Model Based Enterprise Market by Offering (Solutions, Services), Deployment Type (On-premise, Cloud), Industry (Aerospace, Automotive, Construction, Power & Energy, Food & Beverages, Life Sciences & Healthcare, Marine), Region - Global Forecast to 2029

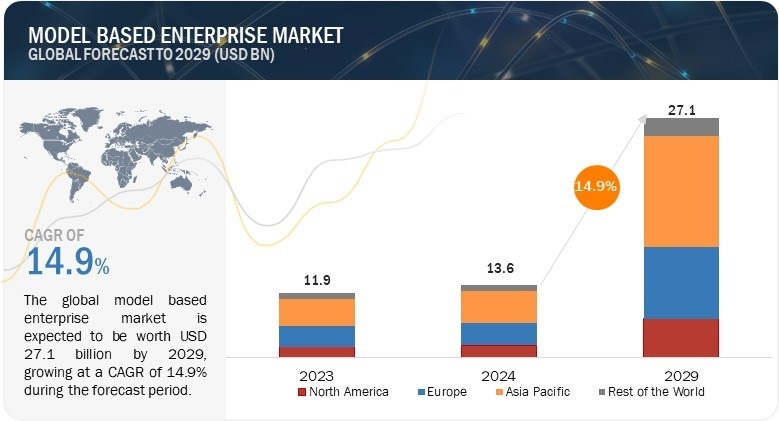

[213 Pages Report] The global model based enterprise market size is expected to grow from USD 13.6 billion in 2024 to USD 27.1 billion by 2029, at a CAGR of 14.9% from 2024 to 2029.

3D printing technology plays a vital role in design and manufacturing processes. Digital 3D models are replacing traditional paper drawings and blueprints because these models contain more information and can be reused by multiple applications. Hence, the use of 3D printing is growing significantly at present, and this technology also has the potential to change the manufacturing and supply chain management processes. Initially, 2D designs were used; however, there was no connectivity or collaboration within the enterprise. Therefore, a 3D master is created to use as a reference point, which can be circulated throughout the enterprise using a neutral format such as 3D PDF, JT, or STEP. Thus, digital information technology enables engineers and technicians in remote locations to access computer-aided design (CAD) models, diagrams, and engineering data, which is critical for the maintenance and repair of complex systems.

Model Based Enterprise Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

DRIVERS: Increasing adoption of cloud-based platforms

The growing popularity of different types of IoT cloud platforms, such as IoT Azure, IoT Watson, and Predix, in various industries, eventually increasing the need for model based engineering. The emergence of IoT allows the connection of a simulation model of the product or process with sensors, which capture data, and actuators, which control the process operations, using the Internet and also helps MBE to enable 3D annotation data modeling. Thus, the IoT and model-based engineering are expected to continue to play a vital role in the design, fabrication, and maintenance of complex products in the near future.

RESTRAINTS: Difficulties in migration from on-premises to cloud-based platform

Enterprise resource planning (ERP) and product life cycle management (PLM) are two essential applications of model based enterprise. Each enterprise system can either be deployed on premise or cloud. Although the cloud-based platform is increasingly being adopted, the on-premise platform is beneficial in terms of data privacy because on-premise software is installed locally, on a company's computers and servers, which restricts any third party to access this data. Moreover, transitioning from the existing on-premise PLM solutions to cloud-based PLM systems requires time and efforts. The support team requires a good amount of time to move the infrastructure and implement cloud-based technologies, resulting in high cost and rework.

OPPORTUNITIES: Rising adoption of digital twin and digital thread technologies

Digital twins have advantages in terms of technology, data and analytics, and innovation, which helps several worldwide industries to grow. At present, many companies have been transforming data collection and analytics, organization, and IT infrastructure to increase their performance agility. Principle and framework of digital twins contribute to creating individual digital projects for organizations and companies. The concept of digital twin can drive other digital initiatives taken by many organizations. Additionally, the digital thread concept was derived from 3D models and simulation tools. With the development of new technologies, these tools are becoming more practical to deploy and can be connected using the digital thread. These digital threads provide the communications framework that allows a connected data flow and integrated view of the asset data throughout its life cycle, which is then structured, revision controlled, and analyzed. MBE comprises model-based definition (MBD), created by engineering function to complete model-based manufacturing and model-based inspection activities.

