Power Device Analyzer Market by Type (Both AC and DC, AC and DC), Current (Below 1000A and Above 1000A), End user (Automotive, Energy, Telecommunication, Consumer Electronics and Appliances, Medical) and Region - Global Forecast to 2027

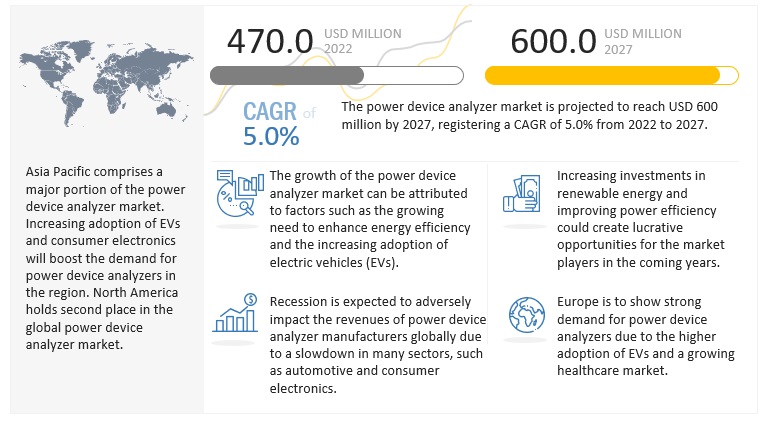

[193 Pages Report] The global power device analyzer market in terms of revenue was estimated to worth $470 million in 2022 and is poised to reach $600 million by 2027, growing at a CAGR of 5.0 % from 2022 to 2027. Power device analyzer is been widely used in various industries and is having a robust growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Map

To know about the assumptions considered for the study, download the pdf brochure

Power Device Analyzer Market Dynamics

Driver: Increasing adoption of power-efficient devices across various industries

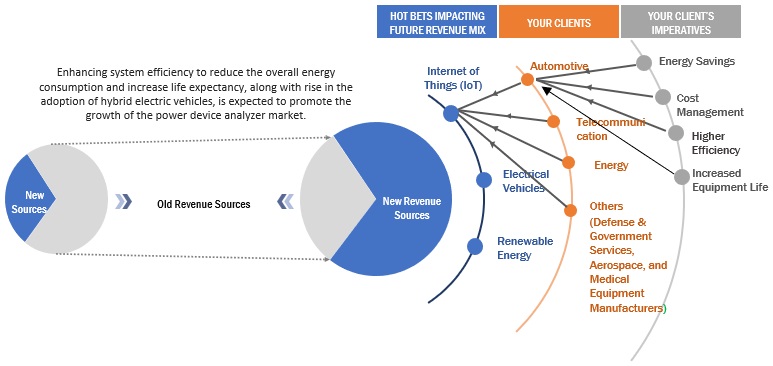

Energy savings is a major concern for every industry. Thus, there has been a constant development of technologies across all industries to achieve greater efficiency and save energy. Furthermore, there is an emerging demand for integrating new-age technologies with the industries to get real-time data and achieve greater efficiency, ultimately saving energy. For example, emerging economies such as China, India, and Brazil are witnessing growth in consumer electronics products with the advent of Internet of Things (IoT) and 5G technologies. The increased demand for smart technology-enabled electronic devices with improved functionalities has led to the development of power-efficient and high-performance consumer electronic products. New age power device analyzers come with detection technology that can provide harmonic distortion readings, comprehensive power quality readings, and three-dimensional charts. These features help ensure a better power supply, thus protecting equipment from future damage and increasing their lifetime. The power device analyzer market thus leverages the increasing adoption of high-efficiency systems.

