North America Well Intervention Market by Service (Logging & Bottomhole Survey, Tubing/Packer Failure & Repair, Stimulation), Type (Light, Medium, Heavy), Application (Onshore, Offshore), Well Type (Horizontal, Vertical), Country - Forecast to 2024

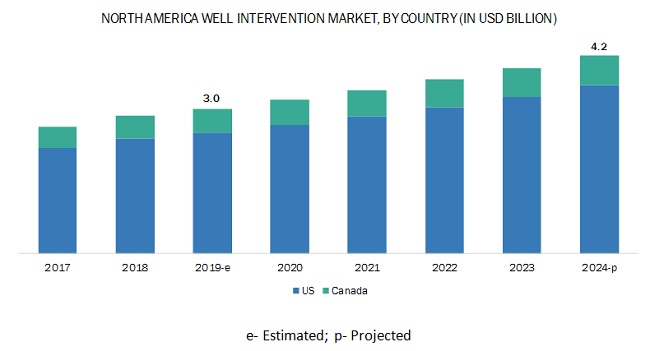

[184 Pages Report] North America well intervention market is projected to reach USD 4.2 billion by 2024 from an estimated USD 3.0 billion in 2019, at a CAGR of 6.5% during the forecast period. Increasing efforts by upstream companies to enhance the production from the mature fields is driving the well intervention market.

By service, the logging & bottomhole survey segment is expected to make the largest contribution to North America well intervention market during the forecast period.

Logging tools are inserted into wells to measure acoustic, electrical, radioactive, and electromagnetic properties of the subsurface formations. It can be conducted during any phase, i.e., drilling, completing, producing, and even at the time of abandonment. This helps in identifying the actual condition of a well. Logging & bottomhole survey has gained more importance in recent years with the increased production of unconventional resources such as shale in Texas (US), Calgary (Canada), and New Mexico (US), as the shale production fields require more scrutiny.

By application, the offshore segment is expected to grow at the fastest rate during the forecast period.

The offshore segment is expected to grow at the fastest rate during the forecast period. The offshore segment is categorized further based on the well depth as shallow, deep-water, and ultra-deepwater. The ultra-deepwater segment is expected to grow at the faster CAGR as compared to deep-water segment. This would ultimately create new revenue pockets for the well intervention market during the forecast period.

Moreover, new oilfield discoveries in deep-water and ultra-deepwater offshore locations are expected to increase the drilling operations, especially in the Gulf of Mexico, due to their planned exploration and drilling projects for the coming years. Such developments in the offshore are driving the well intervention market.

The US is expected to be the largest market during the forecast period.

US and Canada were studied for the North America well intervention market. The US is estimated to be the largest market from 2019 to 2024, driven by the growth in unconventional resources in the states like Texas, New Mexico, and Oklahoma. Additionally, the demand for intervention operations in the maturing offshore fields in the Gulf of Mexico and other onshore fields in the US is expected to drive market growth.

Key Market Players

The major players in the global well intervention market are Halliburton (US), Schlumberger (US), BHGE (US), Weatherford (US), NOV (US), C&J Energy Services, Inc. (US), Superior Energy Services, Inc. (US), Archer (Norway), Expro Group (UK), Trican (Canada), Welltec (Denmark), Altus Intervention (Norway), and Basic Energy Services (US), RPC (US), Pioneer Energy Services (US), Calfrac Well Services (Canada), Oceaneering (US), Key Energy Services (US), Nine Energy Services (US), Step Energy Services (Canada), and Legend Energy Services (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Service, intervention type, application, well type, and country |

|

Geographies covered |

US and Canada |

|

Companies covered |

Halliburton (US), Schlumberger (US), BHGE (US), Weatherford (US), NOV (US), C&J Energy Services, Inc. (US), Superior Energy Services, Inc. (US), Archer (Norway), Expro Group (UK), Trican (Canada), Welltec (Denmark), Altus Intervention (Norway), and Basic Energy Services (US), RPC (US), Pioneer Energy Services (US), Calfrac Well Services (Canada), Oceaneering (US), Key Energy Services (US), Nine Energy Services (US), Step Energy Services (Canada), and Legend Energy Services (US) |

This research report categorizes the well intervention market based on intervention type, service, application, well type, and country.

