Micro Battery Market Size, Share, Statistics and Industry Growth Analysis Report by Type (Thin Film, Printed, Solid-state Chip, Button), Capacity (Below 10 mAh, 10 to 100 mAh, Above 100 mAh), Battery Type (Primary, Secondary), Application (Smart cards, Wireless Sensors) and Region - Global Forecast to 2028

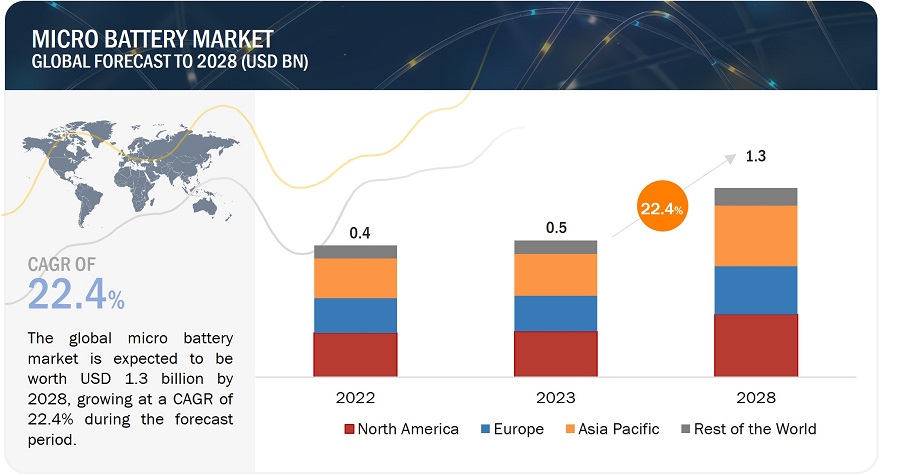

[220 Pages Report] The global Micro Battery Market Size is expected to grow from USD 0.5 Billion in 2023 to USD 1.3 Billion by 2028, at a CAGR of 22.4% from 2023 to 2028.

Micro batteries, such as thin film and printed batteries, are designed to complement products requiring an onboard ultra-thin power supply. Printed batteries offer flexibility and are available in thin and ultra-thin sizes, allowing them to be integrated as a power source in various applications, such as smart packaging, smart cards, wearable devices, consumer electronics, and medical devices. Moreover, advancements in thin film and printed batteries have resulted in new emerging application areas, such as smart textiles, wireless sensors, and energy-harvesting devices.

Micro Battery Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

DRIVERS: Rising demand for wearable devices

Wearable devices include eyewear, such as smart glasses and virtual reality wearable headsets; and wristwear, such as smartwatches and fitness wristbands. People wear wearable devices to compute their daily activities or track body movement and heart rate information. Wearable devices come in many shapes and forms, and most wearable applications require ultra-thin durable batteries, creating a vast market potential for micro batteries. The application areas of wearable devices are growing from consumer electronics and medical devices to wireless communication devices. There are growth opportunities for wearable medical devices and wireless healthcare monitoring systems, as the medical sector will likely witness a significant technological shift. The market for wearable technology is witnessing increasing product innovation with new product launches and developments. Hence, wearable devices require high flexibility and ultra-thin design, which can be achieved through the integration of thin film and printed batteries.

RESTRAINTS: Lack of standards in micro battery designs

The proprietary technology used to manufacture micro batteries differs from manufacturer to manufacturer and is based on the manufacturer’s specifications. These micro batteries are manufactured specifically for specific electronic devices, due to which compatibility issues may arise if used in other devices. Moreover, no substantial regulatory standards exist in printed battery manufacturing regarding the various types of printed technologies and materials used. These factors, therefore, create the requirement for measures and standards to develop these batteries. Thus, due to the lack of standards for the design of micro batteries, it is challenging for product manufacturers to choose the appropriate micro battery for their products.

