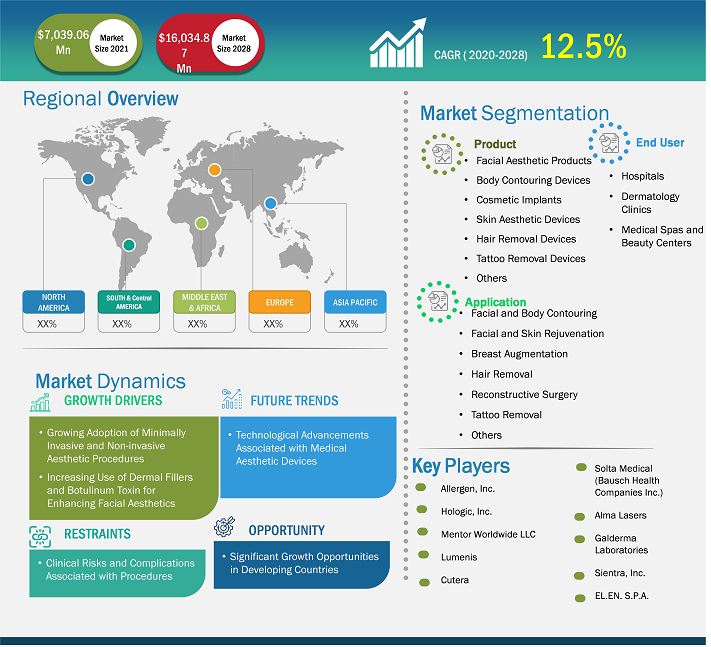

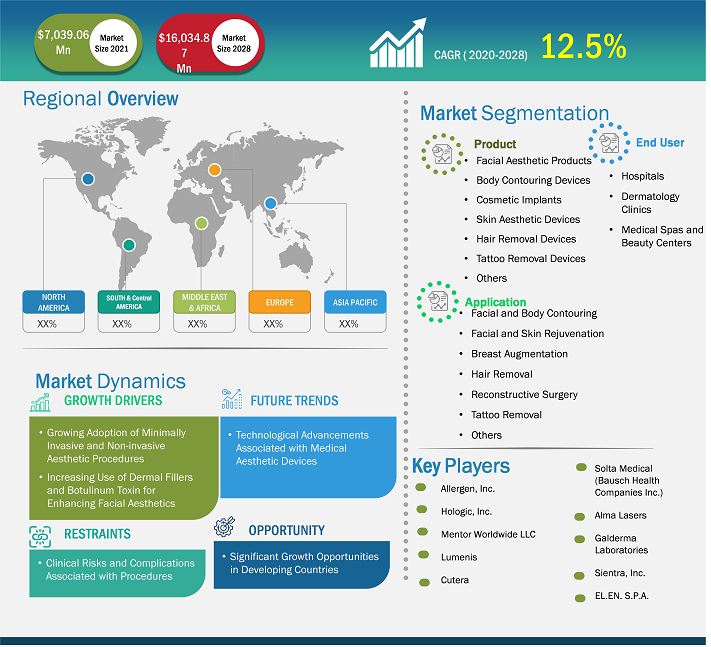

The medical aesthetics market generated US$ 7,039.06 million in 2021 and is projected to hit US$ 16,034.87 million by 2028, rising at a record annual growth rate of 12.5% during 2021–2028.

Market Insights and Analyst View:

The medical aesthetics market is estimated to flourish with a significant growth rate during 2021–2028. The market's growth is attributed to the growing awareness among young and adults about skin aesthetic procedures. In addition, the market’s growth is widely defined by the availability of minimally invasive medical aesthetic procedures and products requiring less effort and providing faster results. Key factors, such as increasing product launches and a growing number of medical aesthetic clinics and hospitals, significantly contribute to the growth of the global medical aesthetic market.

In addition, the growing medical tourism in the Asia Pacific region has led to the growth of the medical aesthetic market. Moreover, there is a rise in the trend of adopting Korean beauty techniques and products that has enhanced the sale of Korean brands for skin aesthetics. There is a rise in ‘K’ beauty, leveraging Korea medical aesthetic market. Further, people in the old age group widely use facial aesthetic products and body contouring products. At the same time, cosmetic implants are widely used in young people.