Based on Service:

- Logging & Bottomhole Survey

- Tubing/Packer Failure & Repair

- Stimulation

- Sand Control

- Zonal Isolation

- Artificial Lift

- Fishing

- Reperforation

- Others (Water shut off, casing repair, horizontal well sand control, well abandonment, sand-washing, and paraffin, asphaltene, and hydrates removal)

Based on the Intervention Type:

- Light

- Medium

- Heavy

Based on Applications:

- Onshore

- Offshore

Based on Well Type:

- Vertical

- Horizontal

Based on the Country:

- US

- Canada

Key Questions Addressed by the Report

- The report identifies and addresses the key segments of the well intervention market, which will help manufacturers and service providers review the growth in demand.

- The report helps system providers understand the pulse of the market and provides insights regarding the drivers, restraints, opportunities, and challenges.

- The report will help key players understand the strategies of their competitors better and make more pivotal strategic decisions.

- The report addresses the market share analysis of key players in the North America well intervention market, and with the help of this, companies can enhance their revenues in the respective markets.

- The report provides insights about emerging countries for North America well intervention, and hence, the entire market ecosystem can gain a competitive advantage.

Frequently Asked Questions (FAQ):

What are the oil & gas trends in North America?

Shale revolution, maturing oil & gas fields, and US’ aim to become net oil exporter by 2020, are some of the prominent trends in the North American upstream oil & gas industry.

What can be new revenue pockets for well intervention service market in North America?

Reactivation of mature oilfields and growth in the number of oil & gas wells are the key driving factors for the well logging, fishing, and sand control services market.

Which application can have higher demand for well intervention services in coming years?

The application of offshore well intervention services is expected to be driven by increasing deep- and ultra-deepwater drilling and production activities and an increase in the number of maturing subsea wells.

Why are horizontal wells more likely to have higher demand for well intervention services in North America?

Horizontal wells require 2–3 times more intervention operations as compared to vertical wells. This is because horizontal wells face more challenges during production, such as chances of water shutoffs and wax formations are higher in horizontal wells.

Which state in the US can have the maximum opportunity for well intervention service projects?

Texas has the largest number of producing and mature oil wells, and thus, is poised as the largest market for well intervention services. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Definition

1.2.1 North America Well Intervention Market, By Service: Inclusions vs. Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Countries Covered

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitation

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Scope

2.2.1 Scope of North America Well Intervention Services: Inclusions vs. Exclusions

2.3 Key Influencing Factors/Drivers

2.3.1 Well Count

2.3.2 Rig Count

2.3.3 Production

2.3.4 Crude Oil Prices

2.4 Market Size Estimation

2.4.1 Ideal Demand-Side Analysis

2.4.1.1 Assumptions

2.4.1.2 Calculation

2.4.2 Supply-Side Analysis

2.4.2.1 Assumptions

2.4.2.2 Calculation

2.4.3 Forecast

2.5 Market Breakdown & Data Triangulation

2.6 Primary Insights

3 Executive Summary (Page No. - 35)

4 Premium Insights (Page No. - 41)

4.1 Attractive Opportunities in the North America Well Intervention Market

4.2 North America Well Intervention Market, By Country

4.3 US Well Intervention Market, By Well Type & States

4.4 North America Well Intervention Market, By Service

4.5 North America Well Intervention Market, By Intervention Type

4.6 North America Well Intervention Market, By Well Type

4.7 North America Well Intervention Market, By Application

5 Market Overview (Page No. - 45)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand for Well Intervention Services to Ramp Up Production From Maturing Oil & Gas Fields

5.2.1.2 Proliferating Shale Activities in the US and Canada are Increasing the Demand for Well Intervention Services in North America

5.2.1.3 Expanding the Offshore Reach of Oil & Gas Exploration & Production in the Gulf of Mexico and East Offshore Canada

5.2.2 Restraints

5.2.2.1 Strict Government Regulations on Drilling Activities

5.2.2.2 Fluctuating Oil Prices are Affecting Operational Spending on Well Maintenance and Well Intervention Services

5.2.3 Opportunities

5.2.3.1 Digitalization of Intervention Services

5.2.3.2 Rising Exploration & Production Activities are Expected to Drive the North America Well Intervention Market

5.2.4 Challenges

5.2.4.1 Challenging Intervention Operations in High-Pressure High-Temperature (Hpht) Drilling

5.2.4.2 Application of Artificial Lift Techniques of Well Intervention in Horizontal Wells

5.3 Supply Chain Overview

5.3.1 Key Influencers

5.3.1.1 Equipment Manufacturers

5.3.1.2 Service Providers

5.3.1.3 Oilfield Operators

6 North America Well Intervention Market, By Service (Page No. - 55)

6.1 Introduction

6.2 Logging & Bottomhole Survey

6.2.1 Operators are Determined to Better Understand the Geology of the Reservoirs, Which is Driving the Logging & Bottomhole Survey Service Across North America