OPPORTUNITIES: Growing use of wireless sensors equipped with micro batteries

Wireless sensors are being adopted rapidly due to the advancements in IoT and wireless sensor technologies. Micro batteries are quickly emerging as a viable power supply option for embedded system designers, enabling wireless sensors to be used in applications that were previously not feasible. Micro batteries allow combining energy harvesting through a thin battery with flexible form factors. These batteries are ideal for energy harvesting systems owing to their ultra-thin profile and low leakage characteristics. The increasing adoption of energy harvesting-based autonomous wireless sensors is expected to act as a growth opportunity for the micro battery industry.

CHALLENGES: Complexities in battery fabrication

Thin film batteries have a number of distinctive features, such as high flexibility, easy portability, lightweight, higher power-holding capacity, and excellent energy density. During the fabrication of thin film lithium-ion batteries, achieving an optimal match between core components such as nanostructured electrode materials, shape-conformable solid electrolytes, and soft current collectors is essential. This enables batteries to maintain stable electrochemical performance even if they are deformed to fit powered devices. However, the fabrication process of such batteries is costly. It also requires a complex screening of solid-state electrolytes, soft current collectors, electrode materials, and whole lithium-ion battery cell assemblies. However, the fabrication of such batteries is more challenging than conventional rechargeable lithium-ion batteries. Studies are being undertaken to focus on the fundamental understanding and simulation of fully thin film and printed flexible lithium-ion batteries. Research is also being carried out to test the reliability and performance of these batteries, which are not easily explored using the present state-of-the-art technologies. Thus, the complexity of fabricating thin film lithium-ion batteries is a key challenge for the market's growth.

Micro Battery Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers such as Panasonic Holdings Corporation (Japan), Murata Manufacturing Co., Ltd. (Japan), TDK Corporation (Japan), Maxell, Ltd. (Japan), VARTA AG (Germany), and Duracell Inc. (US). These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Along with the well-establiished companies, there are a large number of startups and small companies operating in this market such as Cymbet Corporation (US), Enfucell (Finland), and Ultralife Corporation (US), especially for products such as thin film and printed batteries.

Primary battery segment is expected to hold a substantial market share during the forecast period.

Primary or single-use batteries are non-rechargeable batteries that are discarded once used. These batteries are supplied fully charged and discarded after use. Most printed batteries built on zinc-based materials, in particular, are typically primary batteries. Primary batteries are prominently used in applications wherein the recharging of the battery is impossible. These batteries are integrated into the products and do not require recharging. They play an essential role, especially when charging is impractical or impossible, for instance, in pacemakers of heart patients and smart meters. Also, these batteries are disposable and less hazardous as they do not contain cadmium, lead, and mercury, which are hazardous to the environment and human health.

The market for consumer electronics is projected to grow at an impressive CAGR during the forecast period

Micro batteries are increasingly used in consumer electronics applications such as low-drain devices, wearables, calculators, and remote controls. The application of thin film, printed, coin/button, and solid-state chip batteries in consumer electronic devices are driven by the miniaturization of electronic products and rising demand for flexible electronic devices. Thin film batteries can power portable consumer electronic products. They can also conform to the flexible design of portable electronic devices. Micro batteries are being used in low-power consumer electronic devices, which require a flexible, ultra-thin power source. Integrating printed batteries in the place of conventional batteries could make the product flexible, eventually leading to the use of printed batteries in portable consumer electronic products. Button/coin batteries are used in various consumer electronics such as watches, wearables, remote controls, and more.

Micro Battery Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

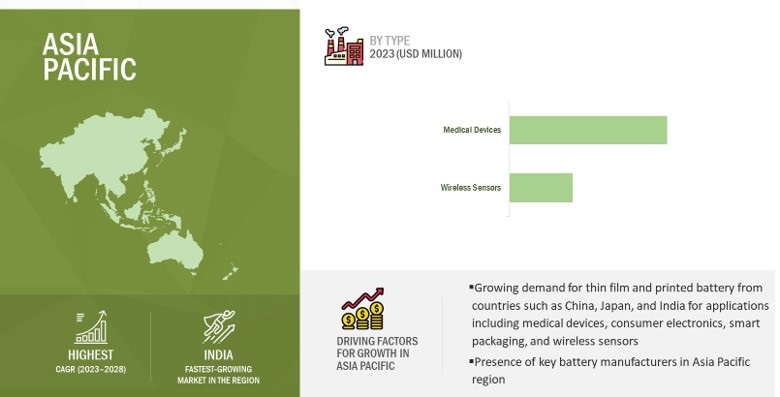

The market in Asia Pacific is projected to grow at the highest CAGR from 2023 to 2028.