Restraints: Expanding grey market

The supply of the power device analyzer is very much strong in the gray market as the cost of the branded device is more than the one which is manufactured locally. Because of this major players in the power device analyzer market face a competition from unknown players who sell in the gray market. These unknowns players in the market are gray market and the local players. These gray market players usually import the goods and sell it through an unauthorized dealer, whereas local players manufacture goods in house and sell it with their local name. Big players face problems such as price, competitiveness, and local supply from these unknown players as it is difficult for them to maintain and achieve. Apart from this many small scale and medium scale industries prefer to buy goods from local players mainly in developing countries because of the reduced cost. This reduces the opportunities for global players. These factors affect the growth of the branded power device analyzer manufacturers

Opportunities: Growing market for IoT devices to boost the demand for power device analyzers

In the past five years, global internet penetration has risen at a tremendous pace. The emergence of IoT and smart applications platforms is an important factor for the general growth of the power device analyzer industry. With the help of technologies, the variation has been created in IoT-enabled devices, such as smartphones, smart TVs, smart ACs, and other electronic gadgets. These emerging IoT technologies require proper testing and equipment measuring facilities. Therefore, IoT-enabled devices are driving the growth of the power device analyzer market as devices based on these technologies need to be tested to ensure that they can communicate and interoperate seamlessly. IoT-enabled devices are expensive and are used in various end user sectors, such as automobile, healthcare, and aerospace and defense. The use of IoT-enabled devices at these end user industries present significant growth opportunities for the test and measurement companies due to specific and strict standards of accuracy, reliability, latency, and availability to be met by them.

Challenges: Requirement of skilled personnel to operate power device analyzers

Power device analyzer requires high skilled personnel with a strong technical background to operate and access the testing or optimize the power conversion system. These analyzers test devices that transform, generate, or consume electricity and measure parameters, such as current, voltage, power, harmonics, and phase. These will require a technically skilled person to understand the methodologies to conduct the tasks. According to the Talent Shortage Survey, ~44% of employers worldwide report that they cannot find the skills they need in people to employ them. So, developing and underdeveloped countries such as Madagascar, Central African Republic, Niger, Nigeria, Cuba, Ecuador, and Guyana from Africa and South America that have a shortage of skilled personnel in the industries will restrain the market’s growth. For instance, in January 2018, according to the Department of Labor, the US economy had 7.6 million unfilled jobs, but only 6.5 million people were looking for work. This shortage of skilled workers is a major restraint for the growth of the power device analyzer market.

Market Trend

By type, Both AC and DC segment is predicted to have the highest CAGR of 5.1% in the power device analyzer market in the period of 2022 to 2027.

Both AC and DC type segment is predicted to have the highest growth rate in the power device analyzer market by type in forecasted period of 2022 – 2027. It is also estimated to account the greatest share in the market. The factors such as rising government initiatives for implementation of energy audits and mandatory regulations , increased demand for Electric Vehicles are positively influencing the both AC & DC segment in type of power device analyzer market.

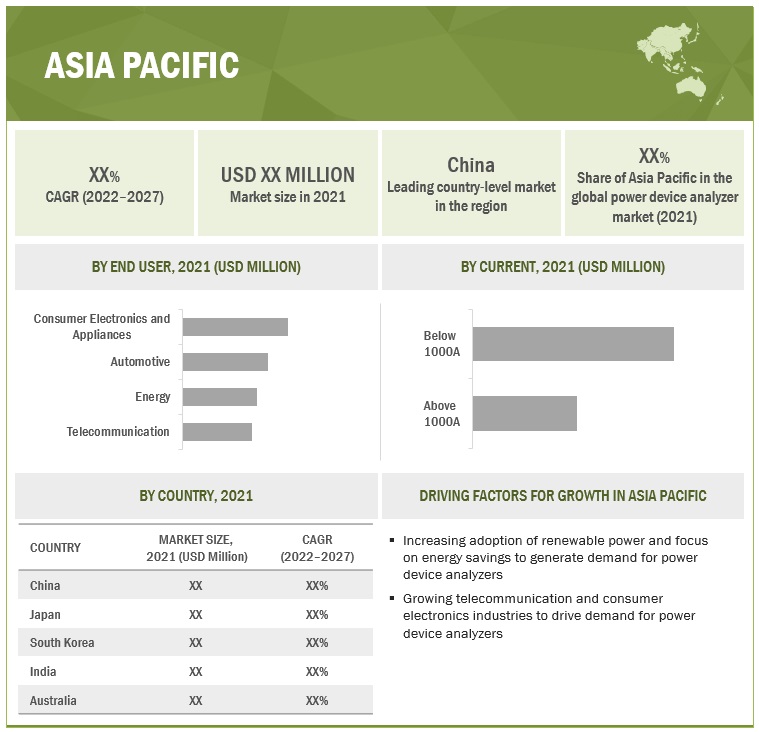

By current, the below 1000A segment is predicted to have the highest CAGR of 5.2% in the power device analyzer market in the period of 2022 to 2027.

