALIA: NEMATICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

12.4.5 VIETNAM

12.4.5.1 Favorable agricultural development strategies to drive growth

TABLE 205 VIETNAM: NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 206 VIETNAM: NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 207 VIETNAM: NEMATICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 208 VIETNAM: NEMATICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

12.4.6 REST OF ASIA PACIFIC

TABLE 209 REST OF ASIA PACIFIC: NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 210 REST OF ASIA PACIFIC: NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 211 REST OF ASIA PACIFIC: NEMATICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 212 REST OF ASIA PACIFIC: NEMATICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

12.5 SOUTH AMERICA

TABLE 213 SOUTH AMERICA: NEMATICIDES MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 214 SOUTH AMERICA: NEMATICIDES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 215 SOUTH AMERICA: NEMATICIDES MARKET, BY FORMULATION, 2017–2021 (USD MILLION)

TABLE 216 SOUTH AMERICA: NEMATICIDES MARKET, BY FORMULATION, 2022–2027 (USD MILLION)

TABLE 217 SOUTH AMERICA: NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 218 SOUTH AMERICA: NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 219 SOUTH AMERICA: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2017–2021 (USD MILLION)

TABLE 220 SOUTH AMERICA: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

TABLE 221 SOUTH AMERICA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 222 SOUTH AMERICA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 223 SOUTH AMERICA: BIOLOGICAL NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 224 SOUTH AMERICA: BIOLOGICAL NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 225 SOUTH AMERICA: NEMATICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 226 SOUTH AMERICA: NEMATICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

12.5.1 ARGENTINA

12.5.1.1 Increase in focus on cultivating soybean and corn to boost demand for nematicides

TABLE 227 ARGENTINA: NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 228 ARGENTINA: NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 229 ARGENTINA: NEMATICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 230 ARGENTINA: NEMATICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

12.5.2 BRAZIL

12.5.2.1 High adoption of GM crops to increase usage of nematicides

TABLE 231 BRAZIL: MOST PRESENT NEMATODE SPECIES

TABLE 232 BRAZIL: NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 233 BRAZIL: NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 234 BRAZIL: NEMATICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 235 BRAZIL: NEMATICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

12.5.3 CHILE

12.5.3.1 Hampered grape cultivation by M. ethiopica nematodes to create need for nematicides

TABLE 236 CHILE: NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 237 CHILE: NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 238 CHILE: NEMATICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 239 CHILE: NEMATICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

12.5.4 REST OF SOUTH AMERICA

TABLE 240 REST OF SOUTH AMERICA: NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 241 REST OF SOUTH AMERICA: NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 242 REST OF SOUTH AMERICA: NEMATICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 243 REST OF SOUTH AMERICA: NEMATICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

12.6 REST OF THE WORLD (ROW)

TABLE 244 ROW: NEMATICIDES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 245 ROW: NEMATICIDES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 246 ROW: NEMATICIDES MARKET, BY FORMULATION, 2017–2021 (USD MILLION)

TABLE 247 ROW: NEMATICIDES MARKET, BY FORMULATION, 2022–2027 (USD MILLION)

TABLE 248 ROW: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2017–2021 (USD MILLION)

TABLE 249 ROW: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

TABLE 250 ROW: NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 251 ROW: NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 252 ROW: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 253 ROW: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 254 ROW: BIOLOGICAL NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 255 ROW: BIOLOGICAL NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 256 ROW: NEMATICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 257 ROW: NEMATICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 258 ROW: NEMATICIDES MARKET, BY NEMATODE TYPE, 2017–2021 (USD MILLION)

TABLE 259 ROW: NEMATICIDES MARKET, BY NEMATODE TYPE, 2022–2027 (USD MILLION)

12.6.1 MIDDLE EAST

12.6.1.1 Rise in population, high dependency on imports, and yield loss due to nematodes to fuel market

TABLE 260 MIDDLE EAST: NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 261 MIDDLE EAST: NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 262 MIDDLE EAST: NEMATICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 263 MIDDLE EAST: NEMATICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