The market in Asia Pacific mainly comprises developing economies, such as China and India, which have a huge potential for the micro battery market growth. Increasing demand for IoT devices and portable consumer electronic devices in countries such as China, India, Japan, and South Korea drives the market for micro batteries in the region. The popularity of next-generation smart cards is also rapidly increasing in this region. All these developments have, in turn, led to the increased demand for flexible batteries in smart cards. The market for micro batteries in Asia Pacific is expected to grow due to the need for smart packaging, wearable devices, and consumer electronics from the major countries in this region.

Key Market Players

Cymbet Corporation (US), Enfucell (Finland), Ultralife Corporation (US), Molex, LLC (US), Panasonic Holdings Corporation (Japan), Murata Manufacturing Co., Ltd. (Japan), TDK Corporation (Japan), Maxell, Ltd. (Japan), VARTA AG (Germany), Renata SA (Switzerland), and Duracell Inc. (US) among others are among a few key players in the micro battery companies.

Micro Battery Market Report Scope:

|

Report Metric |

Details |

|

Estimated Market Size in 2023 |

USD 0.5 Billion |

|

Projected Market Size in 2028 |

USD 1.3 Billion |

|

Growth Rate |

CAGR of 22.4% |

|

Market Size Available for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Units |

Value (USD Million/Billion) |

|

Segments Covered |

Type, Capacity, Battery Type, and Application |

|

Geographic Regions Covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies Covered |

Major Players: Panasonic Holdings Corporation (Japan), Murata Manufacturing Co., Ltd. (Japan) TDK Corporation (Japan), Maxell, Ltd. (Japan), VARTA AG (Germany), Cymbet Corporation (US), Enfucell (Finland), Ultralife Corporation (US), Molex, LLC (US), Shenzhen Grepow Battery Co., Ltd. (China), Renata SA (Switzerland), Duracell Inc. (US), and Seiko Instruments Inc. (Japan) and Others- (Total 25 players have been covered) |

Micro Battery Market Highlights

This research report categorizes the micro battery market by material, type, capacity, battery type, application, and region.

|

Segment |

Subsegment |

|

By Material: |

|

|

By Type: |

|

|

By Capacity: |

|

|

By Battery Type: |

|

|

By Application: |

|

|

By Region |

|

Recent Developments

- In November 2022, VARTA AG launched its latest version of CoinPower series at Electronica, the world's leading trade fair and conference for electronics. The cells of the A5 generation are suitable for TWS headphones and gaming TWS Earbuds, wearables, and IoT devices.

- In September 2022, Maxell, Ltd. developed the PSB401515H. This high-capacity ceramic packaged solid-state battery uses a solid sulfide electrolyte that helps to increase the side length.

- In October 2020, Murata Manufacturing Co., Ltd. introduced High Drain silver oxide batteries (SR) and alkaline manganese batteries (LR) to its product portfolio for medical devices.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the micro battery market from 2023 to 2028?

The global micro battery market is expected to record a CAGR of 22.4% from 2023 to 2028.

What are the driving factors for the micro battery market?

The growing miniaturization of consumer electronics globally is the key driving factor for the micro battery market.

Which application will grow at a fast rate in the future?

The consumer electronics industry is expected to grow significantly during the forecast period. The rising adoption of small form factor devices and wearables is one of the key reasons for this sector's growth.

Which are the significant players operating in the micro battery market?