The below 1000A segment is estimated to have a highest growth rate by current in the power device analyzer market for the forecasted period 2022 – 2027. They also account for the greatest market share. Most of the industries uses below 1000A power device analyzers. Industries like Energy, aerospace & defense, automotive, healthcare equipment manufacturing and wireless communication. The automotive industry widely uses power device analyzers of below 1000A.

By end user, the consumer electronics and appliances segment is predicted to have the highest CAGR of 5.2% in the power device analyzer market in the period of 2022 to 2027.

The consumer electronics and appliances is predicted to have the highest CAGR in the power device analyzer market. Top companies witnessed an increase in demand for consumer electronics, such as air conditioners, smartphones, refrigerators, laptops, smart TVs, and smartwatches, reflecting significant growth in the consumer electronic sector. According to India Brand Equity Foundation (IBEF), the consumer electronics and appliances industry is expected to double to reach USD 21.18 billion by 2025. Thus, an increase in sales of the consumer appliances will require power device analyzers Thereby driving the power device analyzer market.

Asia Pacific has the highest market share in the power device analyzer market

Asia pacific is predicted to have a highest CAGR among other regions with the highest market share of 54.3%. The increased adoption of clean energy and focus towards energy savings are driving the power device analyzer market in this region. The growth of industries such as consumer electronics and automotive are expected to influence the market.

Key Market Players

The major players in the power device analyzer market include Keysight Technologies (US), Fluke Corporation (US), Yokogawa (Japan), Iwatsu (Japan), and Hioki E E Corporation (Japan).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size available for years |

2019–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Type, Current, and End user |

|

Geographies covered |

Asia Pacific, North America, Middle East & Africa, South America, and Europe |

|

Companies covered |

Fluke Corporation (US), Keysight Technologies (US), Yokogawa Electric Corporation (Japan), Iwatsu Electric (Japan), Hioki E E Corporation (Japan), Newtons4th (UK), Rohde & Schwarz (Germany), Carlo Gavazzi (Switzerland), Vitrek (US), Circutor (Spain), ZES ZIMMER Electronic Systems (Germany), Texas Instruments (US), PCE Instruments (UK), Extech Instruments (US), Dewetron (Austria), Magtrol (US), Dewesoft D O O (Slovenia), Janitza Electronics (Germany), Arbiter Systems (US), Valhalla Scientific (US) |

This research report categorizes the power device analyzer market based by type, current, and end user.

Based on type, the power device analyzer market has been segmented as follows:

- Both AC and DC

- AC

- DC

Based on Current, the power device analyzer market has been segmented as follows:

- Below 1000 A

- Above 1000 A

Based on End user, the power device analyzer market has been segmented as follows:

- Automotive

- Energy

- Telecommunication

- Consumer Electronics and Appliances

- Medical

- Others – Aerospace, Defence and Government services

Based on the region, the power device analyzer market has been segmented as follows:

- North America

- Asia Pacific

- Europe

- South America

- Middle East & Africa

Recent Developments

- In May 2021, Iwatsu launched Curve Tracer CS-8000 series. The series can test up to 5kV, 2000A.

- In December 2020, Keysight introduced N6705C DC power analyzer. For greater convenience, all sourcing and measuring functions are available from the front panel. Keysight now offers a recessed binding post (RBP) option with the N6705C for added safety when using banana plugs.

- In October 2020, Yokogawa Electric Corporation was awarded a contract by Oman government to supply an analyzer package solution for Liwa Plastics Industries Complex that is being built for Oman Oil Refineries and Petroleum Industries Company.

- In March 2019, ROHDE & SCHWARZ was awarded a contract by University of Aalborg to supply test equipment for the Electronic Engineering IoT living laboratory which includes oscilloscope, power analyzer, and radio scanner.

Frequently Asked Questions (FAQ):

What is the current size of the power device analyzer market?

The current market size of global power device analyzer market is estimated to be USD 457 million in 2021.

What are the major drivers for power device analyzer market?

Rising focus on energy savings, growth of electric vehicle market and increasing adoption of power efficient devices across various industries are the major drivers for power analyzer market..

