Want to curate the report according to your business needs

Report Description + Table of Content + Company Profiles

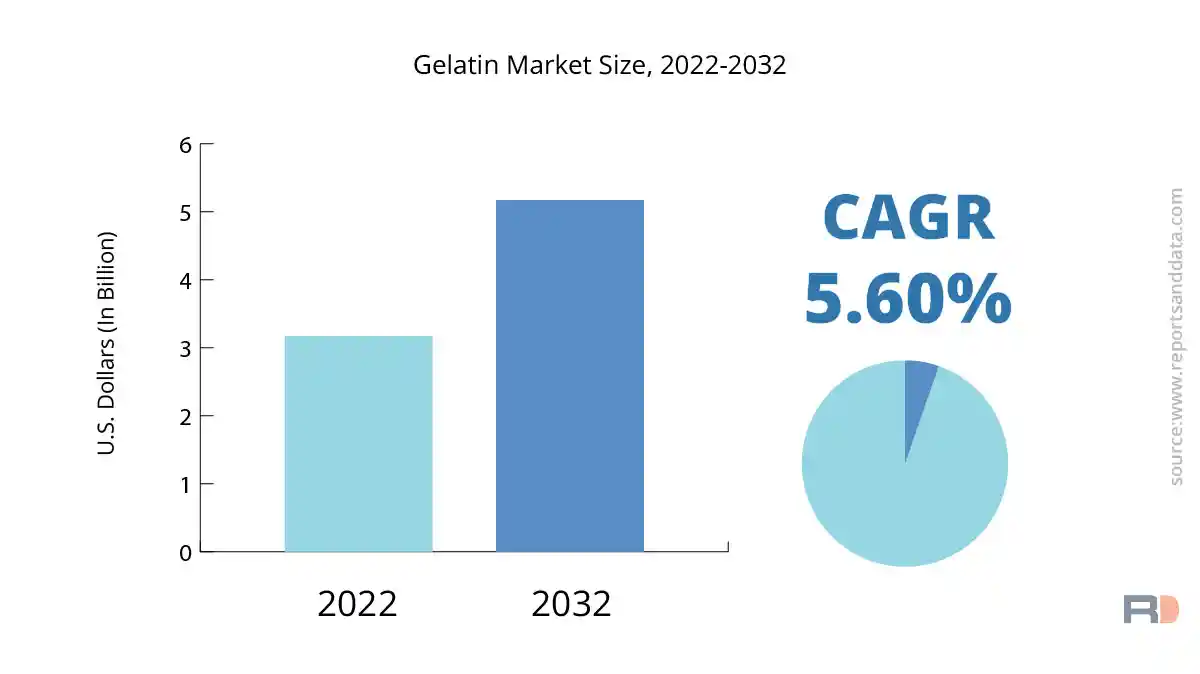

The global gelatin market size was USD 3.17 Billion in 2022 and is expected to reach USD 5.17 Billion in 2032, and register a revenue CAGR of 5.6% during the forecast period. Rapid expansion of end-use sectors such as food & beverage, pharmaceuticals, and personal care is the major factor driving market revenue growth. A variety of products, including gummies, marshmallows, yoghurt, and other food items, all contain gelatin as a fundamental ingredient. It is also utilized in pharmaceuticals and personal care goods as a gelling agent.

Demand for gelatin in the food & beverage industry is being driven by customers' rising need for protein-rich food products. Gelatin is used more frequently in food products such as protein bars, supplements, and sports beverages since it is a rich source of protein and amino acids. Demand for food products based on gelatin is also being driven by rising popularity of health and wellness trends, as customers seek out better-for-them alternatives to processed foods.

Gelatin is also a key end-use for the pharmaceutical industry, which uses it to make capsules, pills, and other medicinal goods. Gelatin is a desirable ingredient in the pharmaceutical sector since it is simple to digest and may hide disagreeable tastes and odors. Gelatin demand in the pharmaceutical industry is expected to be driven by rising demand for healthcare items such as Vitamins and Dietary Supplements.

Gelatin is also a key end-user in the personal care industry since it is used to make Cosmetics, skin care, and hair care products. The potential of gelatin to enhance the health of skin and hair has led to high growth in its use in the personal care sector. Gelatin serves as a binding agent and thickening in these products. Gelatin demand in the personal care sector is expected to rise in response to increasing desire for natural and Organic Personal Care products.

Rising demand for gelatin products with halal and kosher certifications is another factor driving revenue growth the market. Halal-certified gelatin products have been developed as a result of increasing Muslim population and rising demand for halal-certified goods. Parallel to this, emergence of kosher-certified gelatin products is a result of increasing Jewish population and rising demand for kosher-certified goods. These certifications have improved the marketability of items made from gelatin, which is driving revenue growth of the market.

In addition, the pet food industry's growing use of gelatin-based products is expected to drive revenue growth of the market. Gelatin, which is a highly digestible source of protein for animals, is used to make chews, treats, and other pet food products. Demand for gelatin in the pet food business is expected to rise in response to rising demand for pet food products, particularly in emerging countries.

