EV Charging Station Market by Application, Level of Charging, Charging Point, Charging Infrastructure, Operation, DC Fast Charging, Charge Point Operator, Connection Phase, Service, Installation and Region - Global Forecast to 2030

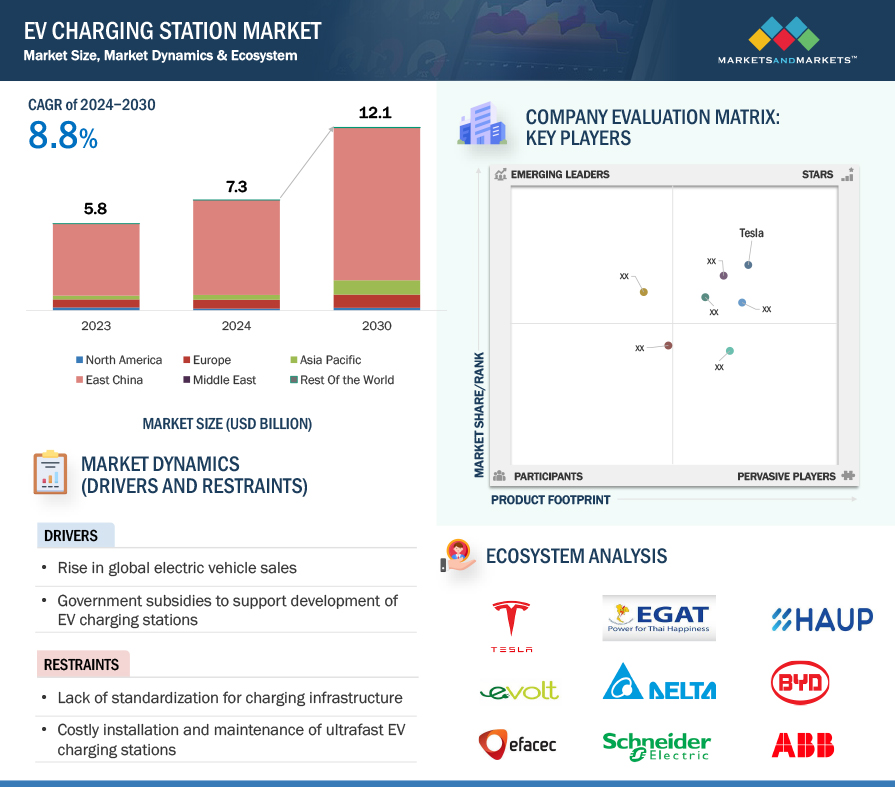

[395 Pages Report] The global EV Charging Station Market is estimated to be worth USD 7.3 billion in 2024 and reach USD 12.1 billion by 2030 at a CAGR of 8.8% over the forecast period. The growth of EV charging stations is driven by factors such as increased global EV sales and the need to expand charging infrastructure. Government policies and subsidies incentivize rapid deployment across regions. The limited driving range of EVs highlights the need for vast charging networks to relieve range anxiety, which leads to increased setup. Decreasing EV prices are also expected to drive up demand for charging stations, catering to a broader consumer base. Such factors will increase the setup of EV charging stations with growing EV sales.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics:

Driver: Government policies and subsidies to support faster setup of EV charging stations

The increasing global demand for EVs is expected to drive up the need for charging infrastructure, with governments worldwide funding its development and offering subsidies. Favorable policies incentivize the installation of charging stations, often accompanied by incentives such as reduced fees and taxes. Many countries have committed to expanding EV charging infrastructure alongside their EV transition plans. Both public and private investments, like US plans to deploy 500,000 new charging outlets by 2030, contribute to growth. Innovations such as high-speed charging stations and wireless systems have emerged from private sector investments. Tackling these challenges requires a collaborative approach involving policy incentives, technological advancements, and education campaigns. In the EU, initiatives like the European Green Deal and the Fit for 55 package aim to support electric mobility and reduce carbon emissions. Similarly, the National Electric Vehicle Infrastructure (NEVI) Formula Program in the US is introducing regulations to enhance the efficiency and accessibility of EV charging networks. Government financial support, such as subsidies for installing charging stations , further stimulates growth in the EV charging station market, prompting automakers to shift their focus towards electric vehicles.