6.3 Tubing/Packer Failure & Repair

6.3.1 Growing Focus for Maintaining the Well Integrity During Well Life is Driving the Tubing/Packer Failure & Repair Well Intervention Services Segment in North America

6.4 Stimulation

6.4.1 Demand for Hydraulic Fracturing in the US Offers A Lucrative Opportunity to Stimulation Service Providers

6.5 Remedial Cementing

6.5.1 Complexity in Carrying Out Squeeze Jobs in Offshore and Shale Reserves is Expected to Drive the Remedial Cementing Segment in North America

6.6 Zonal Isolation

6.6.1 Increase in Oil & Gas Production From Mature & Horizontal Wells is Expected to Drive the Zonal Isolation Market

6.7 Sand Control

6.7.1 Redevelopment of Aging Reservoirs in Oil Sands in Canada Provides A Lucrative Opportunity for the Sand Control Market

6.8 Artificial Lift

6.8.1 Increasingly Challenging Production Environments From Mature Oil & Gas Fields

6.9 Reperforation

6.9.1 Increasing Production From Mature Wells is Likely to Support the Growth of the Reperforation Segment

6.1 Fishing

6.10.1 Prevention of Significant Nonproducing Time in the Oil & Gas Wells is Driving the North American Fishing Service Segment

6.11 Others

7 North America Well Intervention Market, By Intervention Type (Page No. - 66)

7.1 Introduction

7.2 Light Well Intervention

7.2.1 Increasing Demand for Riserless Light Well Intervention (Rlwi) Vessel Assists the Growth of the Light Well Intervention Segment

7.3 Medium Well Intervention

7.3.1 Medium Well Intervention Segment is Growing at the Highest Rate Owing to the Rising Developments of Unconventional Reserves With the Support of Snubbing Units

7.4 Heavy Well Intervention

7.4.1 Developments in Mature Fields Support the Adoption of Heavy Well Intervention Services

8 Well Intervention Market, By Well Type (Page No. - 71)

8.1 Introduction

8.2 Horizontal Well

8.2.1 Wells Drilled Horizontally Into Tight Oil, and Shale Gas Formations Continue to Account for an Increasing Share of Horizontal Wells in North America

8.3 Vertical Well

8.3.1 Demand for Well Intervention Services in Ageing Oil & Gas Fields is Likely to Drive the Vertical Well Segment

9 North America Well Intervention Market, By Application (Page No. - 76)

9.1 Introduction

9.2 Onshore

9.2.1 Growing Shale Activities in the Onshore Region and Rising Rate of Onshore Oilfields Reaching Maturity Drive the Onshore Well Intervention Services

9.3 Offshore

9.3.1 Increasing Number of Discoveries, Along With High Cost of Intervention in Offshore Locations, is Driving Offshore Well Intervention Market in North America

10 North America Well Intervention Market, By Country (Page No. - 82)

10.1 Introduction

10.2 US

10.2.1 By Service

10.2.2 By Intervention Type

10.2.3 By Well Type

10.2.4 By Application

10.2.5 By States

10.2.6 Texas

10.2.6.1 Huge Amount of Shale Resources and Significant Drilling Activities are Driving the Well Intervention Market in Texas

10.2.7 Kansas

10.2.7.1 New Oil & Gas Field Discoveries Bring Opportunities to the Kansas Well Intervention Market

10.2.8 California

10.2.8.1 Urge for the Redevelopment of Mature Oilfields in California is Driving the Well Intervention Market in the State

10.2.9 Oklahoma

10.2.9.1 Continuous Well Drilling Activities in Oklahoma to Drive the Well Intervention Market in the State

10.2.10 Pennsylvania

10.2.10.1 Advances in Proven Technologies are Delivering New Opportunities in Oil & Natural Gas Exploration & Production Around Pennsylvania, Thereby Driving the Well Intervention Services Market

10.2.11 New Mexico

10.2.11.1 New Discoveries in New Mexico Would Drive the Well Intervention Market in the State

10.2.12 Illinois

10.2.12.1 Shale Development Prospects in the Near Future are Likely to Drive the Well Intervention Market in Illinois

10.2.13 Colorado

10.2.13.1 Huge Oil & Gas Reserves in Colorado and Continuous Production From the State Drive the Colorado Well Intervention Market