Which is the fastest-growing region during the forecasted period in power device analyzer market?

Asia Pacific is the fastest-growing region during the forecasted period.

Which is the fastest-growing segment, by end user during the forecasted period in power device analyzer market?

Automotive is to be the fastest-growing segment by component during forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

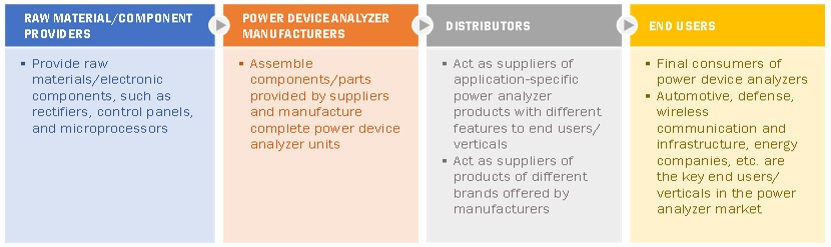

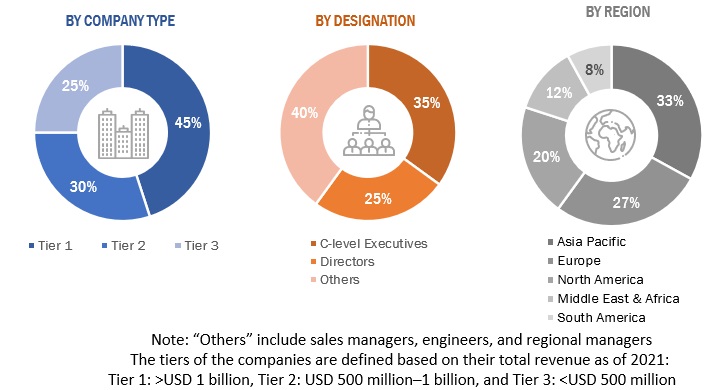

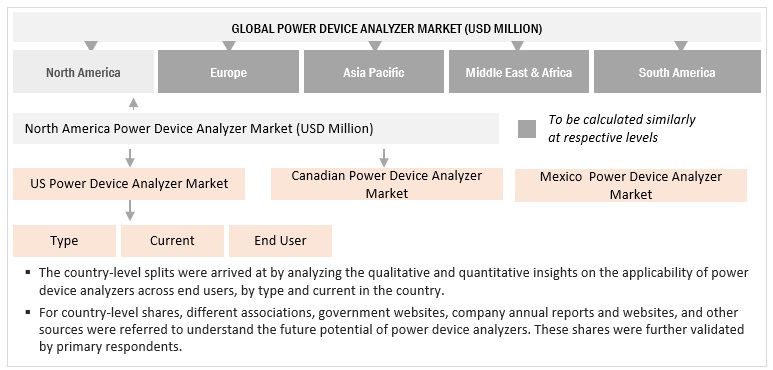

This study involved major activities in estimating the current size of the power device analyzer market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Country-wise analysis were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global power analyzer market. The other secondary sources included press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The power device analyzer market comprises several stakeholders, such as product manufacturers, service providers, distributors, and end-users in the supply chain. The demand-side of this market is characterized by its various end-user industries. Moreover, the demand is also driven by the rising demand of increasing energy saving and improving efficiency across every industry. The supply side is characterized by rising demand for contracts from the end user industries, and new product launches. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the power device analyzer market ecosystem.

Report Objectives

- To define, describe, and forecast the size of the power device analyzer market by type, current, and end user.

- To estimate and forecast the global power device analyzer market for various segments with respect to 5 main regions, namely, North America, Europe, South America, Middle East & Africa, and Asia Pacific in terms of value and volume

- To provide detailed information regarding the drivers, restraints, opportunities, and industry-specific challenges that influence the market growth

- To provide a detailed overview of the power device analyzer value chain, along with industry trends, use cases, security standards, and Porter’s five forces

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments and detail the competitive landscape for market players

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as joint ventures, mergers and acquisitions, contracts, and agreements, and new product launches, in the power device analyzer market

- To benchmark players within the market using the proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

- This report covers the power device analyzer market size in terms of value and volume.

Available Customization

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Power Device Analyzer Market