Restraint: Lack of standardization of charging infrastructure

The absence of standardized electric vehicle (EV) charging infrastructure has become increasingly apparent due to factors such as the expanding EV market and varying charging requirements. Certain EV charging stations may only support specific voltage types. For instance, AC charging stations offer 120V AC via level 1 charging and 208/240V AC via level 2 charging, while DC charging stations provide rapid charging at 480V AC. Various countries adhere to different fast charging standards, with Japan utilizing CHAdeMO, Europe utilizing CCS 2, the US, and South Korea employing CCS 1, and China utilizing GB/T.

Opportunity: Use of V2G-enabled EV charging stations for electric vehicles

Vehicle-to-Grid (V2G) EV charging represents a system facilitating bi-directional electrical energy exchange between plug-in EVs and the power grid. One of the primary advantages of V2G charging stations lies in grid balancing. By enabling electric vehicles to feed power back into the grid during peak demand periods, V2G charging stations contribute to grid stability, potentially obviating the need for costly infrastructure upgrades. This could translate into reduced consumer energy expenses and a more resilient grid infrastructure. Additionally, V2G charging stations offer energy storage capabilities. Electric vehicles serve as mobile energy storage units, providing backup power to residences and businesses during outages or emergencies. This enhances energy resilience and diminishes reliance on diesel generators or other backup systems. Moreover, V2G charging stations have the potential to lower energy costs.

Challenges: Significant dependence on fossil fuel electricity generation & limited production in developing countries

Numerous countries continue to rely on fossil fuels for electricity generation, leading to significant environmental pollution. However, the limited sustainability of these fuels for long-term power generation, coupled with lower grid capacity from such power plants, is expected to hinder the widespread adoption of electric vehicles (EVs) in many nations in the coming decades. For instance, India generates approximately 60% of its electricity from fossil fuels, including coal and lithium, while the United States relies on fossil fuels for a similar percentage of its electricity production. In contrast, Europe utilizes fossil fuels for only about 35-40% of its electricity generation. To address this challenge, countries will need to undertake extensive updates to their power generation infrastructure and transition towards more environmentally efficient methods of electricity production. The continued reliance on fossil fuels for electricity generation contradicts the goal of transitioning to EVs from traditional internal combustion engine (ICE) vehicles and presents a significant obstacle for countries striving to reduce emissions over the long term.

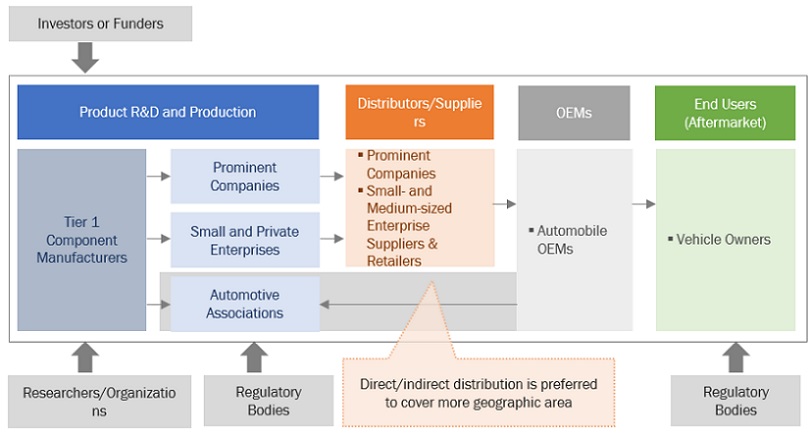

Market Ecosystem

“DC Ultra-fast 1 charger segment is estimated to hold a significant share of EV Charging Station market during the forecast period.”