10.2.14 West Virginia

10.2.14.1 Low Oil Well Drilling Activities are Hampering the Well Intervention Market in West Virginia

10.2.15 North Dakota

10.2.15.1 Demand for Hydraulic Fracturing Services in the Bakken Ford is Likely to Drive the North Dakota Well Intervention Market

10.2.16 Rest of the US

10.3 Canada

10.3.1 By Service

10.3.2 By Intervention Type

10.3.3 By Well Type

10.3.4 By Application

10.3.5 By Province

10.3.6 Alberta

10.3.6.1 Huge Potential From Shale Reserves in Alberta Brings Opportunities to the Alberta Well Intervention Market

10.3.7 British Columbia

10.3.7.1 Innovations From Hydraulic Fracturing Services are Driving the Well Intervention Market in British Columbia

10.3.8 Saskatchewan

10.3.8.1 Focus on Increasing Heavy Oil Production is Driving the Saskatchewan Well Intervention Market

10.3.9 Rest of Canadian Province

11 Competitive Landscape (Page No. - 101)

11.1 Overview

11.2 Competitive Leadership Mapping, 2018

11.2.1 Visionary Leaders

11.2.2 Innovators

11.2.3 Dynamic

11.2.4 Emerging

11.3 Market Share Analysis, 2018

11.4 Competitive Scenario

11.4.1 New Product Launches

11.4.2 Contracts & Agreements

11.4.3 Mergers & Acquisitions

11.4.4 Others

12 Company Profile (Page No. - 109)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.1 Halliburton

12.2 Schlumberger

12.3 Baker Hughes, A GE Company

12.4 Weatherford

12.5 C&J Energy Services

12.6 Superior Energy Services

12.7 Archer

12.8 Expro Group

12.9 Trican

12.10 Welltec

12.11 Altus Intervention

12.12 Basic Energy Services

12.13 RPC

12.14 Pioneer Energy Services

12.15 Calfrac Well Services

12.16 Oceaneering

12.17 Key Energy Services

12.18 Nine Energy Services

12.19 Step Energy Services

12.20 Legend Energy Services

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12.21 Annexure

13 Appendix (Page No. - 176)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (44 Tables)

Table 1 North America Well Intervention Market: Players/Company Connected

Table 2 North America Well Intervention Market: Inclusions vs. Exclusions

Table 3 Demand for Well Intervention Services: New Wells vs. Old Wells

Table 4 North America: Rig to New Well Drill Ratio

Table 5 North America: Ideal Demand-Side Approach

Table 6 North America Well Intervention Market Snapshot

Table 7 Unproved Technically Recoverable Shale Resource in North America vs. Global

Table 8 Major Proved Reserves of Shale Natural Gas in Us

Table 9 Major Proved Reserves of Shale Natural Gas in Canada

Table 10 North America Well Intervention Market Size, By Service, 2017–2024 (USD Million)

Table 11 Logging & Bottomhole Survey: North America Well Intervention Market Size, By Country, 2017–2024 (USD Million)

Table 12 Tubing/Packer Failure & Repair: North America Well Intervention Market Size, By Country, 2017–2024 (USD Million)

Table 13 Stimulation: North America Well Intervention Market Size, By Country, 2017–2024 (USD Million)

Table 14 Remedial Cementing: North America Well Intervention Market Size, By Country, 2017–2024 (USD Million)

Table 15 Zonal Isolation: North America Well Intervention Market Size, By Country, 2017–2024 (USD Million)

Table 16 Sand Control: North America Well Intervention Market Size, By Country, 2017–2024 (USD Million)

Table 17 Artificial Lift: North America Well Intervention Market Size, By Country, 2017–2024 (USD Million)

Table 18 Reperforation: North America Well Intervention Market Size, By Country, 2017–2024 (USD Million)

Table 19 Fishing: North America Well Intervention Market Size, By Country, 2017–2024 (USD Million)

Table 20 Others: North America Well Intervention Market Size, By Country, 2017–2024 (USD Million)

Table 21 North America Well Intervention Market Size, By Intervention Type, 2017–2024 (USD Million)

Table 22 Light North America Well Intervention Market Size, By Country, 2017–2024 (USD Million)

Table 23 Medium North America Well Intervention Market Size, By Country, 2017–2024 (USD Million)

Table 24 Heavy North America Well Intervention Market Size, By Country,2017–2024 (USD Million)

Table 25 North America Well Intervention Market Size, By Well Type,2017–2024 (USD Million)

Table 26 Horizontal Well: North America Well Intervention Market Size,By Country, 2017–2024 (USD Million)