Cymbet Corporation (US), Enfucell (Finland), Ultralife Corporation (US), Molex, LLC (US), Panasonic Holdings Corporation (Japan), and Murata Manufacturing Co., Ltd. (Japan) are among a few key players in the micro battery market.

Which region will grow at a fast rate in the future?

The micro battery market in Asia Pacific is expected to grow at the highest CAGR during the forecast period

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

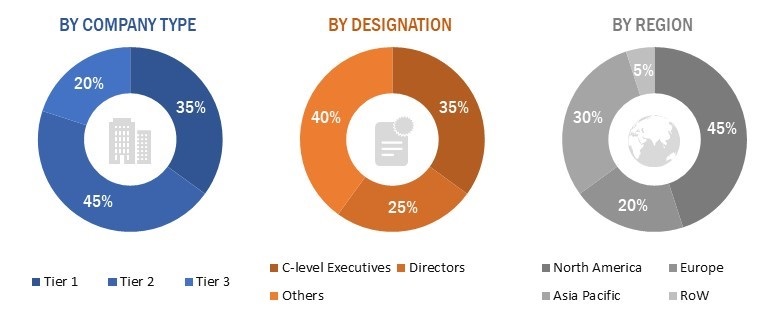

The study involved four major activities in estimating the current size of the micro battery market. Exhaustive secondary research has been done to collect information on the market, peer, and parent markets. The next step has been to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the total market size. After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments. Secondary and primary sources have been used to identify and collect information for an extensive technical and commercial study of the micro battery market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred micro battery providers, distributors, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from various micro battery providers, such as Panasonic Holdings Corporation (Japan), Murata Manufacturing Co., Ltd. (Japan), Enfucell (Finland), Ultralife Corporation (US), Molex, LLC (US), TDK Corporation (Japan), Maxell, Ltd. (Japan), and VARTA AG (Germany); research organizations, distributors, industry associations, and key opinion leaders. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the micro battery market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Micro Battery Market : Top-down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual market (mentioned in market segmentation) through percentage splits from secondary and primary research. For specific market segments, the size of the most appropriate immediate parent market has been used to implement the top-down approach. The bottom-up approach has also been implemented for data obtained from secondary research to validate the market size of various segments.

Micro Battery Market : Bottom-up Approach

The bottom-up approach has been used to arrive at the overall size of the micro battery market from the revenues of the key players and their market shares. Calculations based on revenues of key companies identified in the market led to the estimation of their overall market size.

Market Definition

Micro batteries are composed of thinner materials as compared to conventional batteries and are different from conventional batteries in terms of features, size, form factor, shape, and flexibility. These small-sized batteries are composed of substrate materials, electrodes (cathodes and anodes), electrolyte materials, separators, and other components. Micro batteries consume less space as compared to conventional batteries, and consequently, allow end products to weigh less. Micro batteries are categorized by type into thin-film batteries, printed batteries, solid-state chip batteries, and button batteries. These batteries find applications in consumer electronics, medical devices, wireless sensors, wearable devices, smart textiles, smart cards, and smart packaging.

Market Stakeholders

- Micro battery manufacturers

- Government Bodies and Policymakers

- Industry-standard Organizations, Forums, Alliances, and Associations

- Market Research and Consulting Firms

- Raw Material Suppliers and Distributors

- Research Institutes and Organizations

- Testing, Inspection, and Certification Providers

- Distributors and Resellers

- End Users

Report Objectives

- To define and forecast the micro battery market regarding the type, capacity, battery type, and application.

- To describe and forecast the micro battery market and its value segments for four regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective countries.

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micro-markets concerning individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain and allied industry segments of the micro battery market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

- To strategically profile key players and comprehensively analyze their market position regarding ranking and core competencies, along with a detailed market competitive landscape.

- To analyze strategic approaches such as agreements, collaborations, and partnerships in the micro battery market

- To provide an analysis of the recession impact on the growth of the market and its segments

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Micro Battery Market