The segment for ultra-fast 1 chargers is expected to expand rapidly, supported by growing demand and OEMs offering compatible EVs. The surge in demand for High Power Charging Stations (HPCS) is boosting the development of faster charging infrastructure, with stations capable of delivering a full charge within 10-20 minutes becoming increasingly popular. Major players like ABB and Tesla are leading the charge, with Tesla upgrading its superchargers to 250 kW and planning further upgrades to 300 kW. Electrify America recently inaugurated a flagship indoor station in the US. While demand for ultra-fast chargers is growing, they are primarily used for specific cases due to their higher cost and concerns about battery degradation over time.

“Three-Phase Charger segment expected to be the largest segment during the forecast period.”

The increasing demand for fast charging is driving the market for three-phase electric vehicle (EV) chargers, offering power outputs up to 43 kW AC and 350 kW DC. Government initiatives, such as plans for millions of chargers by 2030 and specific mandates like one DC charger per 60 kilometers in the US, are fostering EV adoption. Advancements in EV technology are making electric vehicles more accessible and affordable, further boosting demand. Three-phase chargers with advanced safety features are ideal for public charging stations and parking lots. They offer rapid charging speeds, significantly faster than single-phase chargers, appealing to users seeking quick recharging times. As EV adoption grows, the need for charging infrastructure is increasing, with three-phase chargers playing a critical role.

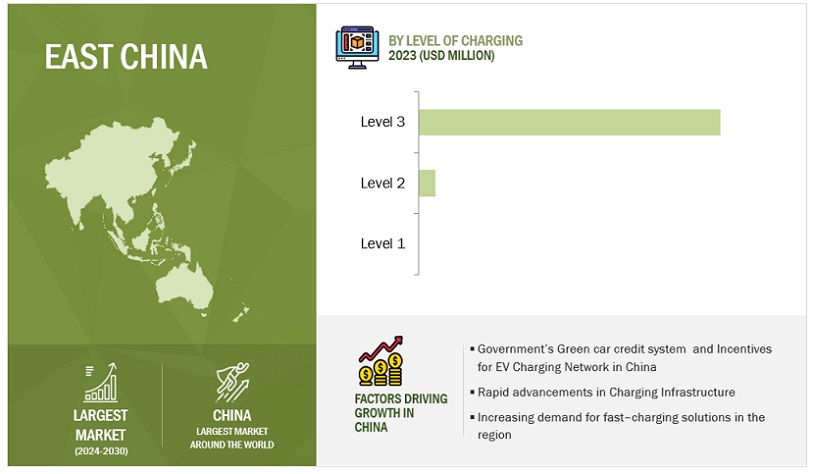

“China is estimated to be the largest market during the forecast period.”

The China region is poised to become the largest market for EV Charging Station by 2030, The growth of the EV charging station market in China is propelled by several key factors. The government's implementation of the Green Car Credit system and generous incentives for expanding the EV charging network have significantly boosted market expansion. Moreover, rapid advancements in charging infrastructure facilitate the accessibility and efficiency of charging stations across the nation. China is investing significantly in the production of EV charging stations to provide charging solutions for the increasing number of EVs in the country. OEMs such as BYD also plan to establish production plants worldwide to manufacture electric buses and trucks to meet demand. Additionally, the rising demand for fast-charging solutions within the region further stimulates market growth, reflecting consumers' evolving preferences towards convenient and speedy charging options for their electric vehicles. EV Battery prices started falling to half in 2024, which is expected to drive EV sales and EVCS setup in coming years. Leading CPOs in China like StarCharge, Stategrid among others are having high setup rate, but low utilization rate. For instance, StarCharge, which is the second biggest public charging network in China, with over 419,000 charging points. Each of these charging points uses only about 40 kilowatt hours (kWh) of power per day. This means that on average, each charger is used for less than two hours a day, with a daily utilization rate of 8 percent.