However, availability of substitutes such as agar-agar and Carrageenan, which are plant-based alternatives to gelatin, is one of the major factors, which could restrain revenue growth of the market. In addition, varying costs of the raw materials required to make gelatin, including as bones and hides, is another factor, which could hamper revenue growth of the market to some extent.

Collagen, a protein found in animal tissues like skin, bones, and connective tissues, is hydrolyzed to create gelatin. Because to its adaptable qualities, including gelling, stabilizing, and thickening, it is frequently employed in the food, pharmaceutical, and cosmetic sectors. By source type, the worldwide gelatin market is divided into bovine, porcine, marine, and other segments.

In terms of revenue, the bovine source type dominated the global gelatin market in 2021. The primary drivers of this segment's growth are the availability of raw materials and rising demand for bovine gelatin in the food and pharmaceutical industries. Several food items, including desserts, Dairy Products, and confectionery, use bovine gelatin as a gelling ingredient. In the pharmaceutical sector, it is also employed in the production of coatings, tablets, and capsules. Moreover, during the forecast period, the market for bovine gelatin is anticipated to rise as a result of rising consumer demand for food products that are functional and healthy-improving.

Another significant source of revenue for the global gelatin market is porcine source type. In the food sector, porcine gelatin is mostly utilized to make confections like gummy bears and marshmallows. Throughout the projected period, the expansion of the porcine gelatin market is anticipated to be driven by the rising global demand for confectionary goods. The expansion of this market, however, is anticipated to be somewhat constrained by worries about the spread of animal illnesses including Bovine Spongiform Encephalopathy (BSE) and African Swine Fever (ASF) through porcine gelatin.

Throughout the projection period, the marine source type of gelatin is anticipated to experience significant expansion. The primary factor fueling the growth of this market is the rising demand for marine gelatin in the cosmetics industry for the production of skincare and haircare products. Moreover, marine gelatin is utilized in the culinary business to create confections like marshmallows and jellies. The market for marine gelatin is anticipated to expand over the course of the forecast period as a result of the rising demand for dietary supplements and functional food products.

Gelatin generated from sources like poultry, fish, and insects is included in the market's "others" segment. Throughout the forecast period, this market segment is anticipated to increase moderately. The market for different types of gelatin is anticipated to rise as consumers desire more sustainable food options and alternative protein sources.

A collagen-derived protein, gelatin is widely employed in a variety of industries, including food and beverage, pharmaceuticals, cosmetics, and others. Based on the application, the gelatin market has been divided into many segments, each of which has its own distinct demand drivers and potential prospects.

Food & Beverage Segment: In 2021, the food & beverage category had a sizeable portion of the global gelatin market. The food and beverage business uses gelatin extensively as a gelling agent, thickener, and stabilizer. Gelatin is frequently used in the making of meat items like sausages and deli meats as well as desserts like jellies, puddings, and marshmallows. The expansion of the gelatin market in the food & beverage sector is being driven by the increased demand for processed foods and convenience foods as well as the rising demand for food products containing protein.

Pharmaceuticals Segment: Throughout the projected period, the global gelatin market is anticipated to have considerable expansion in the pharmaceuticals segment. Capsules, pills, and coatings are only a few of the medicinal items that are made with gelatin. Gelatin capsules are frequently utilized in the pharmaceutical sector because they provide a simple and effective method for delivering medications. The pharmaceuticals industry's gelatin market is expanding as a result of the rising demand for Nutraceuticals and nutritional supplements. The demand for gelatin in the pharmaceuticals sector is also anticipated to rise as its application in the creation of Vaccines increases.

Cosmetics Industry: Gelatin has a variety of important uses in the cosmetics industry. Many cosmetic products, including those for the care of the skin, hair, and nails, are produced using gelatin. Gelatin has many advantages, including strengthening, conditioning, and hydrating for the skin, hair, and nails. The rise of the gelatin market in the cosmetics sector is being driven by the rising demand for natural and organic cosmetic products.

Section for Others:

Photography, paper & pulp, paints & coatings, and other sectors are also included in the section for other uses. Gelatin is a common coating substance for photographic sheets in the photography business. In order to increase the tensile strength and durability of paper, gelatin is also employed as a sizing agent in the Paper and Pulp sector. Gelatin is also employed in the manufacture of Paints and Coatings as a binding agent. The gelatin market's expansion in the other segment is anticipated to be fueled by the rising demand for these sectors.