Growth Drivers and Challenges:

The World Health Organization (WHO) recognizes waste reduction in healthcare delivery as an important aspect of strengthening health systems. Technological advancements have led to the development of surgical approaches that minimize waste and achieve better results with the available resources. Minimally invasive surgeries (MIS) are among the approaches that result in low waste generation and reduced medical expenses; moreover, these surgeries ensure low absenteeism at the workplace, which has a net positive effect on the productivity of an economy. According to the American Society of Plastic Surgeons, 17.7 million surgical and minimally invasive cosmetic procedures were performed in the US in 2018. The use of these surgeries rose sharply by 228% during 2018–2000 in the US, and they now account for ~90% of aesthetic interventions in the country. Minimal invasiveness results in faster recovery, lesser scarring, limited stress, and better patient satisfaction.

The modern concept of natural and harmonious rejuvenation is based on a comprehensive, three-dimensional, multi-layered approach that combines several active ingredients and techniques in surgical procedures such as skin relaxation, volume enlargement, volume repositioning, reshaping, surface renewal, and skin tightening, depending on the specific patient needs. Since the appearance of the skin is considered an important factor in wellbeing and health, the number of aesthetic procedures performed around the world is increasing steadily. Further, nonsurgical procedures include facial injections and cryolipolysis, among others. These short procedures that help correct facial lines, wrinkles, cellulite reduction, and unwanted fat reduction with minimal side effects. The International Society of Aesthetic Plastic Surgery (ISAPS) defines a nonsurgical cosmetic procedure as an effective and safe procedure for those who willing to undergo subtle enhancement and surgical result enhancement with lower recovery periods; these procedures often do not require extensive training, unlike surgical procedures that are associated with greater risks. As per ISAPS estimations, the number of nonsurgical cosmetic procedures have increased by 51.4% from 2011 to 2017. With the proliferation of the medical aesthetics industry, competition is also inevitably increasing. It is a heterogeneous industry as the competition is not only among beauty clinics specializing in surgical cosmetic procedures, but other beauty service providers such as salons and also compete with them.

In the past 20 years, minimally invasive procedures have undergone continuous innovations. In 2017, doctors performed 15.7 million minimally invasive procedures in North America. Thus, surge in the adoption of minimally invasive and non-invasive aesthetic procedures is driving the medical aesthetics market growth.

In contrast, clinical risks and complications associated with procedures are hindering the growth of the medical aesthetic market. Cutaneous and aesthetic surgeries are generally considered low-risk surgeries in terms of patient morbidity and mortality. However, most adverse events go unreported due to a lack of regulation and insufficient enforcement. Many aesthetic procedures, such as spas and beauty salons, are performed in non-medical or quasi-medical settings. Most individual doctors and even hospitals tend to brush these adverse events under the rug to avoid adverse media exposure. However, a lot of awareness about these problems has been showcased and brought to the public attention, leading to obstacles to market growth.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Global Medical Aesthetics Market: Strategic Insights

Market Size Value in US$ 7,039.06 Million in 2021 Market Size Value by US$ 16,034.87 Million by 2028 Growth rate CAGR of 12.5% from 2021-2028 Forecast Period 2021-2028 Base Year 2021

Akshay

Have a question?

Akshay will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Global Medical Aesthetics Market: Strategic Insights

| Market Size Value in | US$ 7,039.06 Million in 2021 |

| Market Size Value by | US$ 16,034.87 Million by 2028 |

| Growth rate | CAGR of 12.5% from 2021-2028 |

| Forecast Period | 2021-2028 |

| Base Year | 2021 |

Akshay

Have a question?

Akshay will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The “Global Medical Aesthetics Market” is segmented based on product, application, and end user. Based on product, the medical aesthetics market is segmented into facial aesthetic products, body contouring devices, cosmetic implants, skin aesthetic devices, hair removal devices, tattoo removal devices, and others. Based on application, the market is classified into facial and body contouring, facial and skin rejuvenation, breast augmentation, hair removal, reconstructive surgery, tattoo removal, and others. Based on end user, the market is segmented into hospitals, dermatology clinics, and medical spas and beauty centers. On the basis of geography is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Spain, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America)

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Segmental Analysis:

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Based on product, the medical aesthetic market is bifurcated into facial aesthetic products (dermal fillers, botulinum toxin, and microdermabrasion devices), body contouring devices (liposuction devices, nonsurgical fat reduction devices, and cellulite reduction devices), cosmetic implants (breast implants, facial implants, and others), skin aesthetic devices (laser skin resurfacing devices, light therapy devices, nonsurgical skin tightening devices, and micro-needling products), hair removal devices, tattoo removal devices, and others. In 2021, the facial aesthetic products segment held the largest market share by product. The same segment of the medical aesthetics market is also expected to witness the fastest CAGR during 2021 – 2028.