Key Market Players

The EV Charging Station market is dominated by major OEMs, including ABB (Switzerland), BYD (China), ChargePoint (US), Tesla (US), Tritium (Australia), and Charge Point Operators including BP (UK), Shell (UK), ENGIE (France), TotalEnergies (France), Enel X (Italy) among others. These companies offer EV Charging solutions and have strong distribution networks at the global level. These companies have adopted extensive expansion strategies and undertaken collaborations, partnerships, and mergers & acquisitions to gain traction in the EV Charging Station market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2020–2030 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2030 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Level of Charging, Charging Service Type, Charge Point Operator, Charging Infrastructure Type, Charging Point Type, Installation Type, Connection Phase, Application, DC Fast Charging Type, Operation, and Region |

|

Geographies covered |

China, Asia Pacific, Europe, North America, Middle East and Rest Of the World |

|

Companies Covered |

ABB(Switzerland), BYD (China), Tesla (US), Schneider Electric (France), Tritium (Australia), Shell (UK), Chargepoint (US) |

This research report categorizes the electric vehicle charging station market based on charging point type, level of charging, installation type, charging infrastructure type, application, DC fast charging type, charge point operator, electric bus charging type, charging service type, operation, connection phase and region.

Based on Level of Charging:

- Level 1

- Level 2

- Level 3

Based on Charging Point Type:

- AC Charging

- DC Charging

Based on Installation Type:

- Fixed

- Portable

Based on Application:

- Private

- Semi-Public

- Public

Based on Charging Service:

- EV Charging Service

- Battery Swapping Service

Based on Charging Infrastructure Type:

- Type 1

- Type 2

- CCS

- CHAdeMO

- Tesla SC (NACS)

- GB/T Fast

Based on DC Fast Charging Type:

- Slow DC (<49 kW)

- Fast DC (50-149 kW)

- DC Ultra-Fast 1 (150-349 KW)

- DC Ultra-Fast 2 (>349 kW)

Based on Electric Bus Charging Type:

- Off-board Top-down Pantograph

- On-board Bottom-up Pantograph

- Charging Via Connector

Based on Charge Point Operator:

- Asia Pacific

- Europe

- North America

Based on Connection Phase:

- Single Phase

- Three Phase

Based on Operation:

- Mode 1

- Mode 2

- Mode 3

- Mode 4

Based on the region:

- China

-

Asia Pacific (APAC)

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Taiwan

- Singapore

-

North America (NA)

- US

- Canada

-

Europe (EU)

- Austria

- Denmark

- France

- Germany

- Netherlands

- Norway

- Spain

- Sweden

- Switzerland

- UK

-

Middle East (ME)

- Saudi Arabia

- UAE

- Israel

-

Rest of the World (RoW)

- South Africa

- Brazil

- Mexico

- Other Countries

Recent Developments

- In January 2024, MAN Truck & Bus and ABB signed a cooperation agreement to tackle the electrification challenges Europe's trucking fleet faced. The agreement focused on accelerating the progress of megawatt charging stations, investigating innovative electric vehicle integrations, and creating software solutions tailored for electric trucks.

- In February 2024, Raizen Power and BYD formed a strategic partnership to accelerate sustainable electric mobility in Brazil. The initiative aims to significantly expand the public network of electric chargers, providing 100% clean and renewable energy and enhancing the recharging experience for users. Raízen Power, aiming for a 25% market share in Brazil's electromobility sector, will install approximately 600 new DC charge points, contributing an additional 18 MW of installed power for nationwide EV recharging.

- In January 2024, BP partnered with Geotab to offer an integrated software solution for managing EV fleets. The partnership combines bp pulse's charge management software, Omega, with Geotab's telematics data, providing fleet operators with a unified platform. This integrated solution, available through the Geotab Marketplace, enables optimization of EV charging operations based on factors such as lower-cost energy and vehicle availability. The combination of Omega's fleet optimization capabilities and Geotab's comprehensive telematics data offers fleet operators’ insights into both charging infrastructure health and vehicle location.