Table 27 Vertical Well: North America Well Intervention Market Size, By Country, 2017–2024 (USD Million)

Table 28 North America Well Intervention Market Size, By Application, 2017–2024 (USD Million)

Table 29 Onshore: North America Well Intervention Market Size, By Country, 2017–2024 (USD Million)

Table 30 Offshore: North America Well Intervention Market Size, By Country, 2017–2024 (USD Million)

Table 31 North America: Well Intervention Market Size, By Country, 2017–2024 (USD Million)

Table 32 US: North America Well Intervention Market Size, By Service, 2017–2024 (USD Million)

Table 33 US: North America Well Intervention Market Size, By Intervention Type, 2017–2024 (USD Million)

Table 34 US: North America Well Intervention Market Size, By Well Type, 2017–2024 (USD Million)

Table 35 US: North America Well Intervention Market Size, By Application, 2017–2024 (USD Million)

Table 36 US: North America Well Intervention Market Size, By State, 2017–2024 (USD Million)

Table 37 Top 10 Oil Producing Fields and Counties in Kansas in 2018

Table 38 New Field Discoveries

Table 39 Canada: North America Well Intervention Market Size, By Service, 2017–2024 (USD Million)

Table 40 Canada: North America Well Intervention Market Size, By Intervention Type, 2017–2024 (USD Million)

Table 41 Canada: North America Well Intervention Market Size, By Well Type, 2017–2024 (USD Million)

Table 42 Canada: North America Well Intervention Market Size, By Application, 2017–2024 (USD Million)

Table 43 Canada: North America Well Intervention Market Size, By Province, 2017–2024 (USD Million)

Table 44 Developments of Key Players in the Market, January 2016–September 2019

List of Figures (67 Figures)

Figure 1 North America Well Intervention Market: Research Design

Figure 2 Newly Drilled Wells in North America, 2018

Figure 3 Crude Oil Price vs. North America Rig Count, 2013–2019

Figure 4 North America: Operational Well Count vs. Crude Oil Production

Figure 5 Crude Oil Price Trend, 2014–2019

Figure 6 North America: Ideal Demand-Side Calculation

Figure 7 Research Methodology: Revenue Estimation of Companies Operating in North America Well Intervention Market (2018)

Figure 8 Ranking of Key Players & Industry Concentration, 2018

Figure 9 Data Triangulation Methodology

Figure 10 Point of View of Key Service Providers

Figure 11 US Dominated the North America Well Intervention Market in 2018

Figure 12 Logging & Bottomhole Survey Segment is Expected to Hold the Largest Share of the North America Well Intervention Market, By Service, During the Forecast Period

Figure 13 Light Intervention Segment is Expected to Lead the North America Well Intervention Market, By Intervention Type, During the Forecast Period 38

Figure 14 Offshore Segment is Expected to Grow at the Highest Cagr in the North America Well Intervention Market, By Application, During the Forecast Period

Figure 15 Horizontal Segment is Expected to Lead the North America Well Intervention Market, By Well Type, During the Forecast Period

Figure 16 Contracts & Agreements is the Major Strategy Adopted By Players in the North America Well Intervention Market, 2016–2019

Figure 17 Production Enhancement Efforts From Maturing Fields and Rising Capital Expenditures are Expected to Drive the North America Well Intervention Market, 2019–2024

Figure 18 US Well Intervention Market is Expected to Grow at the Highest Cagr During the Forecast Period

Figure 19 Horizontal Well Segment and Texas Dominated the US Well Intervention Market in 2018

Figure 20 Logging & Bottomhole Survey is Expected to Dominate the North America Well Intervention Market, By Service, During the Forecast Period

Figure 21 Light Segment Dominated the North America Well Intervention Market, By Intervention Type, in 2018

Figure 22 Horizontal Well Segment is Expected to Lead the North America Well Intervention Market, By Well Type, During the Forecast Period

Figure 23 Onshore Segment Dominated the North America Well Intervention Market, By Application, in 2018

Figure 24 North America Well Intervention Market: Drivers, Restraints, Opportunities, and Challenges

Figure 25 US Offshore Monthly Oil Production (October 2017–June 2019)

Figure 26 Oil & Gas Price Trends Q-O-Q Basis (2016–2019)

Figure 27 Yearly Operational Expenditures of the US and Canada (2017–2019)

Figure 28 North America Well Intervention Supply Chain

Figure 29 Logging & Bottomhole Survey Segment Accounted for the Largest Share of the North America Well Intervention Market,By Service, in 2018