CHALLENGES: Lack of security issues associated with MBE online platform

MBE is often started as a pilot project with limited resources and clients. However, MBE solutions and services grow with time. With that, data management and storage requirements also grow, along with the adoption of PLM. More value is placed on data software than hardware. However, it requires high security. Both large enterprises and SMEs are reluctant when it comes to storing data on cloud-based platforms because of the rise in data security issues in cloud-based processes over time. Cloud processes, such as PLM, ERP, and IoT, need to be monitored continuously to minimize risks and improve security features. Natural or man-made disasters also pose a threat to data centers, and loss of internet connectivity may bring the entire process to a standstill.

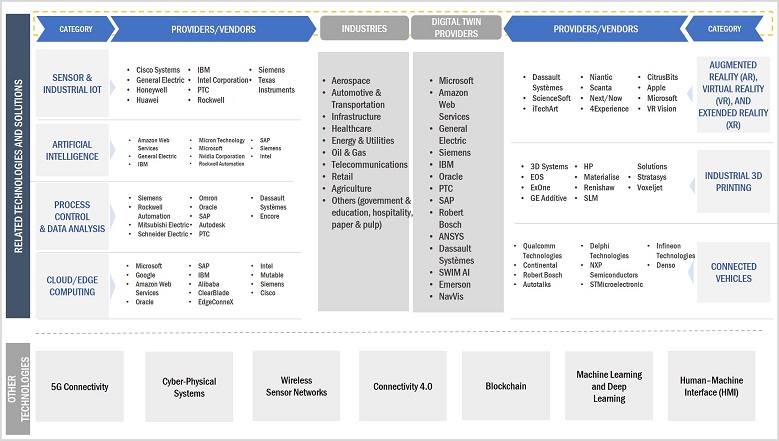

Model Based Enterprise Market Ecosystem

Prominent companies in this market include well-established, financially stable software providers such as Siemens (Germany), PTC (US), Dassault Systèmes (France), SAP (Germany), Autodesk Inc. (US), HCL Technologies Limited (India), and Oracle (US). These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Along with the well-established companies, there are a large number of small and medium companies operating in this market, such as Infor (US) and Aras (US).

Solutions segment is expected to grow with significant CAGR during the forecast period.

The software used in MBE provides comprehensive service provisioning, monitoring, and troubleshooting capabilities. The segment includes product management and planning software, and virtualization software having model exchange validation, processing, intelligence, as well as networking capabilities. The software enhances the performance of modeling software and provides operational simplicity of physical and virtual infrastructure in modeling software applications. Moreover, model based system engineering (MBSE) tools are used to manage a large volume of unstructured data related to design requirements, and model based design (MBD) tools allow engineers to develop the conceptual design of the system to address those requirements.

The market for aerospace segment is projected to hold substantial market share during the forecast period.

Aerospace manufacturers efficiently manage and securely share digital products and associated information with companies involved in the product development cycle. Also, the cloud platform is rapidly adopted in this industry due to its security, cost-saving, and scalability features. The aerospace & defense industry is always keen to acquire new technologies. It requires flexible and scalable infrastructure, which is made available by cloud services. Hence, the aerospace industry can serve customers in a better way by employing cloud-based MBE solutions. In Collins Aerospace, the Model-Based Systems Engineering (MBSE) division devises methodologies and technologies to ensure the systematic and uniform utilization of models across the entirety of aerospace system engineering endeavors, encompassing hardware, software, air-to-ground communications, AI-driven systems, and mechanical elements. Similarly, HCL Technologies Limited offers Model Based Enterprise 2.0 solution for aerospace & defense in which PLM, MES, and ERP are included.