12.6.2 AFRICA

12.6.2.1 Growth in demand for vegetable crops to drive growth

TABLE 264 SOUTH AFRICA: POPULAR WEED SPECIES AS HOSTS OF ROOT-KNOT NEMATODES

TABLE 265 AFRICA: NEMATICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 266 AFRICA: NEMATICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 267 AFRICA: NEMATICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 268 AFRICA: NEMATICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 234)

13.1 OVERVIEW

13.2 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 48 SEGMENTAL REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2017–2021 (USD BILLION)

13.3 MARKET SHARE ANALYSIS, 2021

TABLE 269 NEMATICIDES MARKET SHARE (CONSOLIDATED)

13.4 KEY PLAYER STRATEGIES

13.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

13.5.1 STARS

13.5.2 PERVASIVE PLAYERS

13.5.3 EMERGING LEADERS

13.5.4 PARTICIPANTS

FIGURE 49 NEMATICIDES MARKET, COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

13.5.5 PRODUCT FOOTPRINT

TABLE 270 COMPANY FOOTPRINT, BY FORMULATION

TABLE 271 COMPANY FOOTPRINT, BY TYPE

TABLE 272 COMPANY FOOTPRINT, BY REGION

TABLE 273 OVERALL COMPANY FOOTPRINT

13.6 NEMATICIDES MARKET (STARTUP/SME EVALUATION QUADRANT)

13.6.1 PROGRESSIVE COMPANIES

13.6.2 STARTING BLOCKS

13.6.3 RESPONSIVE COMPANIES

13.6.4 DYNAMIC COMPANIES

FIGURE 50 NEMATICIDES MARKET, COMPANY EVALUATION QUADRANT, 2022 (STARTUPS/SMES)

13.6.5 COMPETITIVE BENCHMARKING

TABLE 274 NEMATICIDES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 275 NEMATICIDES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