- In December 2023, ENGIE, CEVA Logistics, and SANEF partnered in the European Clean Transport Network (ECTN) Alliance. CEVA establishes relay stations at its Avignon, Lyon, Dijon, and Lille agencies and a control tower based in Valenciennes to oversee flows, monitor travel times, and track energy consumption. ENGIE is responsible for installing and operating electric charging stations. SANEF hosted a relay station at the Sommesous service area for testing purposes, representing a prototype of future terminals along highways or near major long-distance freight routes.

- In December 2023, BP and Iberdrola entered into a joint venture aimed to create an extensive fast and ultra-fast public charging network for electric vehicles (EVs) in Spain and Portugal. bp has planned to invest USD 1.08 billion, aiming to install 11,700 charging points by 2030. It commenced operations with over 300 charging points and aims to have nearly 5,000 in Spain and Portugal by 2025.

Frequently Asked Questions (FAQ):

What is the current size of the global EV Charging Station market?

The global EV Charging Station market is projected to grow from USD 7.3 billion in 2024 to USD 12.1 billion by 2030, at a CAGR of 8.8%

Who are the winners in the global EV Charging Station market?

The EV Charging Station market is dominated by major OEMs, including ABB (Switzerland), Tritium (Australia), BYD (China), ChargePoint (US), Tesla (US), and Charge Point Operators including bp (UK), Shell (UK), ENGIE (France) and Total Energies (France).

Which region will have the largest market for EV Charging Station?

The China region will have the largest market for EV Charging Station due to government’s support to Green car credit system and high Incentives for EV Charging Network in the region.

Which country will have the significant demand for EV Charging Station in Europe region?

Germany will be a significant market for EV Charging stations. Government incentives and the presence of large number of CPOs such as EnBW, Shell, and Ionity, among others, will increase the demand in Germany.

What are the key market trends impacting the growth of the EV Charging Station market?

Megawatt Charging System (MCS), Induction charging, Vehicle-to-Grid (V2G) Technology, and Wireless charging are the key market trends or technologies that will have a major impact on the EV Charging Station market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