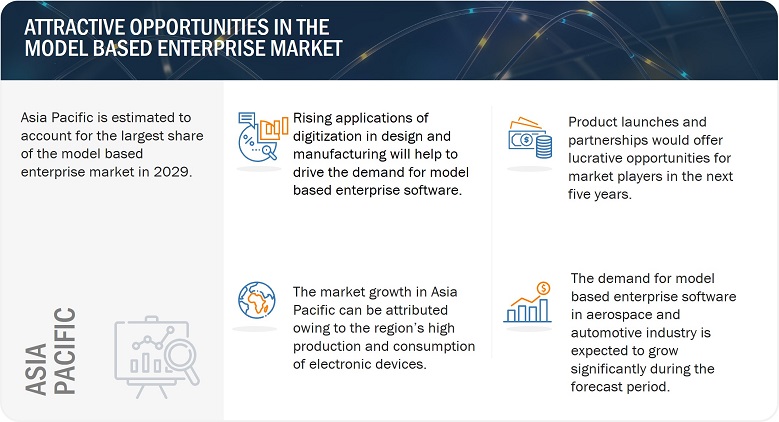

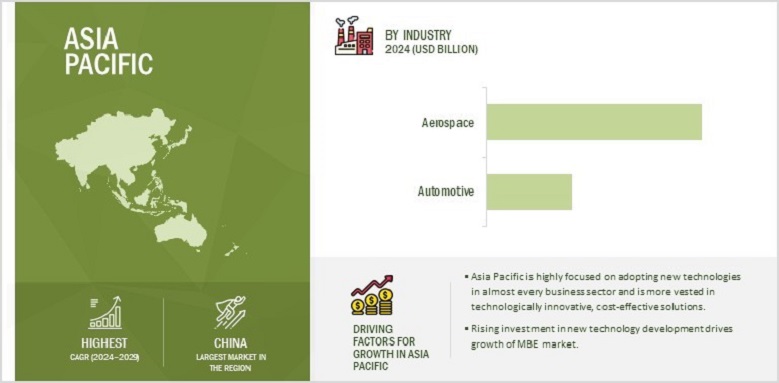

The market in Asia Pacific is projected to hold the substantial market share in 2029.

Model Based Enterprise Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific is witnessing dynamic changes in the adoption of new technologies and advancements in the manufacturing sector. The region is expected to experience widespread growth opportunities during the forecast period. The region is highly focused on adopting new technologies in almost every business sector and is more vested in technologically innovative, cost-effective solutions. Though various countries are slowly adopting MBE solutions, economic globalization, and the need to reduce the capital expenditure are the major factors pushing Asia Pacific countries to implement MBE solutions. The Chinese government is actively adopting new and improved manufacturing strategies to develop its manufacturing sector, and reform and strengthen various industries based in China. Chinese manufacturing enterprises have been spending heavily on the IoT, which would increase the need for MBE for minimizing designing paperwork, improving the efficiency of products, optimizing manufacturing and processes, and so on. Thus, the increasing expenditure on developing new technologies boosts the growth of the MBE market in the near future.

Top Model Based Enterprise Companies - Key Market Players:

Siemens (Germany), PTC (US), Dassault Systèmes (France), SAP (Germany), Autodesk Inc. (US), HCL Technologies Limited (India), and Oracle (US) are among a few top players in the model based enterprise companies.

Model Based Enterprise Makret Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 13.6 billion in 2024 |

| Projected Market Size | USD 27.1 billion by 2029 |

| Growth Rate | CAGR of 14.9% |

|

Market Size Available for Years |

2020–2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024–2029 |

|

Units |

Value (USD Million/Billion) |

|

Segments Covered |

|

|

Geographic Regions Covered |

|

|

Companies Covered |

Major Players: Siemens (Germany), PTC (US), Dassault Systèmes (France), SAP (Germany), Autodesk Inc. (US), HCL Technologies Limited (India), Oracle (US), Wipro (India), ANSYS, Inc (US), Bentley Systems, Incorporated (US) and Others - (Total 25 players have been covered) |

Model Based Enterprise Market Highlights

This research report categorizes the model based enterprise market by offering, deployment type, industry, and region.

|

Segment |

Subsegment |

|

By Offering: |

|

|

By Deployment Type: |

|

|

By Industry: |

|

|

By Region |

|

Recent Developments in Model Based Enterprise Industry :

- In February 2024, Cadence Design Systems, Inc. and Dassault Systèmes announced the extension in their ongoing strategic partnership by integrating the AI-driven Cadence OrCAD X and Allegro X with Dassault Systèmes’ extended 3DEXPERIENCE Works portfolio, for SOLIDWORKS existing and future customers.

- In May 2023, SAP extended its partnership with Google Cloud. This partnership will help to make enterprise data more open and valuable. In addition, it will help in advance enterprise AI development.

- In March 2023, PTC announced the launch of its Creo+ software as a service (SaaS) computer-aided design (CAD) solution and the tenth version of its Creo CAD software. Creo+ has the proven functionality of Creo with new cloud-based tools to improve design collaboration and simplify CAD administration.