13.7 COMPETITIVE SCENARIO

13.7.1 PRODUCT LAUNCHES

TABLE 276 NEMATICIDES MARKET: PRODUCT LAUNCHES, 2017–2022

13.7.2 DEALS

TABLE 277 NEMATICIDES MARKET: DEALS, 2017–2022

13.7.3 OTHERS

TABLE 278 OTHERS, 2017–2022

14 COMPANY PROFILES (Page No. - 258)

14.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

14.1.1 BASF SE

TABLE 279 BASF SE: BUSINESS OVERVIEW

FIGURE 51 BASF SE: COMPANY SNAPSHOT

TABLE 280 BASF SE: NEW PRODUCT LAUNCHES

TABLE 281 BASF SE: DEALS

14.1.2 ISAGRO S.P.A

TABLE 282 ISAGRO S.P.A: BUSINESS OVERVIEW

FIGURE 52 ISAGRO S.P.A: COMPANY SNAPSHOT

TABLE 283 ISAGRO S.P.A: DEALS

14.1.3 CORTEVA AGRISCIENCE

TABLE 284 CORTEVA AGRISCIENCE: BUSINESS OVERVIEW

FIGURE 53 CORTEVA AGRISCIENCE: COMPANY SNAPSHOT

TABLE 285 CORTEVA AGRISCIENCE: NEW PRODUCT LAUNCHES

14.1.4 SYNGENTA AG

TABLE 286 SYNGENTA AG: BUSINESS OVERVIEW

FIGURE 54 SYNGENTA AG: COMPANY SNAPSHOT

TABLE 287 SYNGENTA AG: NEW PRODUCT LAUNCHES

14.1.5 BAYER AG

TABLE 288 BAYER AG: BUSINESS OVERVIEW

FIGURE 55 BAYER AG: COMPANY SNAPSHOT

TABLE 289 BAYER AG: NEW PRODUCT LAUNCHES

TABLE 290 BAYER AG: DEALS

14.1.6 UPL

TABLE 291 UPL: BUSINESS OVERVIEW

FIGURE 56 UPL: COMPANY SNAPSHOT

TABLE 292 UPL: DEALS

14.1.7 AMERICAN VANGUARD CORPORATION

TABLE 293 AMERICAN VANGUARD CORPORATION: BUSINESS OVERVIEW

FIGURE 57 AMERICAN VANGUARD CORPORATION: COMPANY SNAPSHOT

TABLE 294 AMERICAN VANGUARD CORPORATION: DEALS

14.1.8 NUFARM

TABLE 295 NUFARM: BUSINESS OVERVIEW

FIGURE 58 NUFARM: COMPANY SNAPSHOT

TABLE 296 NUFARM: DEALS

14.1.9 FMC CORPORATION

TABLE 297 FMC CORPORATION: BUSINESS OVERVIEW

FIGURE 59 FMC CORPORATION: COMPANY SNAPSHOT

TABLE 298 FMC CORPORATION: NEW PRODUCT LAUNCHES

TABLE 299 FMC CORPORATION: DEALS

14.1.10 CHR. HANSEN

TABLE 300 CHR. HANSEN: BUSINESS OVERVIEW

FIGURE 60 CHR. HANSEN: COMPANY SNAPSHOT

TABLE 301 CHR. HANSEN: DEALS

14.1.11 ADAMA AGRICULTURAL SOLUTIONS LTD.

TABLE 302 ADAMA AGRICULTURAL SOLUTIONS LTD.: BUSINESS OVERVIEW

FIGURE 61 ADAMA AGRICULTURAL SOLUTIONS LTD.: COMPANY SNAPSHOT

TABLE 303 ADAMA AGRICULTURAL SOLUTIONS LTD.: DEALS

14.1.12 MARRONE BIO INNOVATIONS

TABLE 304 MARRONE BIO INNOVATIONS: BUSINESS OVERVIEW

FIGURE 62 MARRONE BIO INNOVATIONS: COMPANY SNAPSHOT

TABLE 305 MARRONE BIO INNOVATIONS: NEW PRODUCT LAUNCHES

14.1.13 T. STANES & COMPANY LIMITED

TABLE 306 T. STANES & COMPANY LIMITED: BUSINESS OVERVIEW

FIGURE 63 T. STANES & COMPANY LIMITED: COMPANY SNAPSHOT

14.1.14 VALENT BIOSCIENCES LLC

TABLE 307 VALENT BIOSCIENCES LLC: BUSINESS OVERVIEW

TABLE 308 VALENT BIOSCIENCES LLC: DEALS

TABLE 309 VALENT BIOSCIENCES LLC: OTHERS

14.1.15 CERTIS BIOLOGICALS

TABLE 310 CERTIS BIOLOGICALS: BUSINESS OVERVIEW

TABLE 311 CERTIS BIOLOGICALS: NEW PRODUCT LAUNCHES

TABLE 312 CERTIS BIOLOGICALS: OTHERS

14.1.16 AGRI LIFE

TABLE 313 AGRI LIFE: BUSINESS OVERVIEW

14.1.17 BIO HUMA NETICS, INC

TABLE 314 BIO HUMA NETICS, INC: BUSINESS OVERVIEW

14.1.18 REAL IPM KENYA

TABLE 315 REAL IPM KENYA: BUSINESS OVERVIEW

14.1.19 HORIZON GROUP

TABLE 316 HORIZON GROUP: BUSINESS OVERVIEW

14.1.20 CROP IQ TECHNOLOGY LTD

TABLE 317 CROP IQ TECHNOLOGY LTD.: BUSINESS OVERVIEW

TABLE 318 CROP IQ TECHNOLOGY LTD.: NEW PRODUCT LAUNCHES

TABLE 319 CROP IQ TECHNOLOGY LTD.: OTHERS

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

14.2 STARTUPS/SMES/OTHER PLAYERS

14.2.1 VARSHA BIOSCIENCE AND TECHNOLOGY INDIA PRIVATE LIMITED

14.2.2 PHERONYM

14.2.3 VIVE CROP PROTECTION

14.2.4 TELLURIS BIOTECH INDIA PRIVATE LIMITED

14.2.5 ECOWIN

15 ADJACENT & RELATED MARKETS (Page No. - 319)

15.1 INTRODUCTION

15.2 AGRICULTURAL BIOLOGICALS MARKET

15.2.1 LIMITATIONS

15.2.2 MARKET DEFINITION

15.2.3 MARKET OVERVIEW

15.2.4 AGRICULTURE BIOLOGICALS MARKET, BY CROP TYPE

TABLE 320 AGRICULTURAL BIOLOGICALS MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 321 AGRICULTURAL BIOLOGICALS MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

15.2.4.1 Cereals & Grains

TABLE 322 AGRICULTURAL BIOLOGICALS MARKET FOR CEREALS & GRAINS, BY REGION, 2017–2021 (USD MILLION)