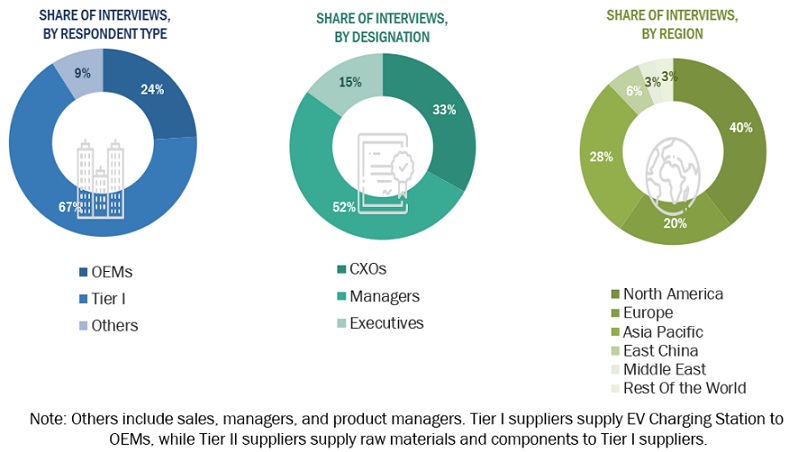

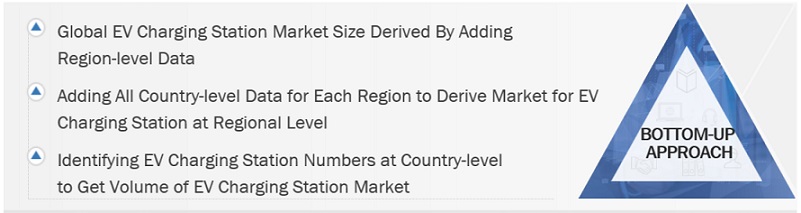

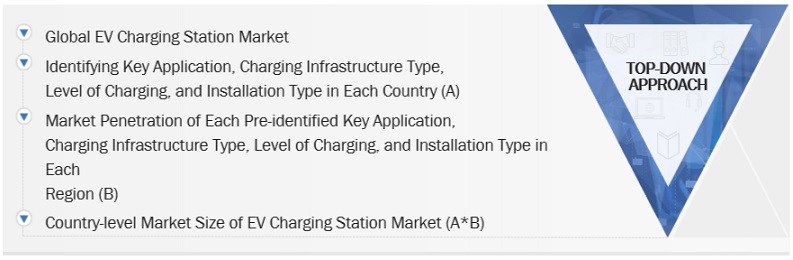

The study involved four major activities in estimating the current size of the EV Charging Station market. Exhaustive secondary research was done to collect information on the market, the peer market, and the child markets. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, European Alternative Fuels Observatory (EAFO), European Automobile Manufacturers' Association (ACEA), China Association of Automobile Manufacturers (CAAM), International Organization of Motor Vehicle Manufacturers (OICA), Electrical Vehicle Charging Association (EVCA), National Highway Traffic Safety Administration (NHTSA), International Energy Association (IEA)], articles, directories, technical handbooks, trade websites, technical articles, and databases (for example, Marklines, and Factiva) have been used to identify and collect information useful for an extensive commercial study of the global EV Charging Station market.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the EV Charging Station market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand (automotive OEMs) and supply (EV Charge Point Operator and EV Charging Service providers sides across major regions, namely, China, Asia Pacific, Europe, North America, Middle East and Rest Of the World. Approximately 30% and 70% of primary interviews were conducted from the demand and supply sides, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews.

In the canvassing of primaries, various departments within organizations, such as sales, operations, and marketing, were covered to provide a holistic viewpoint in the report. After interacting with industry experts, brief sessions were also conducted with highly experienced independent consultants to reinforce the findings from primaries. This, along with the in-house subject matter experts’ opinions, led to the findings described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the bottom-up approach, EV charging station sales at the country level were considered. The penetration of EV charging stations was identified at the country/region level through secondary and primary research. Vehicle sales at the country level were then multiplied by the penetration rate of electric vehicle charging stations to determine the size of the EV charging station market in terms of volume. The country-level market size, in terms of volume, was then multiplied by the region-level average EV charging station subscription price to determine the market size in terms of value for each vehicle type. The summation of the region-level market size by volume and value gives the global-level market size.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Validation

To derive the market for EV charging stations, by segment, in terms of volume, the adoption rate of all segments was identified at the regional level. To derive the market in terms of value, the cost breakup percentage of all segments at the regional level was applied to the global value of the EV charging station market. This gives the EV charging station market for each segment in terms of volume and value.

For instance,

- The EV charging station market, by level of charging, was derived using the top-down approach to estimate the subsegments: Level 1, Level 2 while level 3 was derived from DC charger sales.

- The market size, in terms of volume, was derived at the country level. The total volume of the EV charging station market were multiplied by the adoption rate breakup percentage of charging level at the country level, respectively.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

An electric vehicle is an automobile propelled by one or more electric motors. An electric vehicle uses energy stored in rechargeable batteries, which can be charged using private or public charging infrastructure. There are four main types of electric vehicles, namely, battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), hybrid electric vehicles (HEVs), and fuel cell electric vehicles (FCEVs).

EV charging station is electrical equipment used to charge plug-in electric vehicles. This equipment can charge an electric vehicle in 6-20 hours for normal charging (Level 1 & Level 2 charging) and approximately 15-60 minutes for fast/supercharging (Level 3 charging). EVs have different charging requirements and can be used with the required chargers. They allow the conversion of current for the vehicle to be easily charged and set up at homes, semi-public places, public charging stations, and a portable charging system.