Frequently Asked Questions(FAQs):

What is the total CAGR expected to be recorded for the model-based enterprise market from 2024 to 2029?

The global model based enterprise market is expected to record a CAGR of 14.9% from 2024–2029.

What are the driving factors for the model based enterprise market?

Increasing adoption of cloud-based platforms and constant advancement of software are some of the driving factors for the model based enterprise market.

Which industry will grow at a fast rate in the future?

Aerospace industry is expected to grow at the highest CAGR during the forecast period.

Which are the significant players operating in the model based enterprise market?

Siemens (Germany), PTC (US), Dassault Systèmes (France), SAP (Germany), Autodesk Inc. (US), HCL Technologies Limited (India), and Oracle (US) are among a few top players in the model based enterprise market.

Which region will grow at a fast rate in the future?

The model based enterprise market in Asia Paific is expected to grow at the highest CAGR during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the current size of the model based enterprise market. Exhaustive secondary research has been done to collect information on the market, peer, and parent markets. The next step has been to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the total market size. After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments. Two sources of information-secondary and primary-have been used to identify and collect information for an extensive technical and commercial study of the model based enterprise market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred model based enterprise software providers, distributors, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

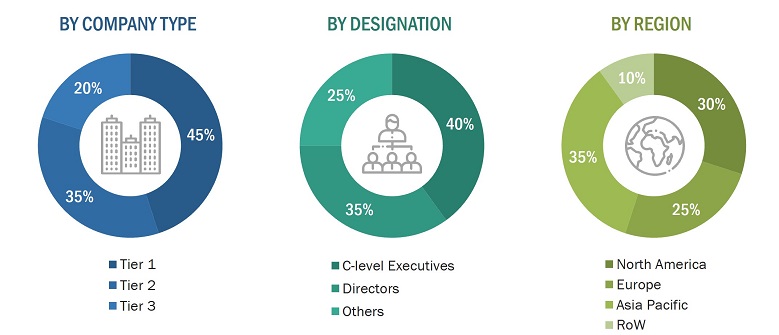

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from model based enterprise software providers, such as Siemens (Germany), PTC (US), Dassault Systèmes (France), SAP (Germany), Autodesk Inc. (US), HCL Technologies Limited (India), and Oracle (US); research organizations, distributors, industry associations, and key opinion leaders. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the model based enterprise market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual market segments (mentioned in market segmentation) through percentage splits from secondary and primary research. For specific market segments, the size of the most appropriate immediate parent market has been used to implement the top-down approach. The bottom-up approach has also been implemented for data obtained from secondary research to validate the market size of various segments.

Model Based Enterprise Market: Top-down Approach

Bottom-Up Approach

The bottom-up approach has been used to arrive at the overall size of the model based enterprise market from the revenues of the key players and their market shares. Calculations based on revenues of key companies identified in the market led to the estimation of their overall market size.

Model Based Enterprise Market: Bottom-up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

Model based enterprise is a global initiative to augment 3D models with additional information to create new documentation deliverables beyond engineering. This Model Based Enterprise (MBE) initiatives are constructed on Model Based Definition (MBD) initiatives as a 3D model with embedded PMI (Product Manufacturing Information) to offer integrated and collaborative environment and to transform an enterprise’s engineering, manufacturing, and aftermarket services through product data reuse and derived context rather than interpreting inputs and recreating the models and drawings. MBE utilizes the standard CAD functionality of layers and saved views to provide the user access to just the information required.

Key Stakeholders

- Industry associations

- Associations and regulatory authorities related to 3D modeling

- Government bodies, venture capitalists, and private equity firms

- Manufacturers of model based enterprise solutions

- Maintenance personnel, developers, and suppliers of model based enterprise offerings

- Research institutes and organizations

Report Objectives

- To define and forecast the model based enterprise market regarding offering, deployment type, and industry.

- To describe and forecast the model based enterprise market and its value segments for four regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective countries.

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micro-markets concerning individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the model based enterprise market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

- To strategically profile key players and comprehensively analyze their market position regarding ranking and core competencies, along with a detailed market competitive landscape.

- To analyze strategic approaches such as agreements, collaborations, and partnerships in the model based enterprise market

- To provide an analysis of the recession impact on the growth of the market and its segments

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Model Based Enterprise Market