TABLE 323 AGRICULTURAL BIOLOGICALS MARKET FOR CEREALS & GRAINS, BY REGION, 2022–2027 (USD MILLION)

15.2.5 AGRICULTURAL BIOLOGICALS MARKET, BY MODE OF APPLICATION

TABLE 324 AGRICULTURAL BIOLOGICALS MARKET, BY MODE OF APPLICATION, 2017–2021 (USD MILLION)

TABLE 325 AGRICULTURAL BIOLOGICALS MARKET, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

15.3 BIOPESTICIDES MARKET

15.3.1 LIMITATIONS

15.3.2 MARKET DEFINITION

15.3.3 MARKET OVERVIEW

15.3.4 BIOPESTICIDES MARKET, BY TYPE

TABLE 326 BIOPESTICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 327 BIOPESTICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.3.4.1 Bioinsecticides

TABLE 328 BIOINSECTICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 329 BIOINSECTICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.3.5 BIOPESTICIDES MARKET, BY CROP TYPE

TABLE 330 BIOPESTICIDES MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 331 BIOPESTICIDES MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

15.3.5.1 Cereals & Grains

TABLE 332 CEREAL & GRAIN CROPS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 333 CEREAL & GRAIN CROPS MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.4 BIOLOGICAL SEED TREATMENT MARKET

15.4.1 LIMITATIONS

15.4.2 MARKET DEFINITION

15.4.3 MARKET OVERVIEW

15.4.4 BIOLOGICAL SEED TREATMENT MARKET, BY TYPE

TABLE 334 BIOLOGICAL SEED TREATMENT MARKET, BY TYPE, 2018–2025 (USD MILLION)

15.4.4.1 Microbials

TABLE 335 MICROBIAL MARKET, BY SUBTYPE, 2018–2025 (USD MILLION)

15.4.5 BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE

TABLE 336 BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2018–2025 (USD MILLION)

15.4.5.1 Corn

TABLE 337 BIOLOGICAL SEED TREATMENT MARKET FOR CORN, BY REGION, 2018–2025 (USD MILLION)

16 APPENDIX (Page No. - 333)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 CUSTOMIZATION OPTIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

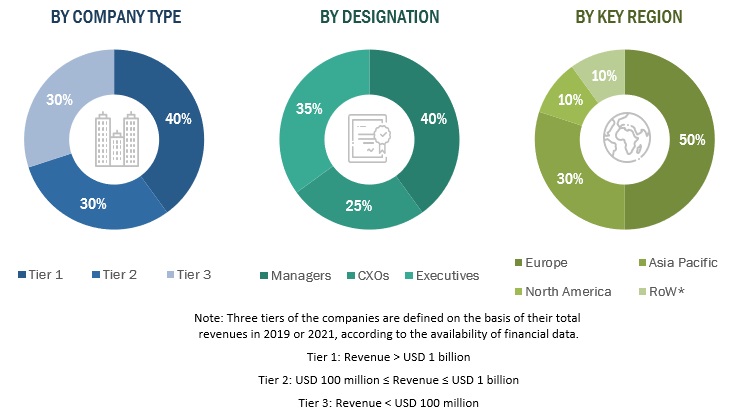

This research study involved the extensive use of secondary sources—directories and databases such as Food and Agriculture Organization and World Health Organization—to identify and collect information useful for a technical, market-oriented, and commercial study of the nematicide market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects. The following figure depicts the research design applied in drafting this report on the nematicides market.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the nematicides market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the nematicide market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- The revenues of major nematicide manufacturers were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

- Macro indicators affecting the growth of the nematicide market were considered while estimating the market size.

- All parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying several factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the global market for nematicides on the basis of type, formulation, crop type, mode of application, nematode type, and region.

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micro markets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the nematicide market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe market for nematicides into Greece, Sweden, Poland, Belgium, Switzerland and other EU and Non-EU countries

- Further breakdown of the Rest of South America market for nematicides into Uruguay, Peru, Venezuela, and Columbia

- Further breakdown of Rest of Asia-Pacific market for commercial greenhouse into Thailand, Singapore, Indonesia, Malaysia, South Korea, New Zealand, and ASEAN countries

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Nematicide Market