List of Key Stakeholders

- Associations, Forums, and Alliances related to EV Charging Stations

- Utility Companies

- Oil & Gas Companies

- Automobile Manufacturers

- Battery Distributors

- Battery Manufacturers

- Charging Infrastructure Providers

- Charging Service Providers

- Energy Storage Companies

- Environmental Groups

- EV Charging Pole Manufacturers

- EV Charging Network Operators

- EV Charging Station Service Providers

- EV Component Manufacturers

- EV Distributors and Retailers

- EV Manufacturers

- Electric Utilities and Grid Operators

- Electrical Contractors

- Government Agencies and Policymakers

- Property Owners

Report Objectives

- To segment and forecast the EV charging station market size in terms of volume (thousand units) and value (USD million)

-

To define, describe, and forecast the EV charging station market based on level of charging, charging service type, charge point operator, charging infrastructure type, charging point type, installation type, connection phase, application, DC fast charging type, operation, and region

- To segment and forecast the market size by volume (thousand units) and value (USD million) based on the level of charging (Level 1, Level 2, Level 3)

- To segment and forecast the market size by volume (thousand units) based on application (private, semi-public, public)

- To segment and forecast the market size by volume (thousand units) based on charging point type (AC charging, DC charging)

- To segment and forecast the market size by volume (thousand units) based on charging infrastructure type (CCS, CHAdeMO, Type 1, Tesla SC (NACS), GB/T Fast, Type 2)

- To provide qualitative insights on electric bus charging type (off-board top-down pantographs, onboard bottom-up pantographs, charging via connectors)

- To provide qualitative insights on charging service type (EV charging services, battery swapping services)

- To segment and forecast the market size by volume (thousand units) based on charge point operators (Asia Pacific, Europe, North America)

- To segment and forecast the market size by volume (thousand units) based on installation type (portable chargers, fixed chargers)

- To segment and forecast the market size by volume (thousand units) based on DC fast charging type (slow DC, fast DC, DC ultra-fast 1, DC ultra-fast 2)

- To segment and forecast the market size by volume (thousand units) based on operation (Mode 1, Mode 2, Mode 3, and Mode 4)

- To segment and forecast the market size by volume (thousand units) based on connection phase (single phase, three phase)

- To forecast the market size with respect to key regions, namely, China, Asia Pacific, Europe, North America, Middle East, and Rest of the World

- To provide detailed information regarding the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze the market with respect to individual growth trends, prospects, and contributions to the total market

-

To study the following with respect to the market

- Value Chain Analysis

- Ecosystem Analysis

- Technology Analysis

- Case Study Analysis

- Patent Analysis

- Regulatory Landscape

- Average Selling Price Analysis

- Buying Criteria

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as deals, product developments, and other activities carried out by key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with company-specific needs.

- Further breakdown for the EV Charging Station market, by charging level, at the country-level (for countries covered in the report)

- Further breakdown of the EV Charging Station market, by DC charging Type, at the country-level (for countries covered in the report)

Company Information

- Profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in EV Charging Station Market

I would like to know more about the investments and policies expected to help boost the growth of the electric vehicle charging station market

The global electric vehicle charging station market size is projected to grow from 2,354 thousand units in 2022 to 14,623 thousand units by 2027, at a CAGR of 44.1. Factors such as rising sales of EVs around the world, along with the growing demand for zero-emission transport will boost the demand for the electric vehicle charging station market. Developments in technologies like portable charging stations, bi-directional charging, smart charging with load management, usage-based analytics, and automated payment, and the development of ultra-fast charging technology will create new opportunities for this market.

This is a brand-new study published couple e of weeks ago and the report covers the industry statistics considering the actual sales volumes and revenue for the year 2021 as the base year data to estimate and forecast the market to 2027. Yes, we have covered the post-COVID19 impact analysis and Supply Chain disruption of the market and also since we track the EV market, we have drawn parallels from the EV sales growth report to estimate the growth rates for the EVSE market.