Figure 30 US Dominated the Logging & Bottomhole Intervention Services Market in 2018

Figure 31 Light Well Intervention Segment is Expected to Be the Largest Well Intervention Market, By Intervention Type, 2019–2024

Figure 32 US Dominated the North America Light Well Intervention Market in 2018

Figure 33 Horizontal vs. Vertical Well Count Trend in the US (2004–2018)

Figure 34 Horizontal Well Segment is Expected to Lead the North America Well Intervention Market, By Well Type, From 2019 to 2024

Figure 35 Onshore Segment is Expected to Lead the North America Well Intervention Market, By Application, From 2019 to 2024

Figure 36 Percentage Breakdown of Cost Shares for the US Onshore Oil and Natural Gas Drilling and Completion

Figure 37 US Dominated the Onshore Application Segment of the North America Well Intervention Market in 2018

Figure 38 US Dominated the Offshore Application Segment of the North America Well Intervention Market in 2018

Figure 39 Regional Snapshot: North America Well Intervention Market, in 2018

Figure 40 Texas Held the Largest Share in US Well Intervention Market, in 2018

Figure 41 Texas: Monthly Oil Production Trend From June 2018 to June 2019

Figure 42 California: Monthly Oil Production Trend From June 2018 to June 2019

Figure 43 Oklahoma: Monthly Oil Production Trend From June 2018 to June 2019

Figure 44 New Mexico: Monthly Oil Production Trend FromJune 2018 to June 2019

Figure 45 Alberta Held the Largest Share in the Canada Well Intervention Market, in 2018

Figure 46 Alberta Oil Production From 2016 to 2019

Figure 47 British Columbia Energy Production, By Resource, 2018

Figure 48 Key Developments in the North American Well Intervention Market, January 2016–September 2019

Figure 49 North American Well Intervention Market, Competitive Leadership Mapping, 2018

Figure 50 Ranking of Key Players & Industry Concentration, 2018

Figure 51 Halliburton: Company Snapshot

Figure 52 Schlumberger: Company Snapshot

Figure 53 Baker Hughes, A GE Company: Company Snapshot

Figure 54 Weatherford: Company Snapshot

Figure 55 C&J Energy Services: Company Snapshot

Figure 56 Superior Energy Services: Company Snapshot

Figure 57 Archer: Company Snapshot

Figure 58 Expro Group: Company Snapshot

Figure 59 Trican: Company Snapshot

Figure 60 Basic Energy Services: Company Snapshot

Figure 61 RPC: Company Snapshot

Figure 62 Pioneer Energy Services: Company Snapshot

Figure 63 Calfrac Well Services: Company Snapshot

Figure 64 Oceaneering: Company Snapshot

Figure 65 Key Energy Services: Company Snapshot

Figure 66 Nine Energy Services: Company Snapshot

Figure 67 Step Energy Services: Company Snapshot

This study involved four major activities in estimating the current size of the North America well intervention market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global well intervention market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

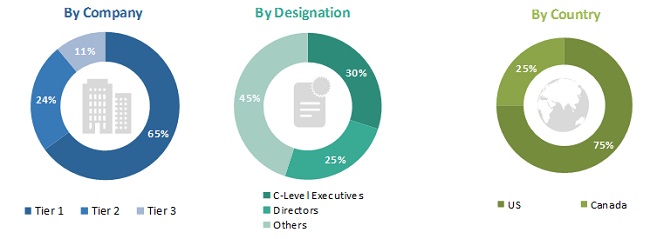

The well intervention market comprises several stakeholders, such as tools manufacturers, services providers, and end-users in the supply chain. The demand-side of this market is characterized by its end-users, such as drilling service providers, upstream operators, and others. The supply-side is characterized by intervention service providers, tool providers, integrators, and others. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents are given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the North America well intervention market and its dependent submarkets. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the oil & gas upstream sector.

Report Objectives

- To define, describe, segment, and forecast the North America well intervention market by service, application, intervention type, well type, and country

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the North America well intervention market with respect to individual growth trends, future expansions, and contribution of each segment to the market

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To forecast the growth of North America well intervention market with respect to the main countries (the US and Canada)

- To profile and rank key players and comprehensively analyze their market share

- To analyze competitive developments such as contracts & agreements, expansions & investments, new product launches, mergers & acquisitions, joint ventures, and partnerships & collaborations in the well intervention market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Country Analysis

- Further breakdown of country or state/province-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in North America Well Intervention Market