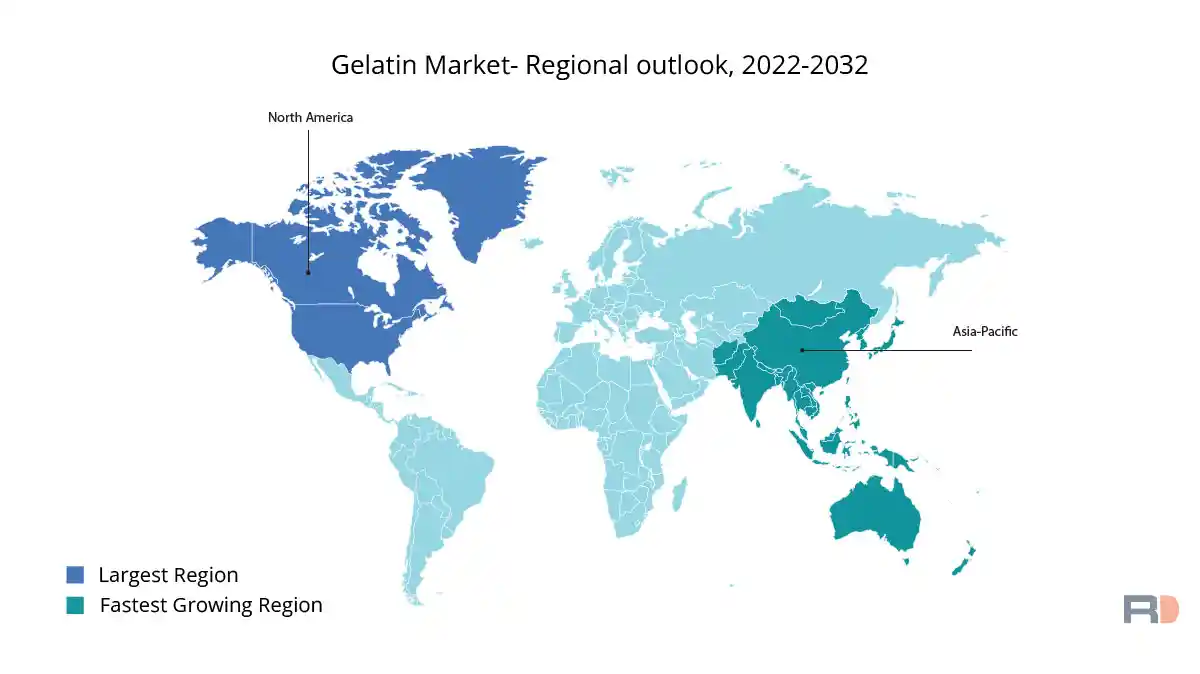

In 2021, the Asia Pacific region accounted for the greatest revenue share on the global gelatin market. The increased need for nutritive and functional food products, rising healthcare costs, and an ageing population are predicted to be the main drivers of the region's growth. The region's developing pharmaceutical and nutraceutical sectors are also anticipated to increase demand for gelatin. Due to their big populations and expanding middle class, China and India are anticipated to play a significant role in the expansion of the regional gelatin market.

During the projection period, gelatin sales in North America are anticipated to expand significantly. The market is being pushed by the expanding demand from consumers for natural and healthy ingredients as well as the trend towards clean label products. Also, the region's gelatin market is anticipated to rise due to the growing use of gelatin in the pharmaceutical industry for drug encapsulation. Furthermore, it is anticipated that the market players in this area will have considerable growth possibilities due to the rising demand for nutraceuticals and functional foods.

During the course of the projected period, the gelatin market in Europe is anticipated to expand steadily. The market is being pushed by the rising demand for dietary supplements and functional foods, particularly in Western European nations. The region's developing pharmaceutical and nutraceutical sectors are also anticipated to increase demand for gelatin. Due to their huge populations and rising health consciousness, Germany and the United Kingdom are anticipated to play a significant role in the expansion of the regional gelatin market.

The global gelatin market is highly fragmented, with the presence of numerous large and small-scale players. The major players operating in the gelatin market include:

The leading companies in the gelatin market are adopting various strategies to expand their market share and strengthen their presence in the market. Some of the key strategic developments in the gelatin market are:

The key players in the gelatin market are continuously introducing new and innovative gelatin products to meet the changing consumer preferences and market demand. Some of the recent product launches in the gelatin market are:

This report offers historical data and forecasts revenue growth at a global, regional, and country level, and provides analysis of market trends in each of segments and sub-segments from 2019 to 2032. For the purpose of this report, Reports and Data has segmented the global gelatin market based on source type, application, and region:

| PARAMETERS | DETAILS |

| The market size value in 2022 | USD 3.17 Billion |

| CAGR (2022 - 2032) | 5.6% |

| The Revenue forecast in 2032 |

USD 5.17 Billion |

| Base year for estimation | 2022 |

| Historical data | 2020-2021 |

| Forecast period | 2022-2032 |

| Quantitative units |

|

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Source Type Outlook, Application Outlook, Regional Outlook |

| By Source Type Outlook |

|

| By Application Outlook |

|

| Regional scope | North America; Europe; Asia Pacific; Latin America ; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; France; BENELUX; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE; Turkey |

| Key companies profiled | Gelita AG, Rousselot, Kewpie Corporation, Nitta Gelatin Inc, Sterling Biotech Group, Jellyfish collagen, Gelco SA, Italgelatine S.p.A, Lapi Gelatine S.p.A, Geltech Co. Ltd. |

| Customization scope | 10 hrs of free customization and expert consultation |

Facing issues finding the exact research to meet your business needs? Let us help you! One of our Research Executives will help you locate the research study that will answer your concerns. Speak to Analyst Request for Customization

Request a FREE Sample here to understand what more we have to offer over competition…

upto20% OFF

upto20% OFF

Want to curate the report according to your business needs

Report Description + Table of Content + Company Profiles