Medical Aesthetics Market, by Product – 2021 and 2028

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Based on the end user, the medical aesthetics market is bifurcated into hospitals, dermatology clinics, medical spas and beauty centers, and home care. In 2021, the hospitals segment held the largest share of the market by end-user, and the same segment is expected to grow at the fastest CAGR during the forecast years.

Regional Analysis:

Based on geography, theglobal medical aesthetic market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. In 2021, North America held the largest share of the global medical aesthetic market, and Asia Pacific is estimated to register the highest CAGR during the forecast period. The US medical aesthetic market was the leading in the North American region. Several factors drew market growth in the US, such as rising aesthetic procedures and the growing development of noninvasive aesthetic devices.

The Asia Pacific includes countries such as China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. This region accounted for over 26.57% of the global medical aesthetic market in 2021 owing to the large population of countries such as China and India, the increasing focus of market players, and the introduction of new products or therapies in the country. Moreover, the rising incidence of skin rejuvenation, growing awareness of cosmetic procedures to improve aesthetic appeal, increase in healthcare expenditure, and availability of technological advancements in aesthetic products helps to boost the growth of the medical aesthetic market in the region.

Industry Developments and Future Opportunities:

Various initiatives taken by top aesthetic medical device companies operating in the global medical aesthetic market are listed below:

- In January 2021, Allergan Aesthetics announced that they had entered into a warrant agreement with Cypris Medical, a privately held, medical device company in Chicago. After completing a clinical trial in 2021, Allergan Aesthetics will have the right to exercise an option to acquire Cypris Medical, including the company's Xact device. The planned clinical trial will evaluate the safety and effectiveness of Xact in treating midface descent and neck lifts.

- In October 2020, Alma unveiled its new Alma Hybrid. Designed to enable endless options of ablative, non-ablative, and thermal treatments for skin rejuvenation and scar revision, Alma Hybrid creates a unique synergistic effect by combining the power of three core energies, including CO2 laser, 1570nm laser, and IMPACT for Trans Epidermal Delivery (TED).

- In May-2021, Galderma expanded its consumer care portfolio in Switzerland. The expansion offers consumers more options for their dermatology needs. The move includes the introduction of the dermatologist-recommended CETAPHIL line for sensitive skin, as well as the expansion of the DAYLONG brand for sun protection.

Covid-19 Impact:

Worldwide, due to an increased number of infected patients, healthcare professionals and leading organizations were distracted, and the focus was more on treating COVID-19-infected people. The focus on innovations and new product launches for aesthetic products was restricted. Moreover, cosmetic surgeons with a unique perspective of working with patients and their teams create difficulties and challenges in distress. For instance, in North America, in light of the pandemic of COVID-19, the American Society of Plastic Surgeons (ASPS) in May 2020 released a statement to urge the suspension of elective and non-essential procedures of cosmetic and laser surgeries in the US.

The ASPS also stated that the necessary action resulted in a detrimental financial effect on the aesthetic surgery community. However, the organization put in its best efforts to continue the consultations for medical interventions through virtual platforms. The ASPS encouraged the use of telehealth in order to arrange the preoperative consults and follow-up appointments of post-operative patients.

In addition, the cosmetic surgery societies implemented various strategies to curb financial losses and have amended their policies to support small businesses, such as the Small Business Administration offering expanded disaster impact loans and deferment of the federal income tax payments that helped companies to stabilize their losses.

Competitive Landscape and Key Companies:

Some of the prominent medical aesthetics companies operating in the medical aesthetic market include ALLERGAN, Hologic Inc., Mentor Worldwide LLC, Lumenis, Cutera, Solta Medical (Bausch Health Companies Inc.), Alma Lasers, Galderma Laboratories (Nestle), Sientra, Inc., and EL.EN. S.P.A., amongst others. These companies focus on new product launches and geographical expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. They have a widespread global presence, allowing them to serve a large set of customers and subsequently increase their market share.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product ; Application ; End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, RoAPAC, RoE, RoMEA, RoSCAM, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The factors that are driving and restraining factors that will affect medical aesthetics market in the coming years. Factors such as growing adoption of minimally invasive and non-invasive aesthetic procedures, increasing use of dermal fillers and botulinum toxin for enhancing facial aesthetic are driving the market growth. However, clinical risks and complications associated with procedures are likely to hamper the growth of the market.

Aesthetic Medicine comprises all medical procedures that are aimed at improving the physical appearance and satisfaction of the patient, using non-invasive to minimally invasive cosmetic procedures. The Aesthetic Medicine specialty is not confined to dermatologists and plastic surgeons as doctors of all specialties seek to offer services to address their patient's aesthetic needs and desires. Some Aesthetic Medicine procedures are performed under local anesthesia while some procedures don't require anesthetics at all.

The medical aesthetics market majorly consists of the players such as ALLERGAN, Hologic Inc., Mentor Worldwide LLC, Lumenis, Cutera, Solta Medical (Bausch Health Companies Inc.), Alma Lasers, Galderma Laboratories (Nestle), Sientra, Inc. and EL.EN. S.P.A. are amongst others.

The global medical aesthetics market based on product is segmented into facial aesthetic products, cosmetic implants, body contouring devices, skin aesthetic devices, hair removal devices, tattoo removal devices, others. In 2021, the facial aesthetic products segment held the largest share of the market, by product and is also expected to witness fastest CAGR during 2021 to 2028.

The global medical aesthetics market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. The North American area holds the largest market for aesthetic skin devices. The United States held the most significant medical aesthetics market and is expected to grow due to factors such as the increasing number of people with obesity adopting aesthetic skin procedures, technological advancements by key players in aesthetic skin devices, and others.

The Asia Pacific region is expected to account for the fastest growth in the medical aesthetics market. In Japan and South Korea, the market is expected to grow owing to the development of the healthcare systems and proliferating medical tourism.

The List of Companies - Medical Aesthetics Market

- ALLERGAN

- Hologic Inc.

- Mentor Worldwide LLC

- Lumenis

- Cutera

- Solta Medical (Bausch Health Companies Inc.)

- Alma Lasers

- Galderma Laboratories (Nestle)

- Sientra, Inc.

- EL.EN. S.P.A.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Global Medical Aesthetics Market

Aug 2021

Colonoscopes Market

Forecast to 2028 - COVID-19 Impact and Global Analysis By Product Type (Fiber Optic Colonoscopy Devices, Video Colonoscopy Devices); Application (Colorectal Cancer, Lynch Syndrome, Ulcerative Colitis, Crohn's Disease, Polyp); End User (Hospitals, Ambulatory Surgery Center, Others), and Geography

Aug 2021

Noninvasive Fat Reduction Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Cryolipolysis, Laser Lipolysis, Ultrasound, and Others), End User (Hospitals, Dermatology Clinics & Cosmetic Clinics, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Aug 2021

Medical Ultrasound Flow Meter Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Implementation Type (Clamp-On, Inline, and Others), Technology (Doppler, Transit Time, and Hybrid), Application (Heart and Lung Machines, Extracorporeal Membrane Oxygenation, Perfusion, Organ Transportation Systems, and Others), End User (Hospitals and Clinics, Ambulatory Surgical Centers, Research Laboratories, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Aug 2021

Rapid Test Kits Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Rapid Antigen Testing, Rapid Antibody Testing, and Others), Product (Over-the-Counter Rapid Testing Kit and Professional Rapid Testing Kit), Technology (Lateral Flow Assay, Solid Phase, Agglutination, Immunospot Assay, and Cellular Component-Based), Application (Blood Glucose Testing, Infectious Disease Testing, Pregnancy and Fertility, Cardiometabolic Testing, and Others), End User (Hospital and Clinics, Home Care, Diagnostics Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Aug 2021

Osteoarthritis Therapy Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Therapy Type [Transcutaneous Electrical Nerve Stimulation (TENS), Occupational Therapy, Physical Therapy, Platelet-Rich Plasma Therapy and Stromal Vascular Fraction, Prolotherapy, and Others], Disease Indication (Knee Osteoarthritis, Spine Osteoarthritis, Foot and Ankle Osteoarthritis, Shoulder Osteoarthritis, Hand Osteoarthritis, and Others), End User (Hospitals & Clinics, Specialty Clinics, Ambulatory Surgical Centers, Homecare, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Aug 2021

Bariatric Surgeries Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type [Adjustable Gastric Bands (AGB), Sleeve Gastrectomy, Gastric Bypass, Biliopancreatic Diversion with Duodenal Switch (BPD-DS), and Others], End User (Hospitals and Ambulatory Surgical Centers), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Aug 2021

Post-Acute Care Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Service Type (Skilled Nursing Facilities, Inpatient Rehabilitation Facilities, Long-Term Care Hospitals, Home Health Agency, and Others), Age (Elderly, Adult, and Others), Disease Conditions (Amputations, Wound Management, Brain Injury and Spinal Cord Injury, Neurological Disorders, and Others), and Geography

Aug 2021

Lung Cancer Therapy Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Therapy Type (Noninvasive and Minimally Invasive), Indication (Non-Small Cell Lung Cancer and Small Cell Lung Cancer), End User (Hospitals, Oncology Clinics, Research Centers, and Others), and Geography (North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa)